By Sarah Cash

September is long touted as a chance to start fresh and spend on shiny books and clothes for the new season ahead. That makes it the perfect opportunity to maximize your spending with a strategic points-earning approach. Because if you spend your money the right way, your 2026 trips might just be free- or nearly!

Key Takeaways

- Focus on transferable points: Chase Ultimate Rewards, Amex Membership Rewards, and similar programs offer maximum flexibility

- Calculate your spending first: Know your budget before choosing cards ($5,000-$8,000 over 2-3 months is typical)

- Welcome offer bonuses are crucial: Look for offers like “75,000 points after spending $4,000 in 3 months”

- Use PointsYeah’s Card and Bank Offers: Filter cards by spending requirements, annual fees, and earning categories

- Know which airline and hotel programs work best for you: Take a look at your travel patterns and ensure the credit card you choose can transfer to those airline and hotel partners

- Think long-term: Open multiple cards over time as your spending patterns and travel goals evolve

Why Transferable Points Are Your Best Strategy

The most effective way to earn points and miles is through credit cards that offer transferable points. Unlike airline-specific miles, transferable points can be moved to many different airline and hotel partners, giving you incredible flexibility.

Chase Ultimate Rewards points demonstrate this flexibility: they transfer to multiple airlines and hotels, typically at 1:1 ratios, letting you accumulate transferable points and book when ready using PointsYeah. Unlike restrictive airline miles tied to single programs, transferable points give you options.

Planning Your Spending Strategy

Now that you know you should focus on transferable credit card points, what’s next? Determine the amount of money you will be spending and in what time period. Say you’re spending on school supplies and new clothes for the family. You might need to spend $5,000 over a couple months, or maybe you’ll be spending $8,000 over three months.

Understanding these numbers is crucial for two reasons:

- Responsible spending: Never spend beyond your means just to earn points

- Card selection: Your spending amount determines which welcome bonuses you can realistically achieve

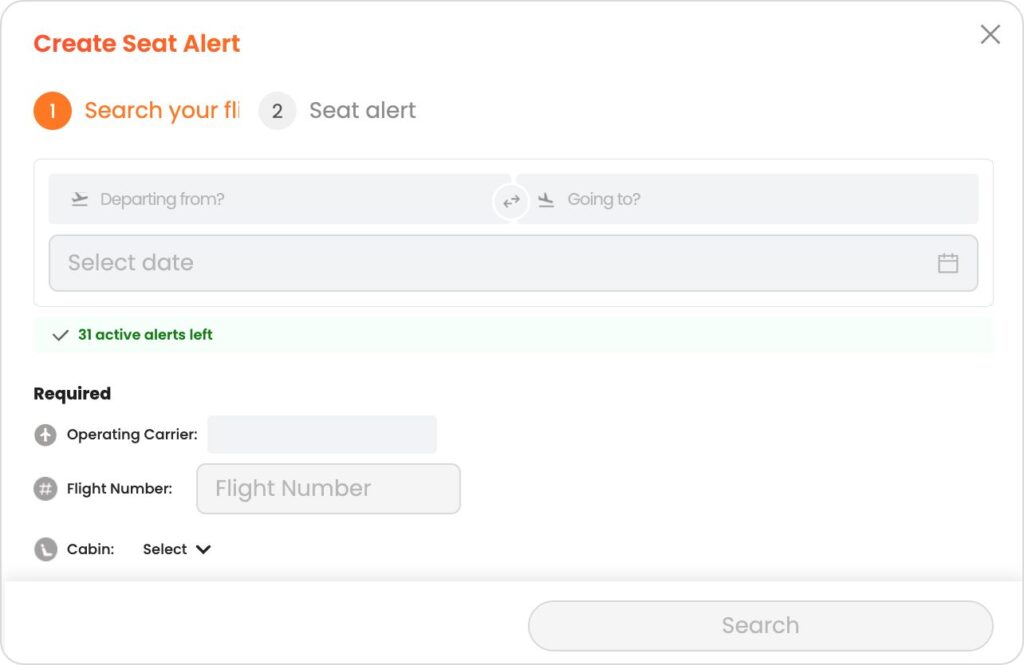

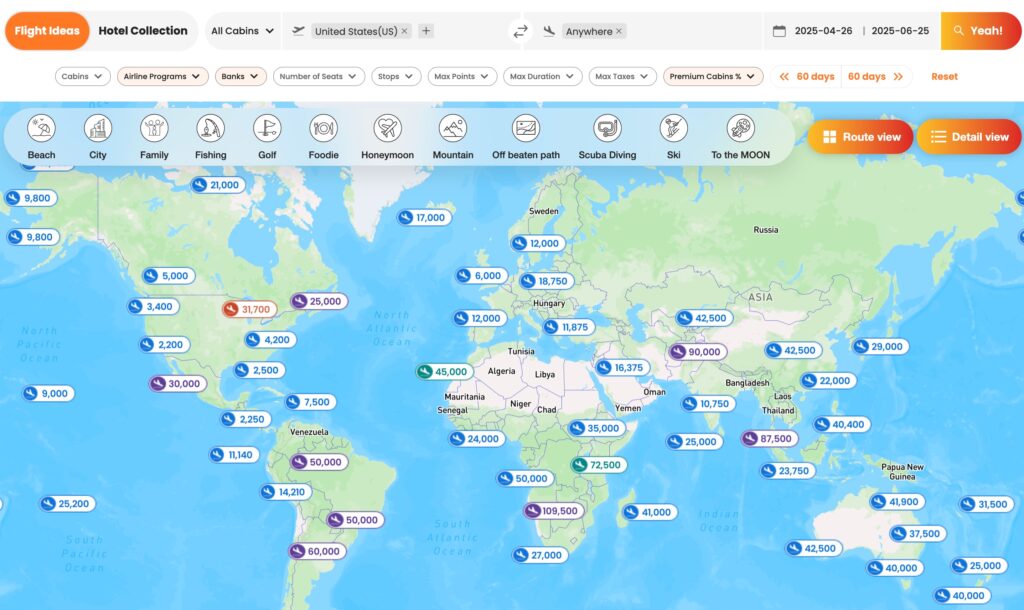

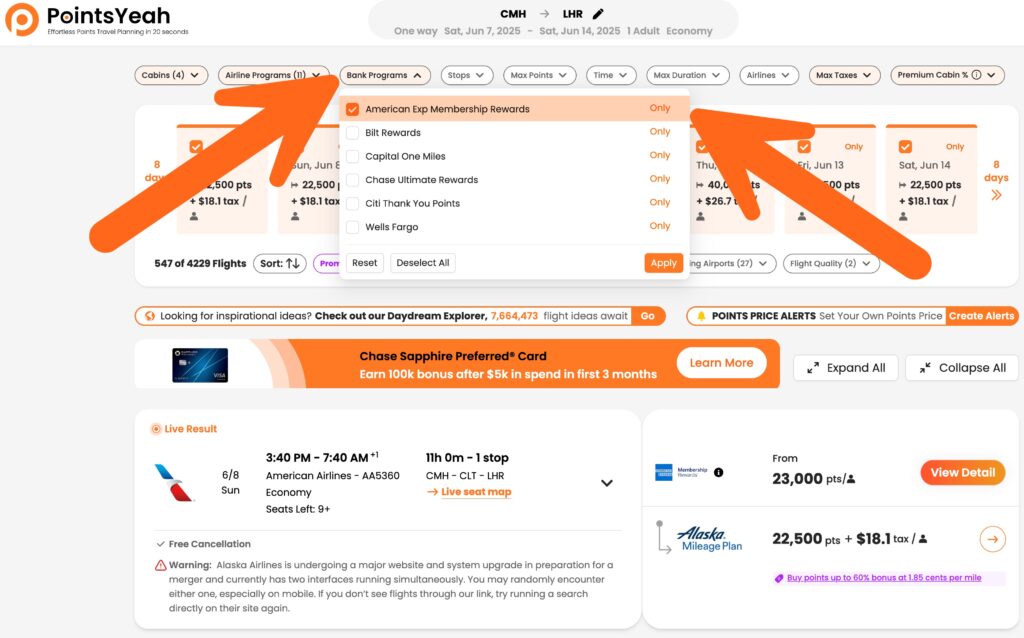

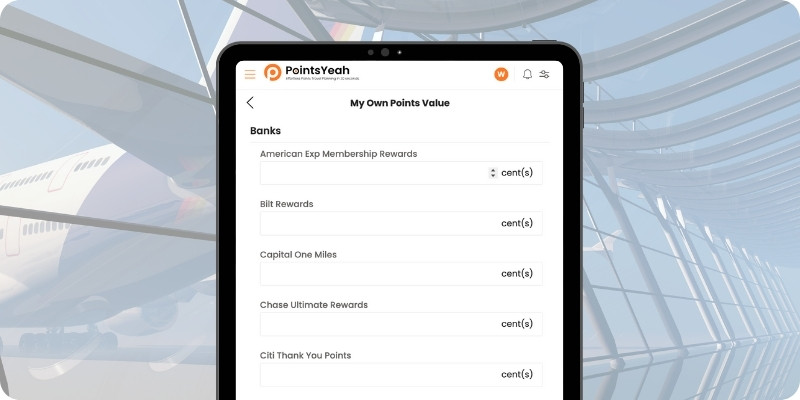

Use PointsYeah’s Card and Bank Offers section to match your spending with relevant card offers. Navigate to “Card and Bank Offers” in the top bar or sidebar, then click “Credit Cards” to access the filtering tools.

How to Research and Compare Credit Cards

PointsYeah’s Card and Bank Offers section offers comprehensive filtering options to help you find the perfect card match. You can search by:

- Benefits (lounge access, elite status, free night certificate)

- Earning categories (dining, gas, groceries, etc.)

- Bank programs (Chase, Amex, Capital One)

- Welcome offer amount & spending requirements

- Annual fees

Essential Questions to Ask

When evaluating any credit card, focus on these five key factors:

1. Welcome Offer Details Look for specific terms like “75,000 points after spending $4,000 within the first 3 months.” Make sure the spending requirement aligns with your planned purchases.

2. Earning Structure Cards typically offer tiered earning rates—perhaps 3x points on dining and hotels, 2x on groceries, and 1x on everything else. Choose cards that maximize earnings in your highest spending categories.

3. Additional Benefits Consider perks like airport lounge access, travel credits, or purchase protections. Only value benefits you’ll actually use.

4. Transfer Partners Take a look at what airline and hotel partners the credit card program has. If you really love Hyatt hotels, or typically fly with American Airlines, then you should open cards that include the ability to transfer to those partners.

5. Annual Fee Balance the fee against the card’s benefits and your expected point earnings. Sometimes a higher annual fee pays for itself through better earning rates and valuable perks.

Real-World Example: Finding a Workhorse Card

Let’s say you want a versatile “workhorse” card with these priorities:

- Low annual fee (less than $100)

- Strong earning rate across all categories (at least 2x points)

- Decent welcome bonus (75,000 points)

- Minimal extra perks to keep costs down

Using the filters in PointsYeah’s Card and Bank Offers section, you can quickly identify cards matching these exact criteria. The platform displays key information at a glance, making comparisons straightforward.

Building Your Long-Term Strategy

Don’t feel pressured to find the “perfect” card immediately. Finding the right credit card is a marathon, not a sprint. You can:

- Start with one card and build responsible spending habits

- Add more cards over time as your comfort level and spending increase

- Adapt your strategy as your lifestyle and travel goals evolve

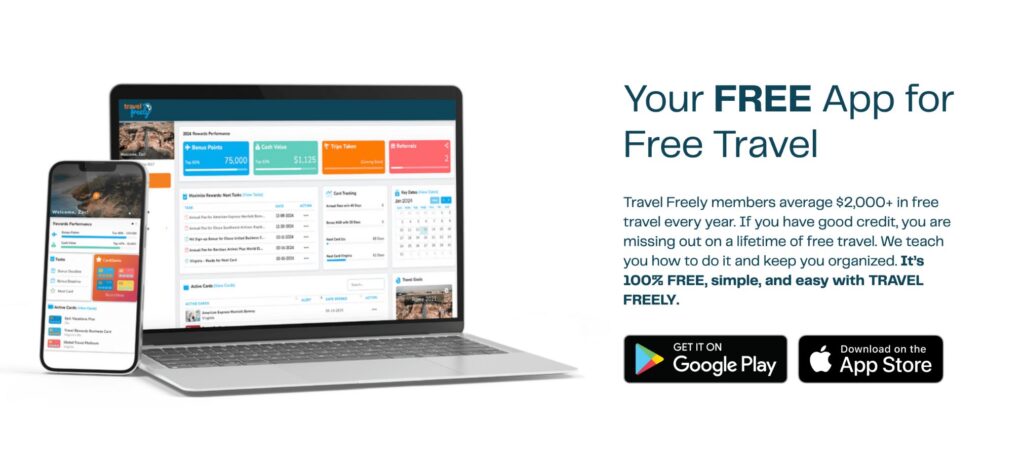

Start Your Points Journey Today

The beauty of a strategic points approach is making your everyday spending work harder for you. The same dollars you’d spend on school supplies and clothes can now fund experiences and trips you might never have considered otherwise.

Ready to begin? Head to PointsYeah’s Card and Bank Offers section and start exploring credit card options that match your spending plans. Your 2026 travel adventures await!