By Sarah Cash

Key Takeaways for European Flight & Hotel Redemptions

- Low-cost redemptions beat budget airlines: Some European routes cost as little as 4,000-7,500 miles plus minimal taxes

- Orphaned miles find perfect use: Stranded airline miles and hotel points are an excellent use for short European stays

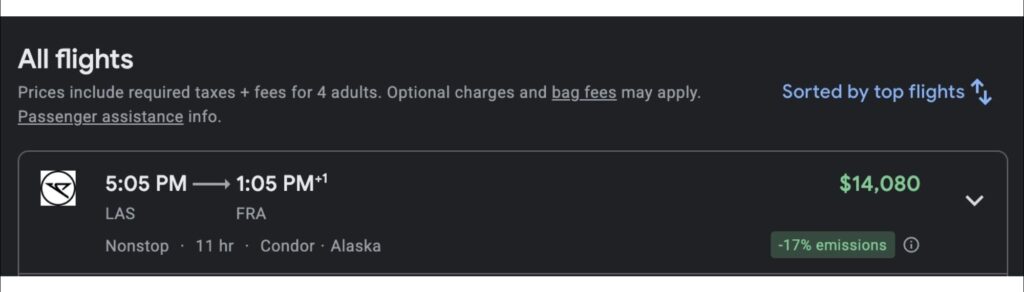

- Business class flights offer exceptional value: Premium cabin flights can cost much less using points vs. paying cash

- Transfer bonuses maximize value: Strategic transfers from credit card programs can slash redemption costs

- Flexible routing creates adventures: Use search tools to discover unexpected destinations at low mileage rates

- Hotel program perks: Know specific hotel loyalty program discounts, like getting a fifth night free when you book with Marriott Bonvoy points.

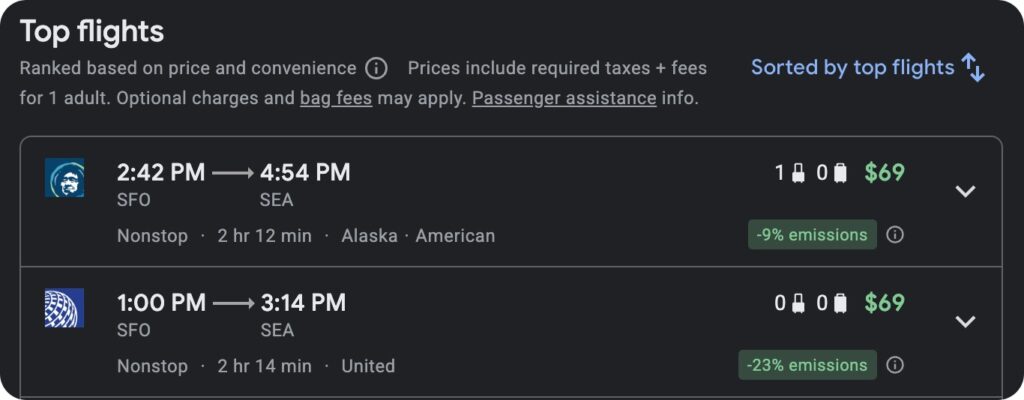

Ryanair, easyJet, and other low-cost carriers abound in Europe, setting low prices for intra-European flights. While you can typically only redeem miles for flights on more full-service airlines like Turkish Airlines and Lufthansa, that may seem like a waste of points in comparison to the cash cost. However, there are many cases and reasons why using points for flights and hotel stays within Europe may actually be the wise decision.

When Points Beat Budget Airlines on European Routes

Let’s examine a flight from Bologna to Paris. This flight costs 4,000 Virgin Atlantic Flying Club miles and $21 in taxes—an extremely low cost, even compared to the cash price of $114. Because this is such a low-cost point redemption, it makes perfect sense to use points here rather than cash.

Orphaned Airline Miles

This flight from Krakow to Istanbul costs 7,500 Air Canada Aeroplan miles and $44 in taxes, compared to $138 in cash. Whether you should pay cash or use points becomes less clear-cut here. Though you come out slightly ahead when you use points, the cash cost may be low enough that you prefer saving your points for higher-value redemptions. Make sure you consider the cost of cancelling or changing the flight as well, since that is typically easy to do with an award flight, but much more costly with a cash ticket.

This scenario perfectly illustrates when you might want to use “orphaned” miles—those stranded in your airline or hotel loyalty account that cannot be transferred back to credit card programs like Chase Ultimate Rewards. These orphaned points remain in your account until they expire or are used, making intra-European flights an excellent redemption opportunity since they often cost fewer points. In short, if you have orphaned miles, or plans that may change, using points for your ticket will be more cost effective. If not, spending cash may be the smarter option if you have the money.

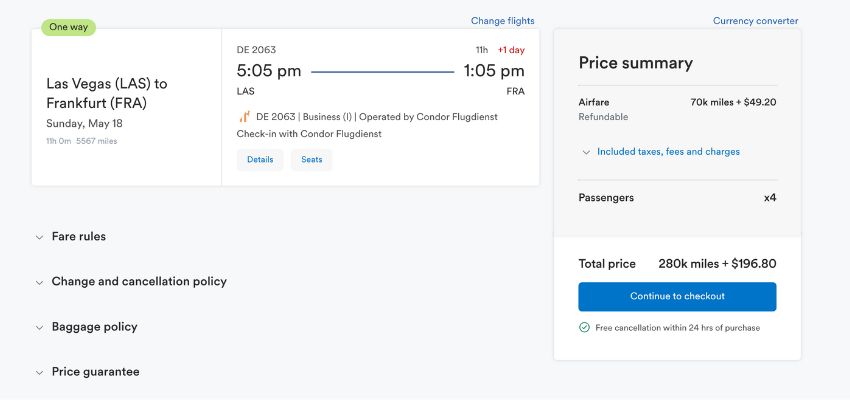

Maximizing Business Class Value on European Routes

Within Europe, business class journeys offer good award redemptions with much more convenience and flexibility. Take this example from Milan to Paris, which costs 8,000 Virgin Atlantic Flying Club miles and $28 in taxes, compared to $413 in cash for business class one-way.

Flying business class for your journey will help ease travel stress, especially when you’re not paying much cash. Keep in mind that European business class typically won’t include wider seats, though you will receive increased baggage allowance, plus a more premium check-in and airport experience. For example, on an economy ticket, Air France lets you take one bag up to 50 lbs, and the ticket costs $111 in cash. But for the above business class ticket, you can take two bags at up to 71 lbs each, for just 8k points + $28 in taxes. If you’re on a longer trip and are carrying more luggage, this can be a great way to alleviate travel worries, and save time and cash.

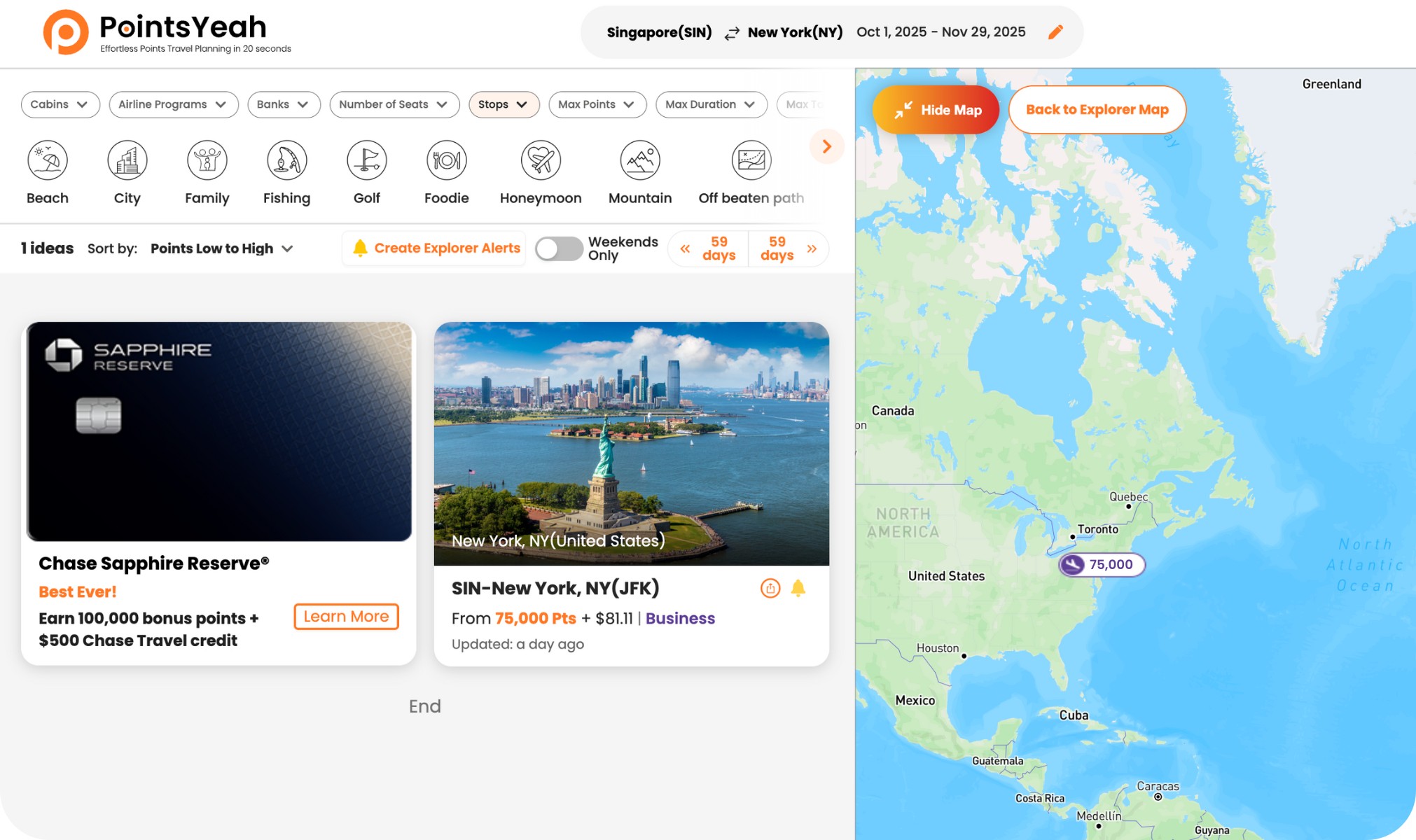

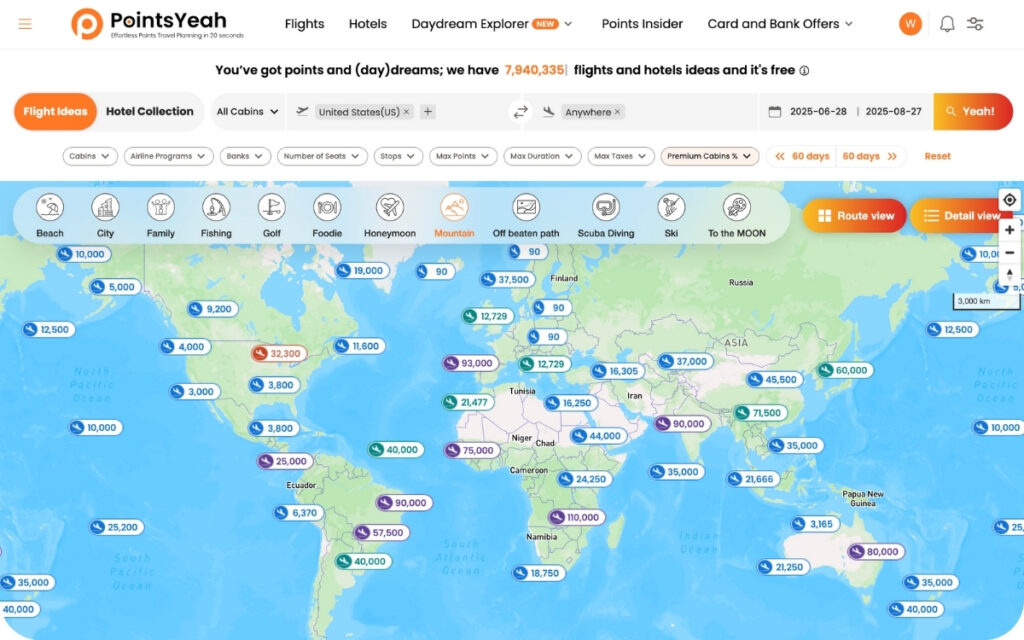

Building Flexible European Adventures with Miles

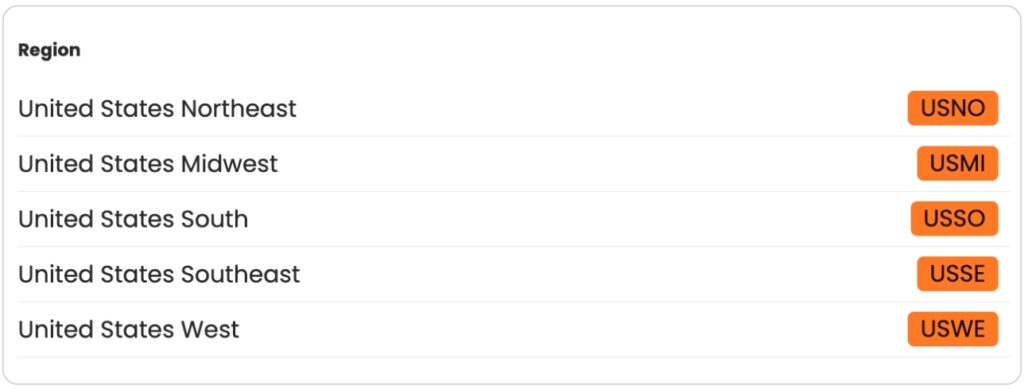

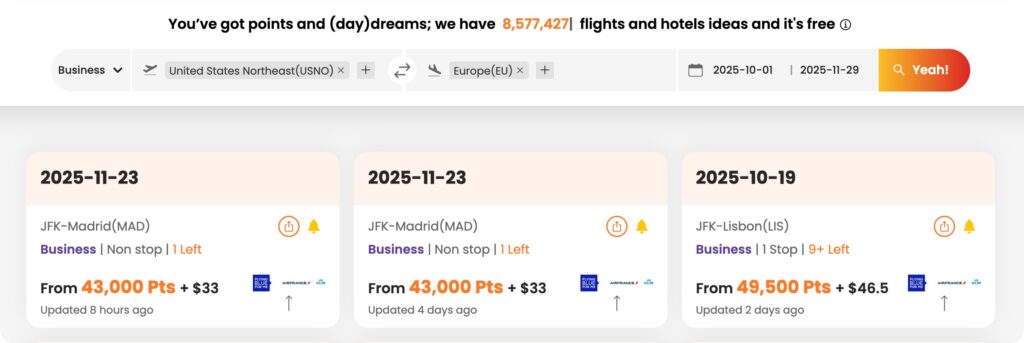

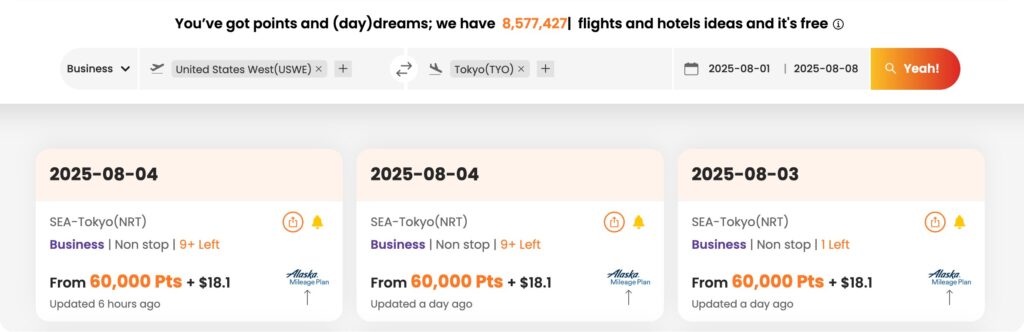

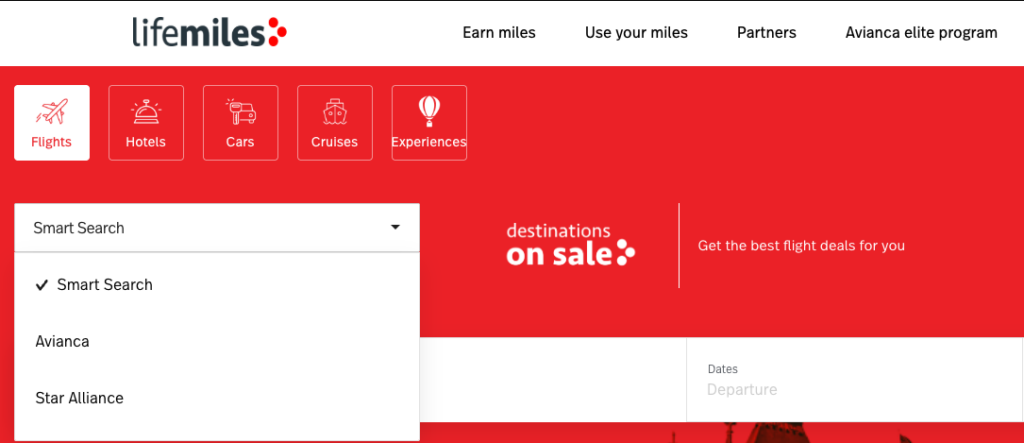

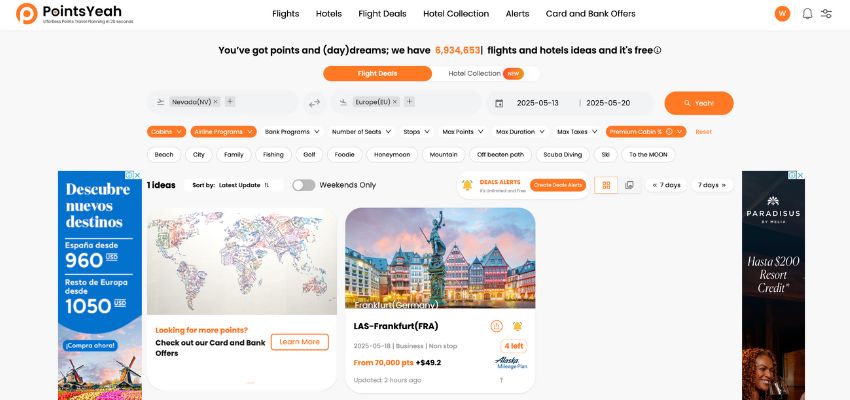

If you’re planning a European vacation, consider building your trip around cheap flight redemptions. Daydream Explorer serves as the best flight search tool when you have date and destination flexibility. Searching from Eastern to Northern Europe over the next couple months reveals opportunities like a nonstop flight from Warsaw, Poland to Riga, Latvia for just 6,000 United MileagePlus miles and $25 in taxes—compared to $150 cash. This highlights a super low-cost way to build an adventure while making your points and miles work efficiently for your travels.

Strategic Hotel Point Redemptions

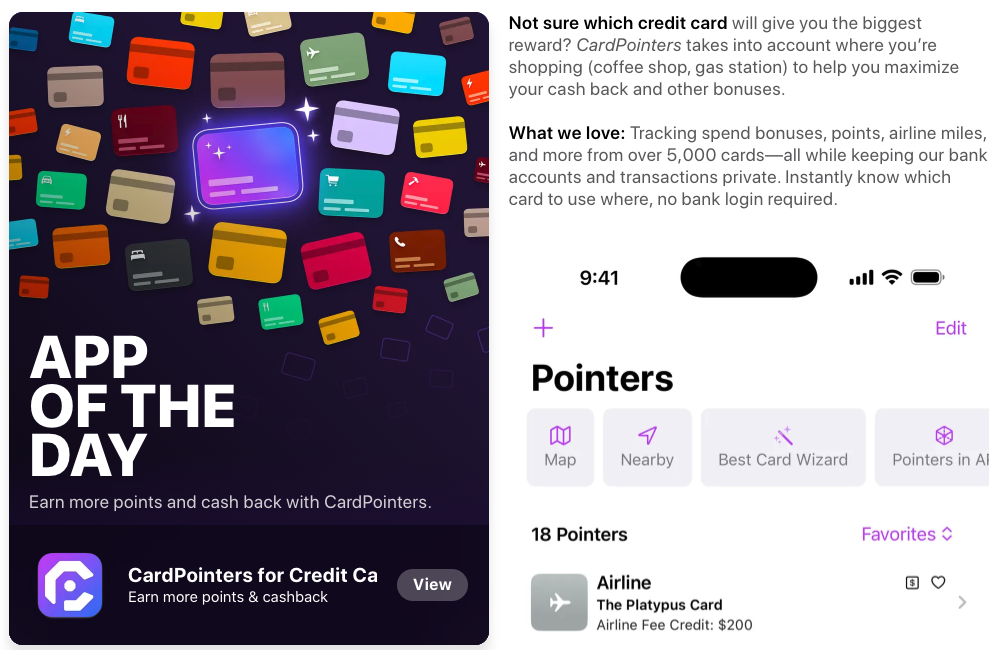

Complement your flight strategy by leveraging points for European hotel stays to create an almost entirely free vacation. Transferring Citi ThankYou points to Choice Hotels at a 1:2 transfer ratio delivers exceptional value—4,000 Citi points becomes 8,000 Choice points for a free night in Paris. Even when cash rates are relatively low, using only 4,000 points for accommodations in a major European city is difficult to beat.

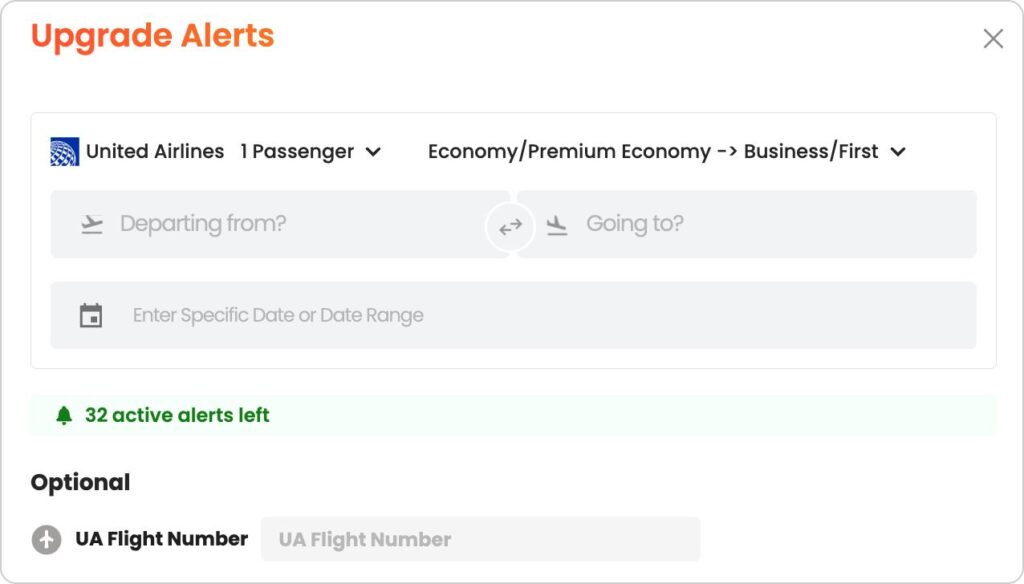

Transfer bonuses apply to hotel programs just like airline loyalty programs. Through August 15, 2025, Chase is offering a 50% transfer bonus to Marriott, enabling luxury stays in Belgrade, Serbia, for 37,000 points per night at a St. Regis property. While substantial, you can optimize this redemption by combining it with Marriott’s “Fifth Night Free” benefit—stay five nights for the cost of four when booking with points. This strategy stretches your point balance while potentially accessing luxury properties that might otherwise exceed your budget.

Bottom Line: European Points & Miles Strategy

When searching for flights and hotels within Europe, follow these essential strategies: always compare cash rates against points redemptions, prioritize using orphaned points from your loyalty accounts, take advantage of credit card transfer bonuses, evaluate business class rates, maintain flexibility with both destinations and travel dates, and utilize hotel program perks like getting an extra free night.

These optimization tips help you save cash for on-the-ground adventures throughout Europe. After all, it’s a lot harder to use points and miles for your crepes and concerts than for your flights and hotels!