The part points can’t cover

Points and miles can make travel easier. They can unlock flights and hotels that would normally cost a lot in cash.

But when real life shows up mid-trip, points can’t always save you. Medical bills are cash. Replacing stolen items is cash. Last-minute solutions are cash. And they usually happen when you have the least energy to deal with them.

A lot of PointsYeah users rely on the travel insurance that comes with their credit cards and feel that separate travel insurance is no longer necessary. The reality is that credit card travel insurance often comes with major limitations:

- Card-specific coverage

- Tedious claims processes

- Long reimbursement timelines

That’s why I personally use the Allianz Travel Insurance Annual Plan and have for many years. It works very differently than credit card coverage.

The trip that turned into two ER visits

During the holidays, I traveled to Mexico and ended up visiting the ER twice for different reasons, racking up about $2,600 in medical bills.

This is where travel insurance became real.

Filing the claim took just a few minutes (under 5 minutes). I only needed:

- Medical records

- Medical bills

- Credit card payment slips (yes, I still kept the points)

That’s it!

I chose direct deposit and was reimbursed through two payments totaling $2,554.30, all within a few days, with no phone calls and no back-and-forth emails.

Get a personalized Allianz quote so you have coverage in place before your next trip.

The receipts (direct deposit)

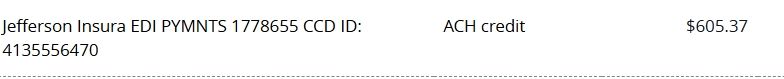

Payment #1

- Claim filed: 12/27/2025

- Payment date: 01/03/2026

- Amount: $605.37

- Status: Completed

- Payment method: Direct Deposit

Claim filed 12/27/2025. Payment issued 01/03/2026 for $605.37 via direct deposit.

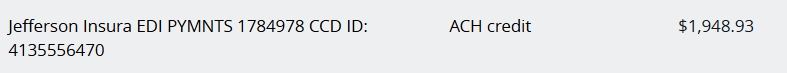

Payment #2

- Claim filed: 01/03/2026

- Payment date: 01/13/2026

- Amount: $1,948.93

- Status: Completed

- Payment method: Direct Deposit

Claim filed 01/03/2026. Payment issued 01/13/2026 for $1,948.93 via direct deposit.

Total reimbursed: $2,554.30

That’s why I say travel insurance saved me about $2,600. The exact amount, $2,554.30, came back through two direct deposits in just days.

This is why I keep an annual plan. Get a personalized Allianz quote for your next trip.

And this wasn’t a one-off

Back in 2022, I was flying from Istanbul to Belgrade when the plane turned around mid-flight due to weather.

If you travel enough, you know what happens next. Everyone rushes to the service desk, lines explode, confusion spreads, and hours get burned waiting for the airline to maybe offer something.

Instead, I booked a hotel inside the terminal, paid for dinner, and went to sleep, while everyone else waited hours just to get a hotel.

All of those expenses were reimbursed within days.

That wasn’t the only time I used it. On separate trips, I’ve also had two theft incidents (my computer and wallet) and one emergency dental visit. Those losses were reimbursed promptly as well.

If you want the same kind of backup when travel goes sideways, get a personalized Allianz quote.

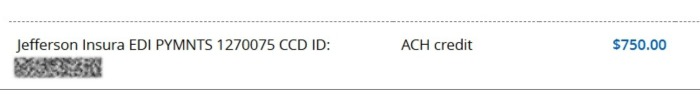

Another real receipt: $750 reimbursement (ACH credit)

This is another example of what a reimbursement looks like once it hits your account.

I have a separate screenshot showing an ACH credit of $750.00 labeled “Jefferson Insura EDI PYMNTS…” and “ACH credit” for $750.00.

Another reimbursement example: $750 ACH credit.

Why the annual plan has been worth it for me

I like the annual plan because it keeps things simple(Or you can see Troy always loss things). I don’t have to think about it every time I book a trip, and I’m covered across the year without buying a new policy for every itinerary.

On top of the reimbursements above, there are a few parts of my $510 annual policy that I’ve found especially useful:

- No receipts required for claims under $100, which helps keep smaller claims quick and easy

- Rental Car Damage & Theft Coverage up to $45,000, which is great to have any time I rent a car

- Coverage for travel partners, since you can add their names during purchase

- Loyalty Program Redeposit Fee Coverage $500.00(This comes play when using non USA programs)

That combination is why I keep renewing it year after year.

Curious what an annual plan looks like for your travel? Start with a personalized Allianz quote.

See below for my whole coverage.

- Trip Cancellation: $5,000.00

- Pre-existing Medical Condition Limit: $5,000.00

- Trip Interruption: $5,000.00

- Pre-existing Medical Condition Limit: $5,000.00

- Change Fee Coverage: $500.00

- Travel Delay: $1,600.00

- Maximum reimbursement per 24-hour period of delay:

- Daily Limit: $200.00

- Minimum Required Delay (Hours): 6

- Baggage Coverage: $1,000.00

- Maximum benefit for all high value items, per policy: $500.00

- Baggage Delay: $1,000.00

- Minimum Required Delay (Hours): 12

- Emergency Medical/Dental Coverage: $50,000.00

- Dental Care maximum sublimit: $750.00

- Emergency Transportation: $250,000.00

- Business Equipment Coverage: $1,000.00

- Business Equipment Delay/Rental: $1,000.00

Get a personalized quote

Get a personalized Allianz quote and make sure your next trip has the backup it deserves.

Happy travels!