By Sarah Cash

Key Takeaways

- Track and rebook regularly: Monitoring your existing hotel reservations using tools like PointsYeah Hotel Collection Calendar view can lead to significant savings through better rates or award availability.

- Optimize free night certificates: Use hotel loyalty program benefits and credit card perks at higher-value properties for maximum return.

- Consider unique accommodations: Alternative lodging like capsule hotels can offer local experiences while saving money. Search for this with PointsYeah Hotel Collection.

- Leverage flexible cancellation policies: Airlines like United offer free award flight cancellations, making rebooking risk-free.

- Set price alerts: Use tools like PointsYeah Points Price Alerts, Explorer Alerts, and Hotel Alerts to automatically monitor award flight prices.

- Strategic point usage: Reserve cash for expensive award periods and use points when rates are favorable.

The Digital Nomad Advantage

As a digital nomad with no home base, I book flights and accommodation almost every week of my life. That might sound exhausting to some, but it also means I have booked, canceled, and rebooked hundreds of reservations to maximize savings and discover new experiences. Here’s how I strategically manage my reservations and saved $866 in just one week.

Capsule Hotel Stay: Saving $196 on Tokyo Accommodation

The Opportunity

A fellow nomad recently reminded me about Tokyo’s famous capsule hotels – known for being clean, comfortable, and offering premium amenities like hot tubs, and complimentary breakfast. I discovered a capsule hotel featuring free champagne and a traditional sauna for approximately $50 per night. You can do this by searching for Unique Hotels when searching PointsYeah’s Hotel Collection.

The Decision

I had already booked a two-night stay at an Intercontinental Hotel, leveraging my Ambassador status to receive one free weekend night. However, I decided to cancel this reservation for two reasons:

- The cost was relatively high compared to other Intercontinental properties worldwide.

- I genuinely wanted to experience Japan’s capsule hotel culture.

The Savings

- Original IHG cost: $452 for two nights

- Capsule hotel cost: $256 for five nights

- Total savings: $196

The Intercontinental would certainly have been more luxurious, but the capsule hotel provided a cultural experience while allowing me to save my Ambassador Weekend Free Night certificate for a higher-value property.

Searching by Hotel Type

- Navigate to PointsYeah Hotel Collection, which you can select from the left sidebar on the main page.

- Search for the desired category of hotels on PointsYeah by clicking the relevant circle underneath the search bar.

- Click “Unique Hotels” for local accommodations that you won’t find elsewhere.

Key Lesson: Always evaluate whether unique local accommodations might offer better value than luxury hotels, and reserve your loyalty program benefits for maximum impact. To do this, search for “Unique Hotels” in PointsYeah’s Hotel Collection.

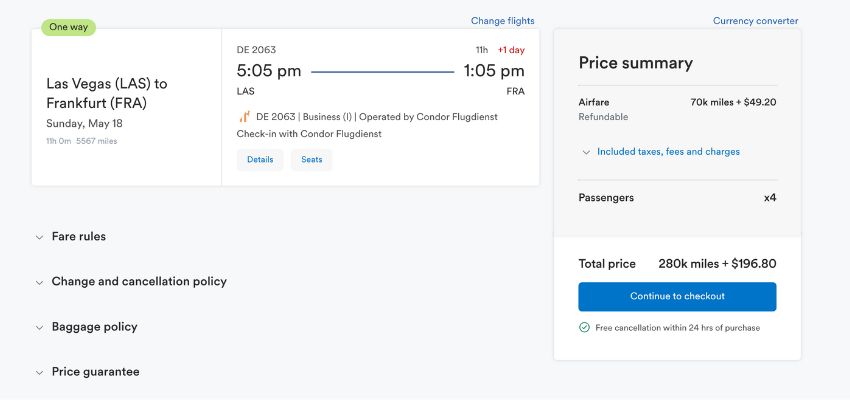

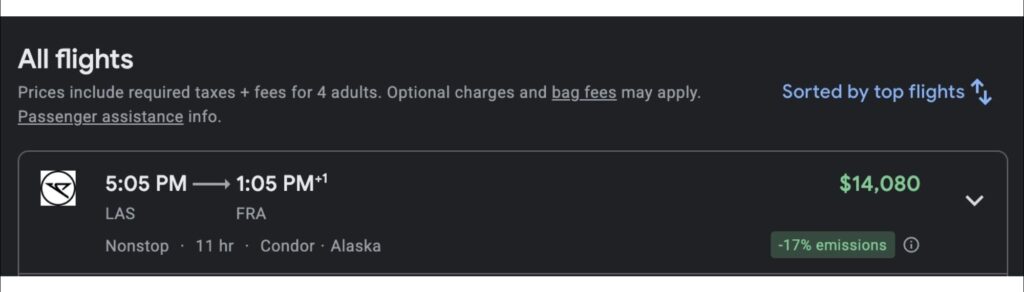

United Award Flight Optimization: $670 in TravelBank Savings

The Situation

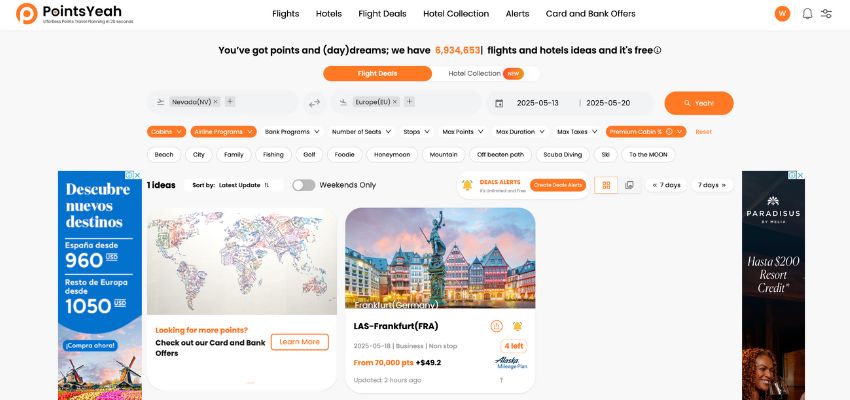

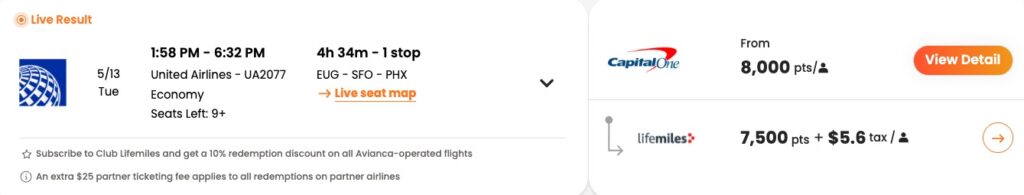

I had originally booked two United business class flights in the South Pacific using United TravelBank funds. While monitoring award availability using Points Price Alerts, I discovered these flights were available in economy for just 15,000 miles plus $13 in taxes.

The Analysis

Both flights were overnight routes under two hours – short enough that business class wouldn’t significantly enhance comfort compared to longer routes where lie-flat seats provide real value.

The Rebooking Strategy

Thanks to United MileagePlus’s free cancellation policy, I was able to:

- Cancel the original TravelBank bookings (refunding $833).

- Rebook using 15,000 miles + $13 in taxes for both flights, a value of over 5 cents per point!

- Preserve TravelBank funds for future premium cabin flights on longer routes.

Key Lesson: Regularly monitor award availability using PointsYeah Points Price Alerts for existing bookings, especially with airlines offering free cancellations. Short flights may not justify premium cabin costs that could be better used on long-haul routes.

Hyatt Taipei Strategy: Mixed Bookings for Optimal Value

The Challenge

While attempting to optimize a Hyatt reservation in Taipei, I discovered that three of my eight planned nights were only bookable with cash, not points. I had originally planned on booking my stay solely with points.

The Current Booking

- Total cost: $448 cash + 25,000 Hyatt points for 8 nights

- Expected earnings: 16,000 points through a Hyatt promotion

- Net point usage: 9,000 points (25,000 redeemed – 16,000 earned)

Searching by Hotel Collection Calendar

- Navigate to PointsYeah Hotel Collection, which you can select from the left sidebar on the main page.

- Search for desired hotels on PointsYeah.

- Click “Award Calendar” on the tile for the hotel you want to stay at.

Key Lesson: Even when you can’t immediately optimize an award booking, continue monitoring for improvements in award space using the Hotel Collection Calendar view. Mixed cash-and-points bookings can still provide excellent value.

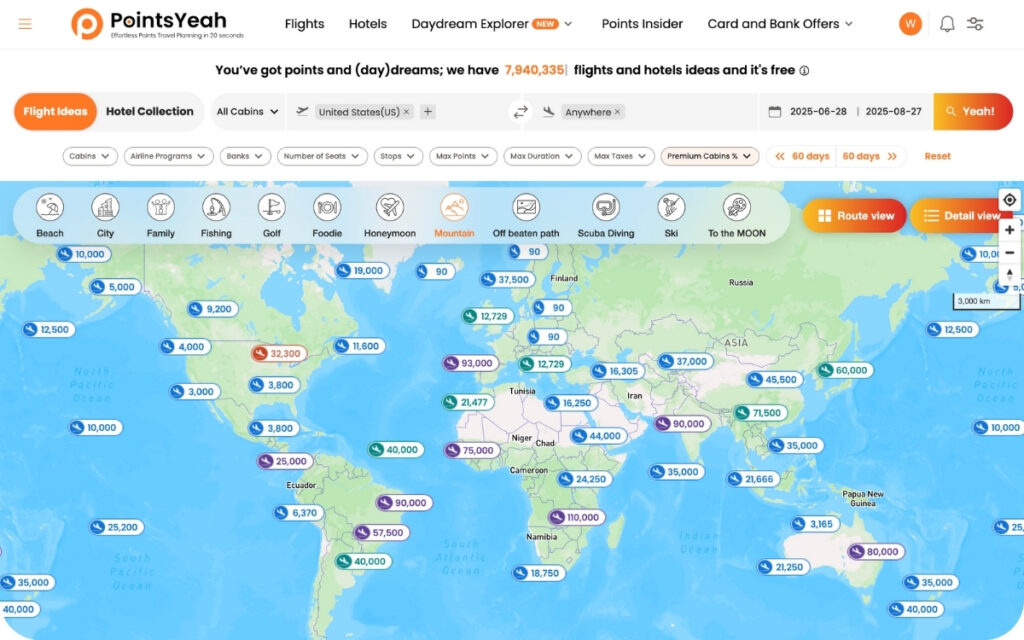

Future Planning: New Zealand Award Alerts

The Strategy

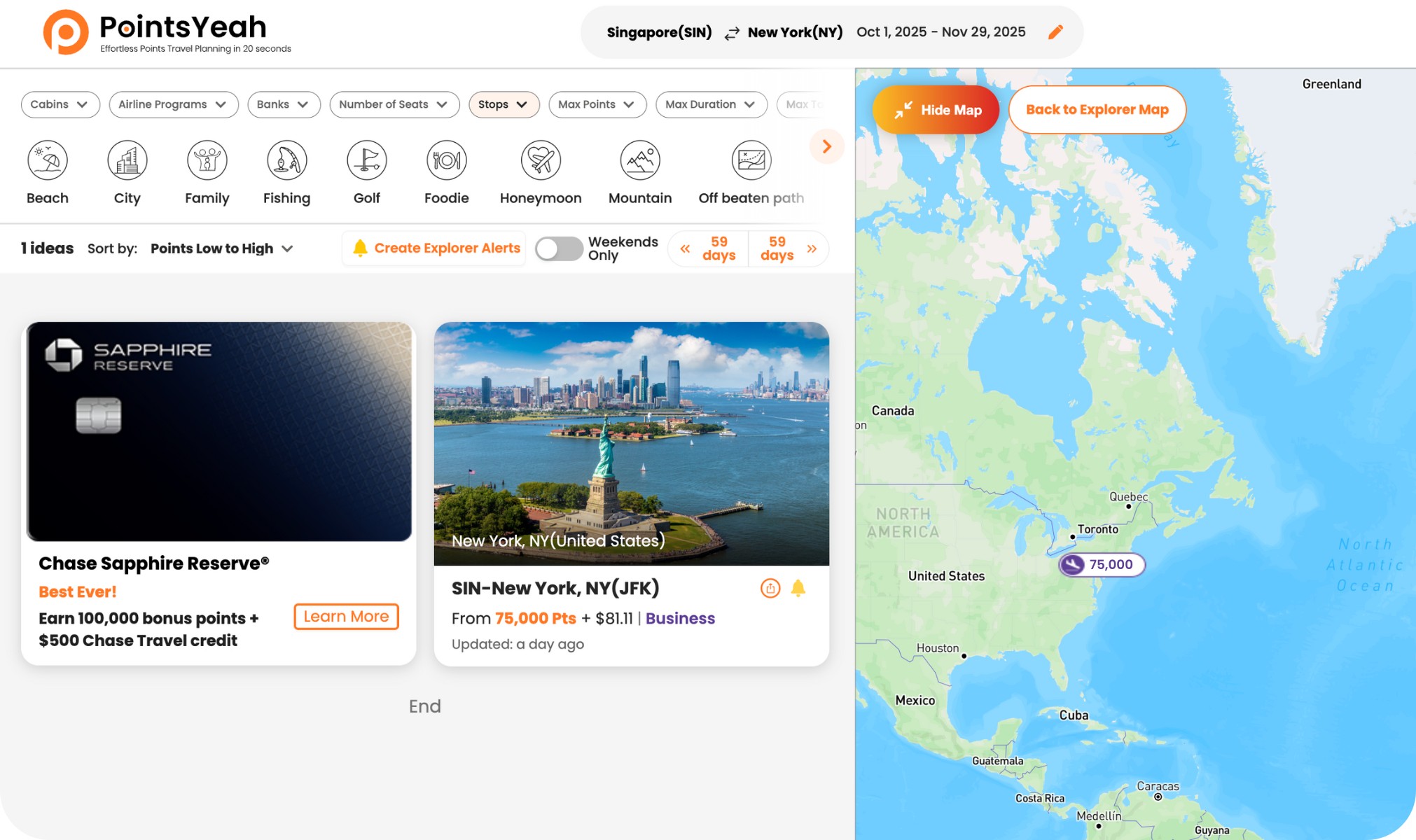

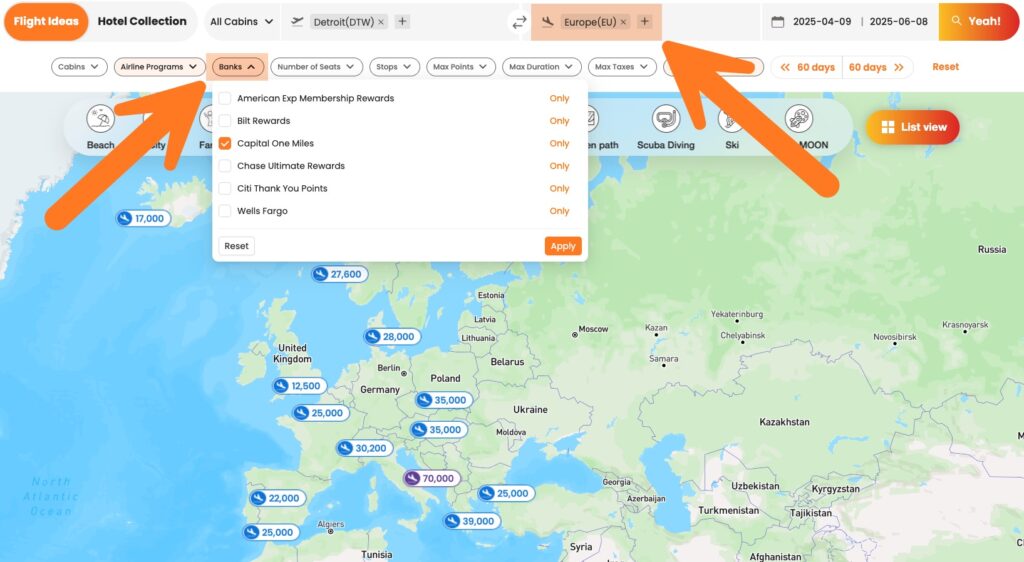

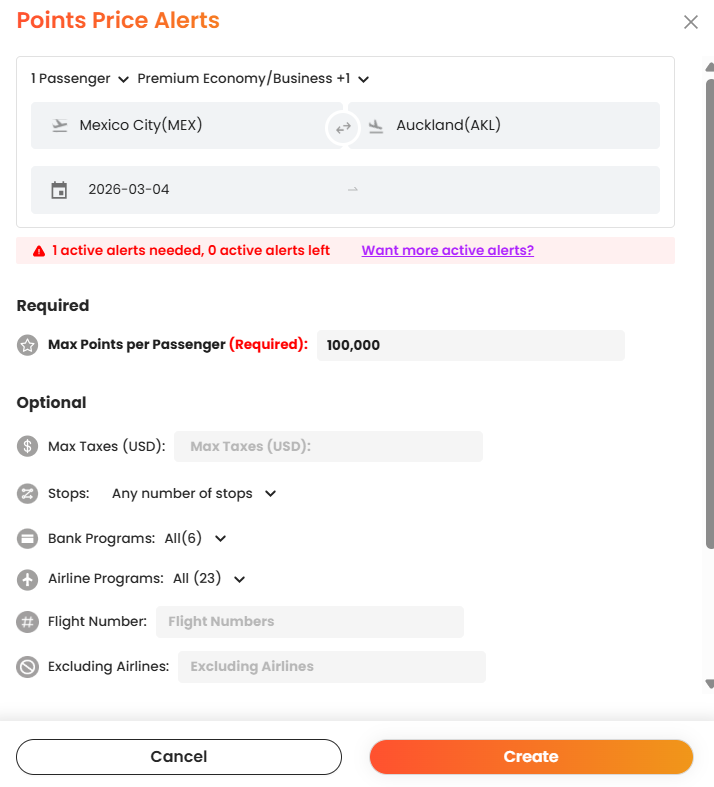

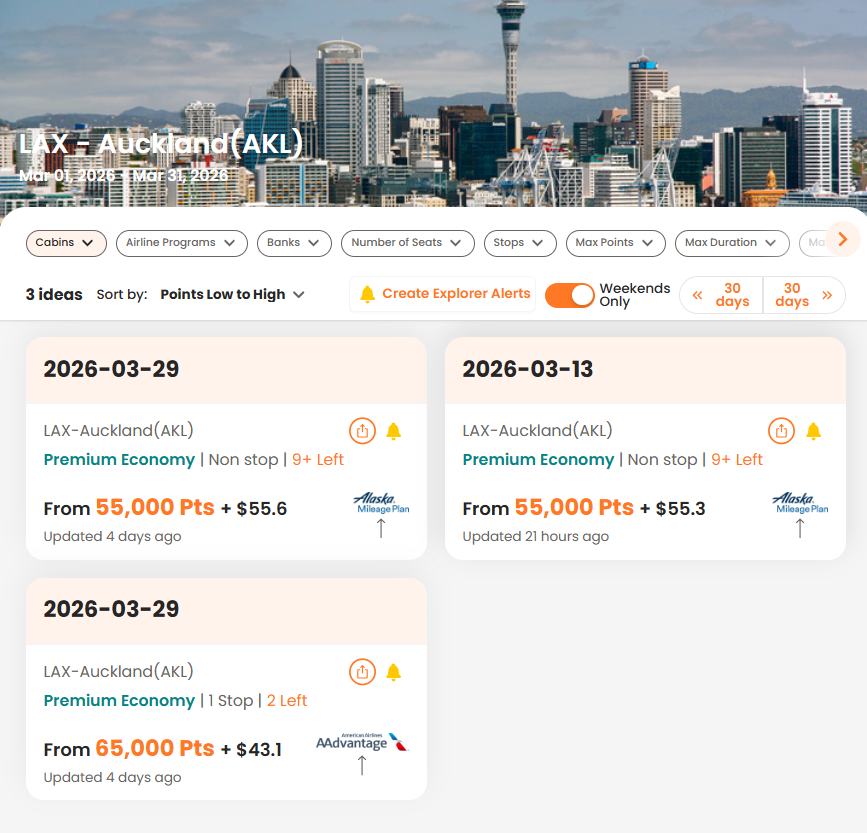

Looking ahead to my trip to New Zealand next year, premium cabin award flights are currently expensive. Rather than booking immediately, I’m using PointsYeah Points Price Alerts and Explorer Alerts to monitor fare changes.

Setting Up Points Price Alerts for my exact route

- Search for desired flights on PointsYeah.

- Click “Create Alerts” in the top right corner.

- Receive notifications when award prices drop or availability improves.

Setting Up Explorer Alerts for a broader search

- Navigate to PointsYeah Daydream Explorer, which you can select at the top or from the left sidebar on the main page.

- Search for flights from anywhere in the US to New Zealand over your desired period of time to find more flights for your trip.

- Click the “Create Explorer Alerts” toggle at the top of the search.

- Receive notifications when award prices drop or availability improves.

Key Lesson: For future travel, especially to expensive destinations, set up automated price monitoring with PointsYeah Points Price and Explorer Alerts rather than settling for current high rates.

Essential Strategies for Travel Savings

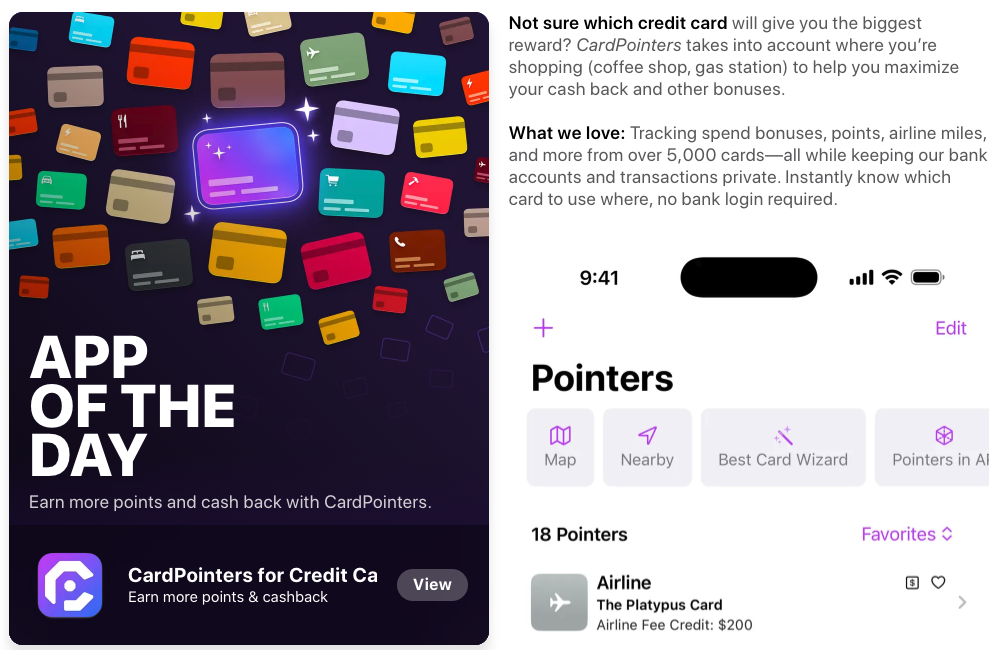

- Maximize Credit Card Benefits

- Embrace Unique Experiences

- Master Flexible Booking Policies

- Implement Systematic Monitoring

Conclusion: The Power of Strategic Rebooking

This single week of tracking my reservations underscores how significant savings are possible through strategic rebooking. The $866 I saved is money that I can spend on travel experiences or invest elsewhere.

I’m so grateful to live my life on the road. While this digital nomad lifestyle can be expensive, points and miles save me tens of thousands annually on flights and accommodations. The key is developing a routine for consistent monitoring and optimization.

Your action items:

- Review your existing reservations this week.

- Set up price alerts for future travel with PointsYeah Points Price Alerts, Explorer Alerts, and Hotel Alerts.

- Understand the cancellation policies of your preferred airlines and hotels.

- Consider local accommodations by using PointsYeah’s Hotel Collection for your next destination.