If you have more than one credit card, you’ve probably felt it, that moment of confusion at checkout when you wonder which card earns the most for this purchase. Or maybe you’ve realized too late that your $200 travel credit expired last week.

It’s not that you don’t know your benefits. It’s that there’s too much to keep track of, rotating categories, new bonuses, annual credits, bank rules, and limited-time offers. That’s where CardRight comes in.

Built for Real Credit Card Users

CardRight was founded by credit experts who saw how overwhelming it can be to manage multiple cards. The app was designed to help everyday users stay on top of their rewards, maximize bonuses, and avoid missing out on perks they’ve already earned.

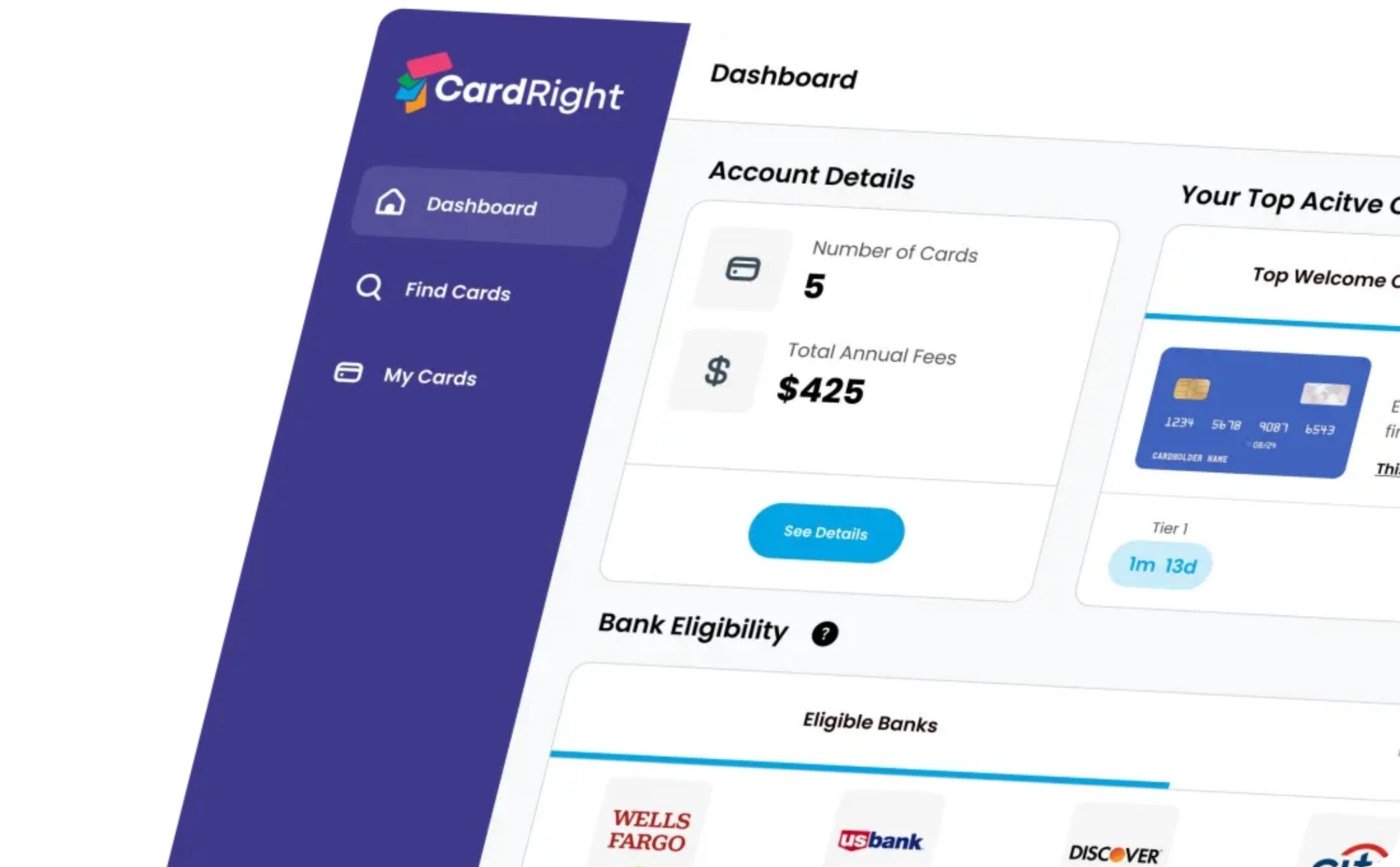

Unlike spreadsheets or manual tracking, CardRight pulls everything into one clear, organized dashboard, making it simple to see what’s active, what’s expiring soon, and where you’re missing value.

Turn Confusion into Clarity

Once you add your cards, CardRight starts working automatically. It gives you a 360° view of your entire credit card setup, including:

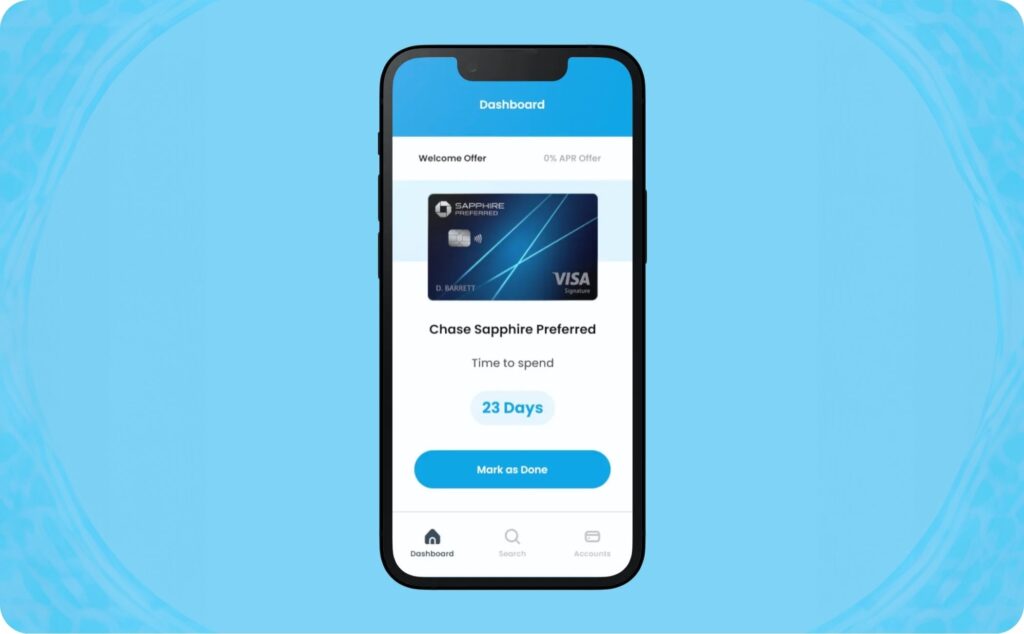

- Bonuses and expiration dates: See live countdowns for every bonus or benefit before it expires.

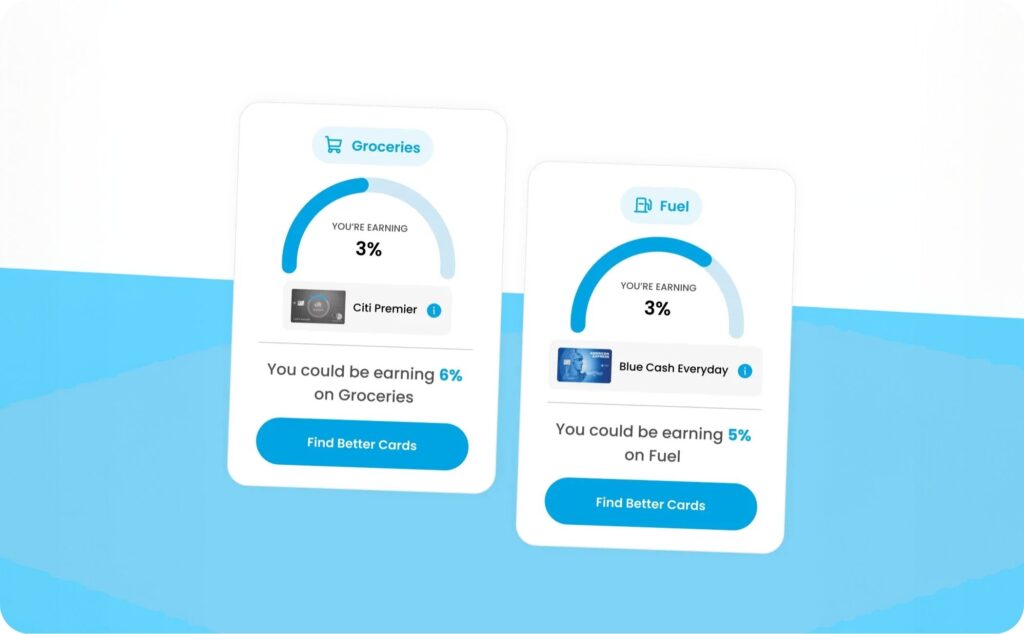

- Best card recommendations: See which of your cards earns the most points or cashback in each category.

- Credits and perks: Track your travel credits, dining offers, and other recurring benefits so you never forget to use them.

- Eligibility tracking: Check your eligibility against common bank rules before applying for a new card.

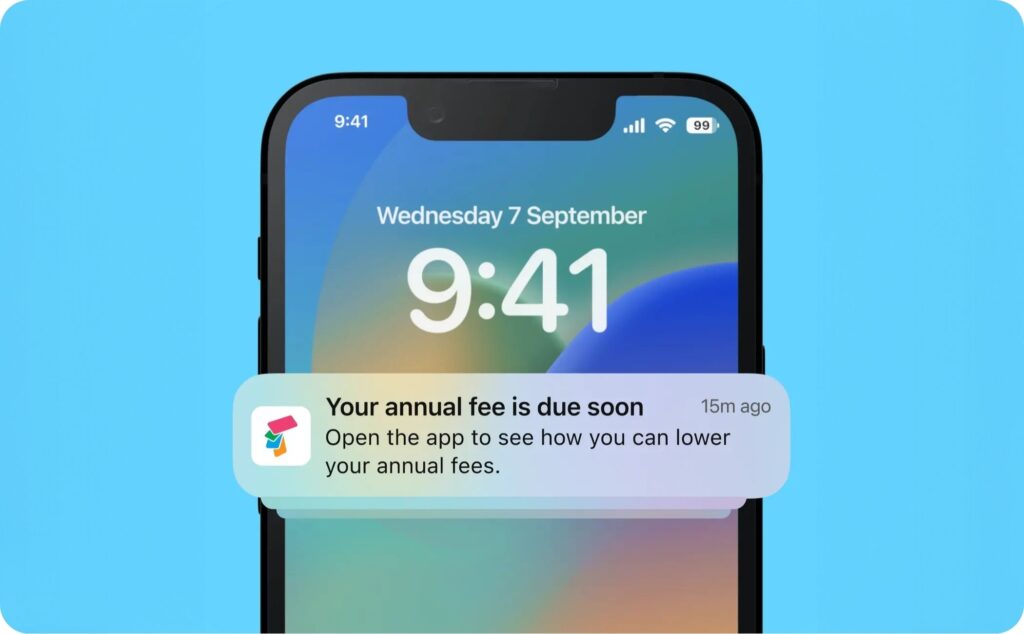

- Notifications and alerts: Receive reminders for upcoming renewals, category changes, and expiring bonuses.

Think of it as your digital assistant for managing rewards, smart enough to remember every perk and deadline, so you don’t have to.

Simple Setup, Smarter Management

CardRight’s onboarding is fast. You simply add your cards, and the app does the rest. Within minutes, you’ll have a full overview of your cards, current bonuses, and credits in one place.

It works seamlessly across iOS, Android, and desktop, so you can check your progress from anywhere, at home, at checkout, or even mid-flight.

Security You Can Count On

CardRight takes privacy seriously, using secure encryption and multiple safeguards to keep your information protected. Your card information stays private, CardRight only tracks the details you choose to manage.

Why It Matters

Managing rewards efficiently isn’t just about convenience. Every missed credit or unused bonus means leaving real value on the table. CardRight helps you:

- Redeem rewards before they expire

- Avoid losing statement credits or perks

- Use the right card for every purchase

- Save time and frustration from manual tracking

For anyone who wants to actually use their rewards instead of worrying about them, this app is a game-changer.

Who It’s For

CardRight is built for:

- Travelers who want to keep track of travel credits, lounge passes, and insurance benefits

- Points enthusiasts managing multiple cards and bonus categories

- Cashback optimizers who want to earn the highest return on every purchase

- Everyday users who just want peace of mind knowing nothing’s slipping through the cracks

Win a Rimowa Carry-On

We’ve partnered with CardRight to give one traveler a Rimowa Essential Lite+ Carry-On, worth close to $1,000 — built for travel and ready for wherever your points take you. Upgrade how you travel and manage your cards.

To enter, make sure you have a CardRight account. If you’re new, sign up first, then register for the giveaway with the same email before November 18, 2025, at 11:58 PM ET.

Terms apply. See official rules.

Use Credit Cards Responsibly

⚠️ Always pay your balances in full.

⚠️ Only apply for cards you can manage responsibly.

⚠️ Review terms and offers before applying.

Final Thoughts

CardRight isn’t just another credit card tracker, it’s a smarter way to manage your rewards and make sure you’re always earning, never wasting.

If you’ve ever forgotten about a bonus, missed a benefit, or felt like your cards were running you instead of the other way around, CardRight is the fix.

It’s simple, secure, and designed for people who actually want to make the most of their rewards.