When it comes to long-haul travel, most flyers think there are only two options: spend fewer points and squeeze into economy, or spend big for a lie-flat seat in business class. But there’s a middle ground that too many travelers overlook: premium economy.

Premium economy sits perfectly between comfort and value. It offers just enough extra space and service to make a long flight restful, yet it typically costs 30–50% fewer points than business class. For many travelers, especially families, it’s the ideal balance between comfort, cost, and practicality.

What Is Premium Economy?

Premium economy is a distinct cabin class found on most major international airlines, positioned between economy and business class. It usually features:

- Wider seats with 5 to 7 inches more legroom than economy

- Deeper recline and leg or foot rests for better rest on long flights

- Enhanced dining, often served with real glassware and upgraded meal options

- Priority check-in and boarding, making airport navigation smoother

- Extra baggage allowance and dedicated overhead bin space

Airlines like ANA, Singapore Airlines, British Airways, and Lufthansa are known for exceptional premium economy products, while American, Delta, and United have invested heavily in improving their cabins for long-haul travelers.

The Real Advantage: Sleep and Comfort Without Overspending

Long flights can be exhausting, especially overnight routes from the U.S. to Europe or Asia. Premium economy provides just enough space and recline to actually sleep on the plane, which can make or break how you feel when you land.

You won’t get a lie-flat seat, but the comfort upgrade is significant enough that many travelers now choose premium economy intentionally, not as a downgrade from business class but as a smart, points-efficient choice.

Save Points While Flying in Comfort

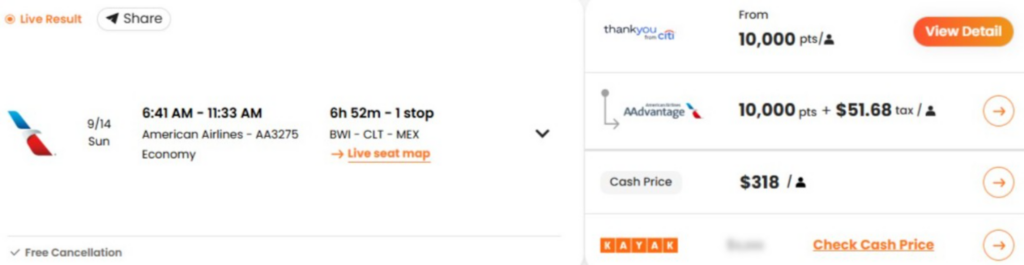

From an award travel perspective, premium economy is one of the best values in the sky. Many routes cost 30–50% fewer miles than business class redemptions, yet the experience is far better than standard economy.

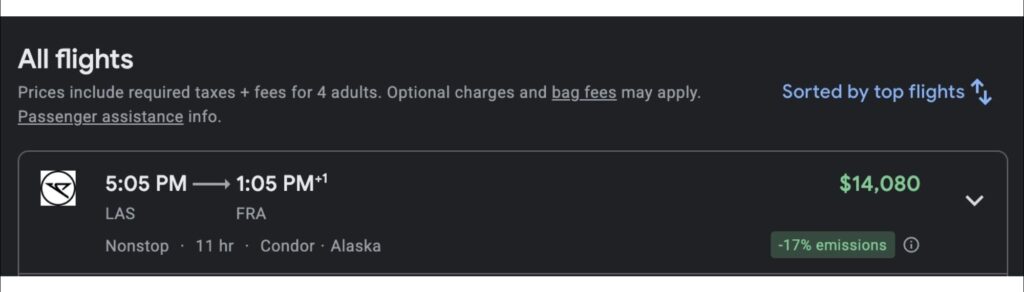

For example:

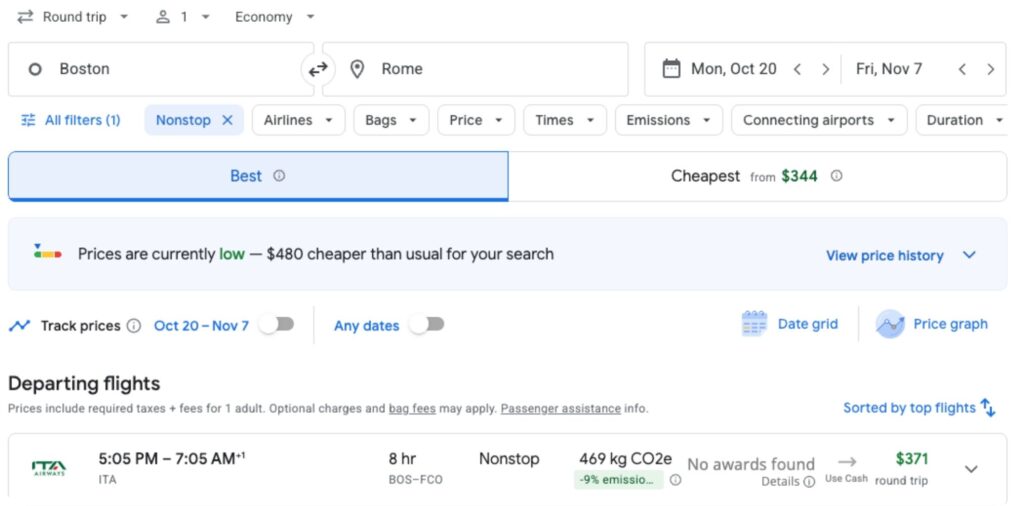

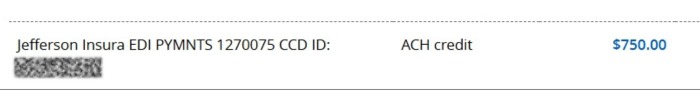

- New York to London in Virgin Atlantic Premium Economy can often be found for under 14K points, but with higher fees than economy. Even with the added surcharges, it remains a great value for a comfortable transatlantic flight.

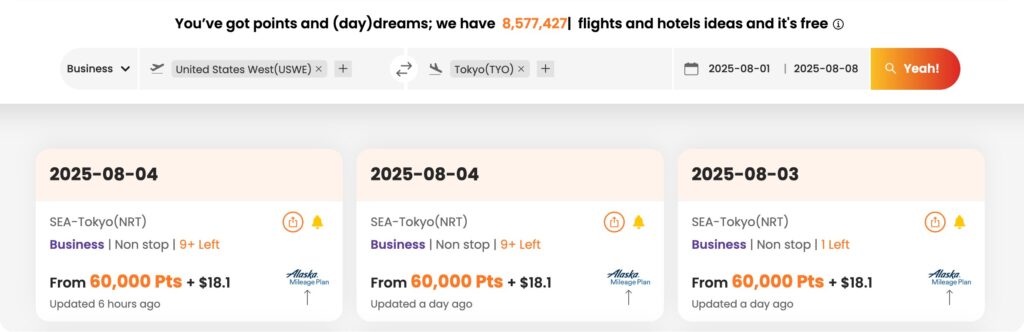

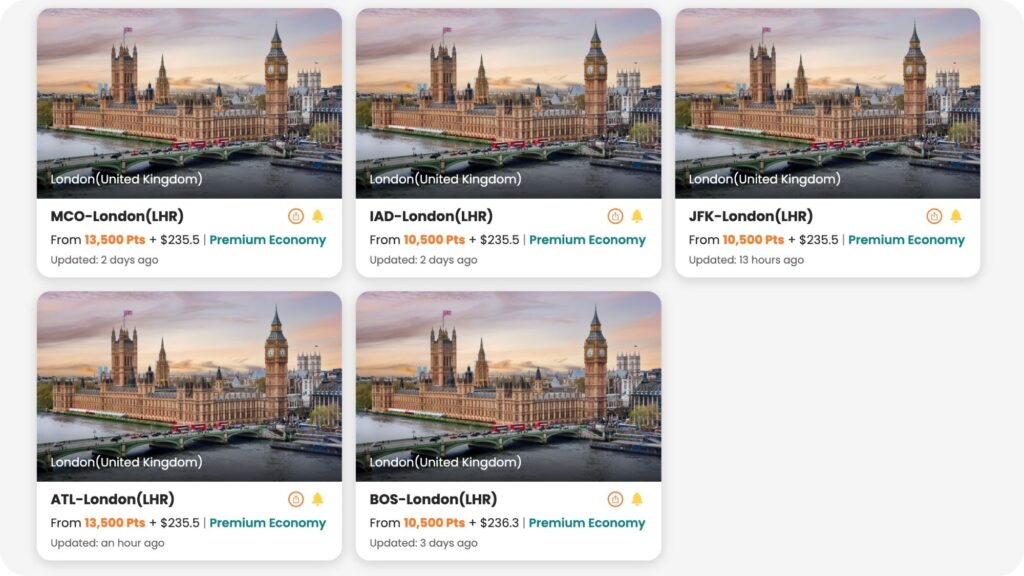

- Fly from major cities in the U.S. to Tokyo in Japan Airlines Premium Economy can be booked for 50,000 Alaska Atmos Reward points plus $18 in taxes.

These savings matter even more for families booking multiple tickets or travelers who want to conserve points for hotels or future trips.

Added Airport Perks That Simplify Your Journey

Beyond what you get onboard, premium economy passengers often receive priority airport services that make the journey smoother from start to finish:

- Priority check-in counters to skip long lines

- Faster boarding and deplaning, so you spend less time waiting

- Priority baggage handling, meaning your bags usually arrive first

These conveniences can make flying with kids or connecting through busy airports much less stressful.

Premium Economy vs. Business Class: The Real Comparison

| Feature | Premium Economy | Business Class |

| Seat Type | Recliner with extra legroom | Lie-flat bed or pod |

| Points Required (avg.) | 30–50% less than Business | High, premium pricing |

| Meals | Upgraded economy-style | Multi-course dining |

| Ideal For | Budget-minded comfort seekers, families | Frequent travelers and luxury seekers |

f you value sleep, space, and smart redemptions, premium economy delivers 70 to 80% of the comfort for nearly half the points. For most travelers, that’s a deal worth booking.

Why Premium Economy Is Perfect for Families

Families love premium economy for good reason. The extra seat width and legroom make it easier for kids and adults to relax without breaking the points bank. Parents appreciate early boarding, dedicated cabin service, and the ability to sit together in a smaller, quieter cabin.

For long flights to destinations like Europe, Japan, or Australia, premium economy can save thousands of points per trip while keeping everyone comfortable.

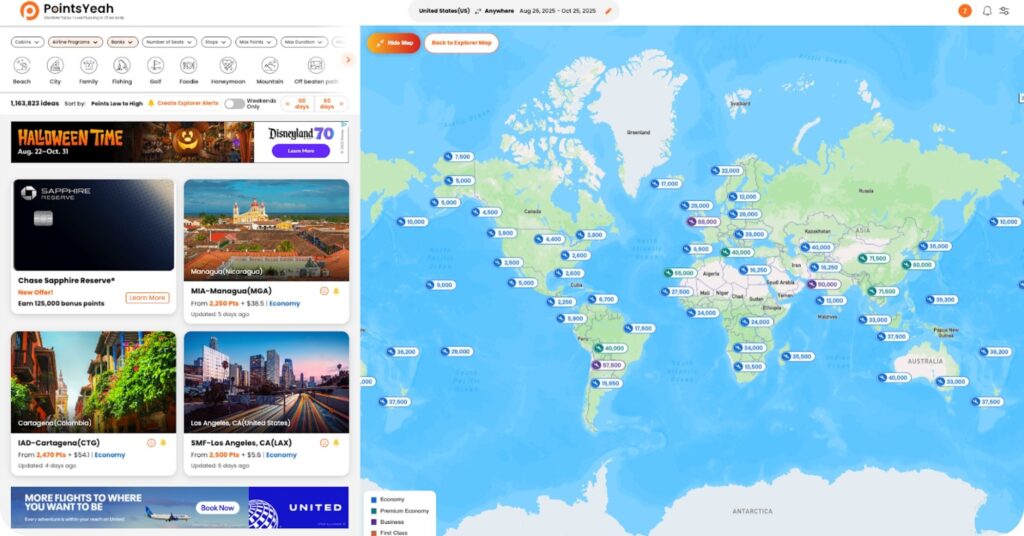

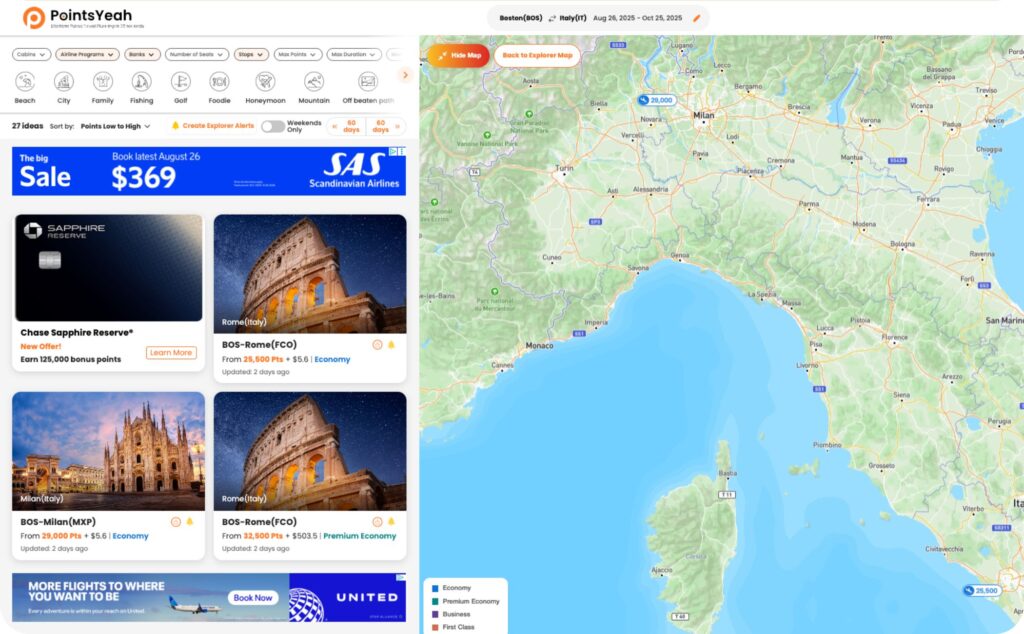

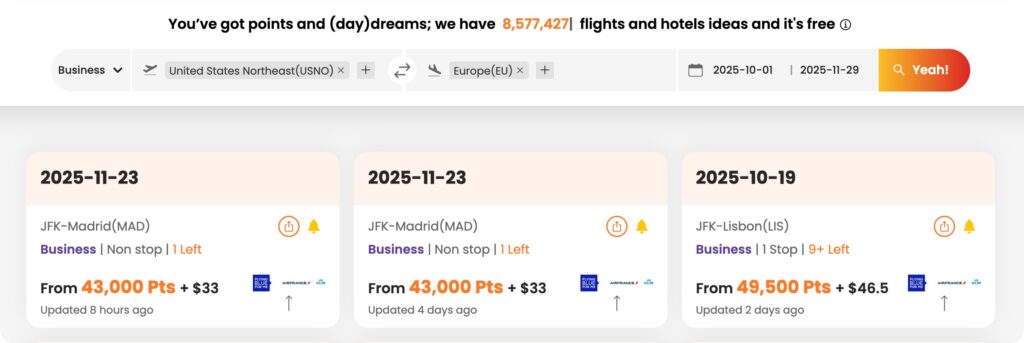

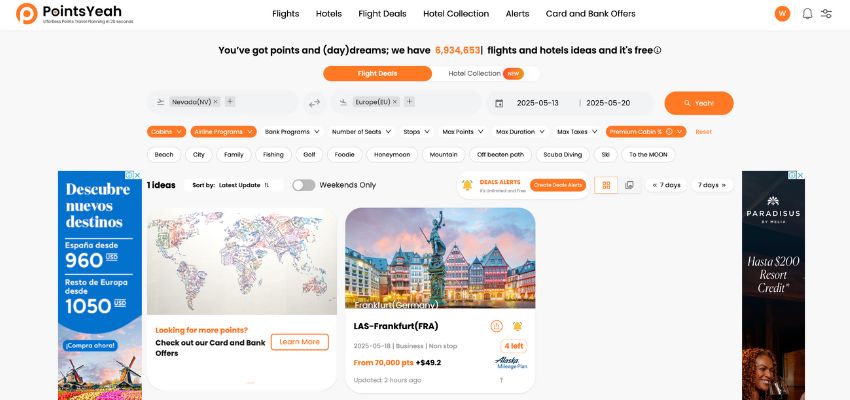

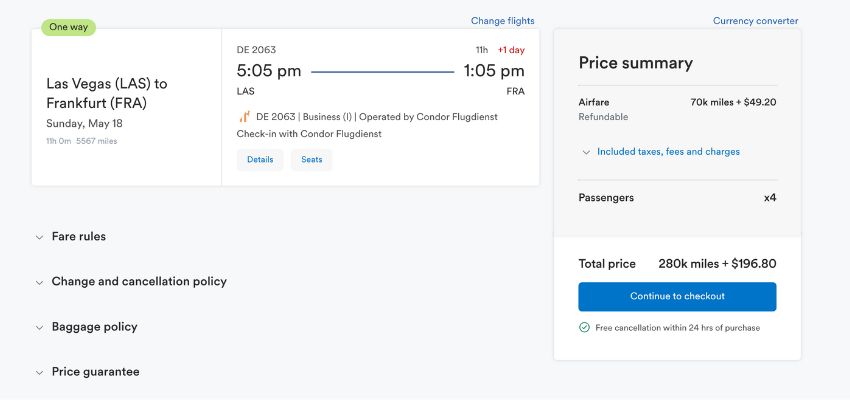

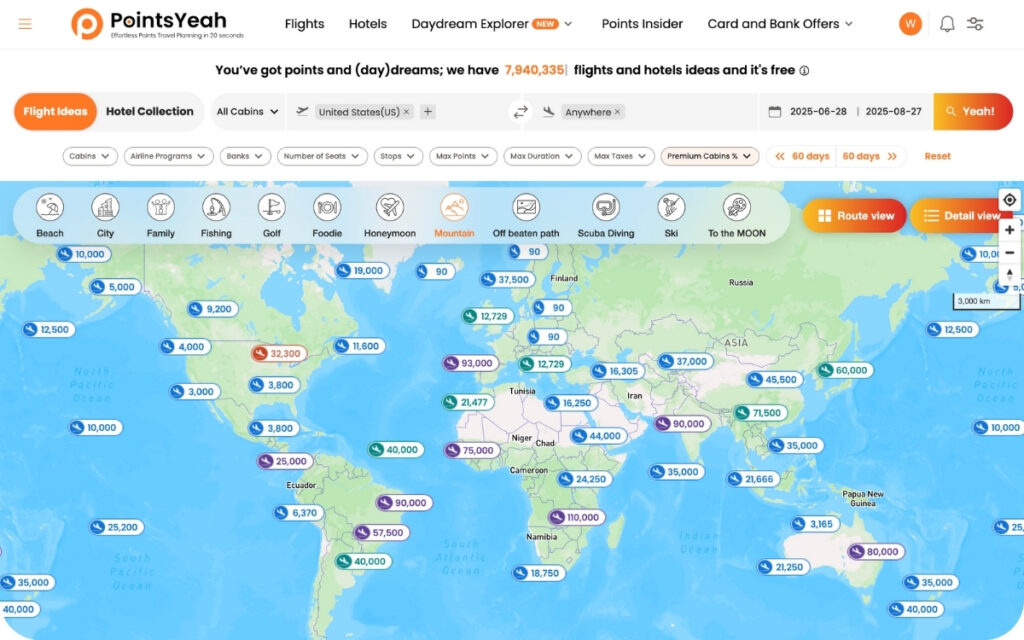

How to Book Premium Economy Using PointsYeah

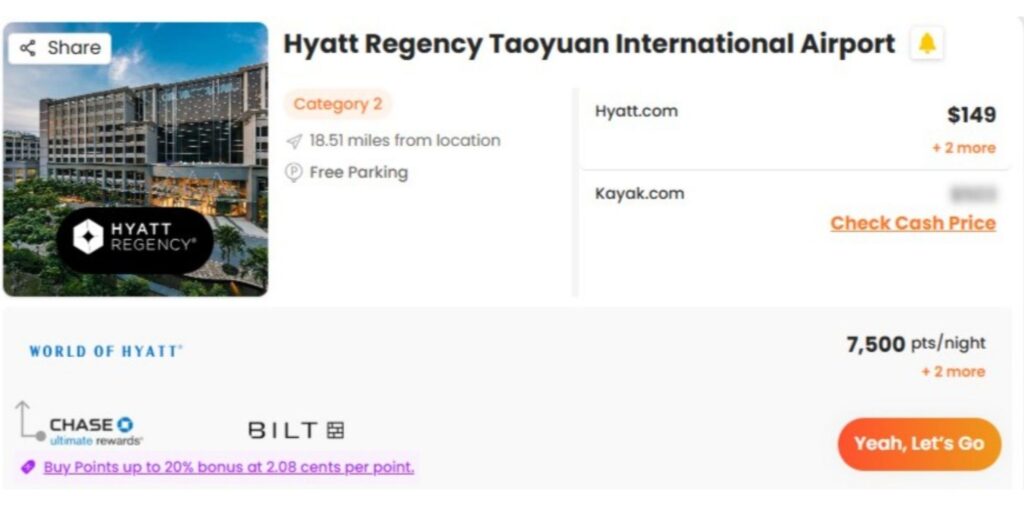

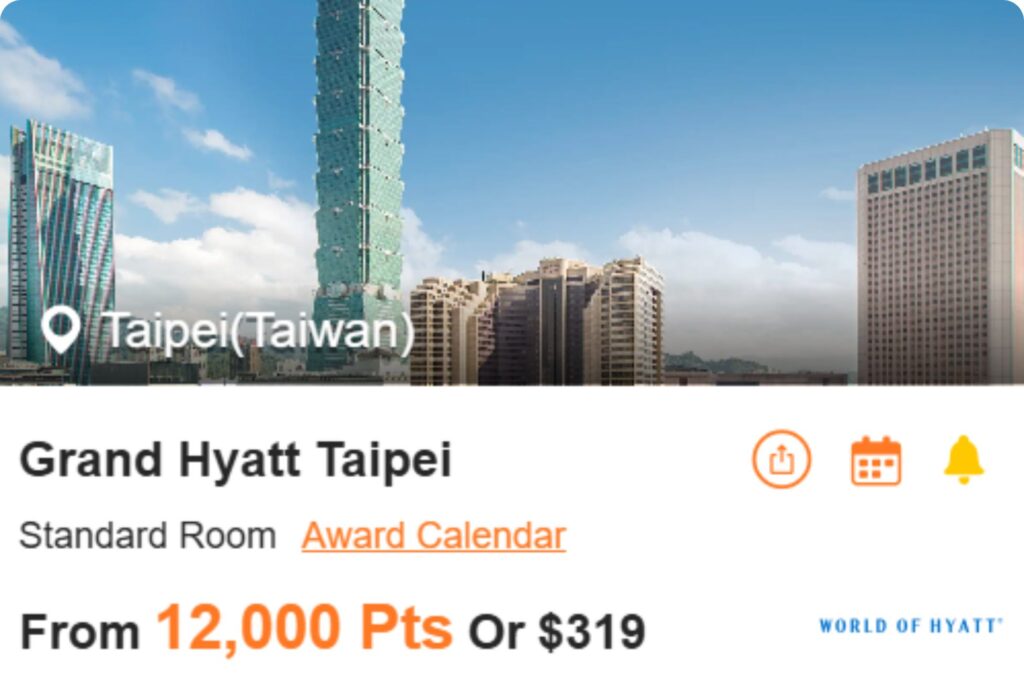

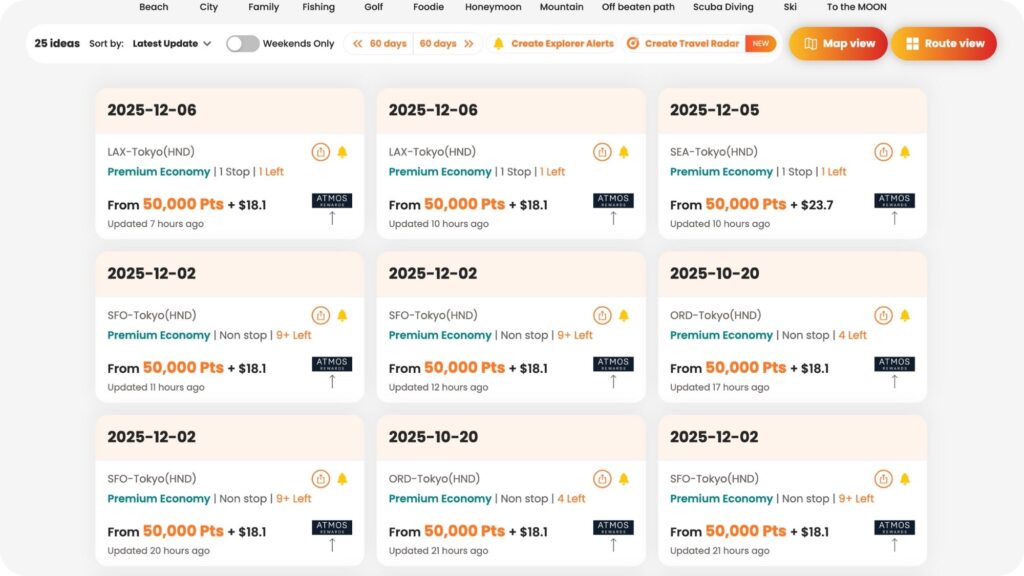

Finding premium economy award space isn’t always easy since these cabins have limited seats. That’s where PointsYeah helps.

With PointsYeah’s lightning-fast award search, you can:

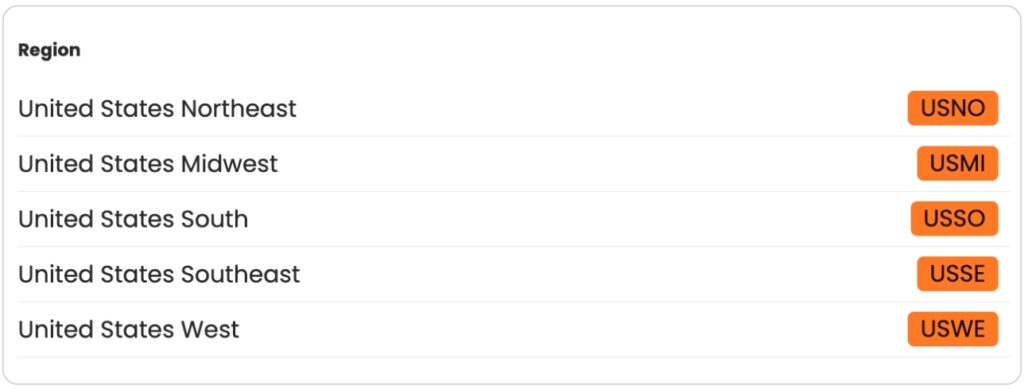

- Compare award space across 200+ airlines instantly

- Filter by cabin class, including premium economy

- Set alerts so you’re notified when award seats open up

- Track points prices and book when value improves

It’s the simplest way to see whether premium economy seats are worth the points, and often, they are.

When Premium Economy Is the Smarter Move

Premium economy makes the most sense when:

- You’re flying overnight or long-haul (8+ hours)

- You want to save points but still sleep comfortably

- You’re traveling with family or a partner

- Business class redemptions are scarce or overpriced

- A transfer bonus makes premium economy redemptions especially strong

Booking premium economy can also help you extend the lifespan of your points, freeing up more value for future business or first-class deals when they truly count.

Final Thoughts: The Smart Traveler’s Sweet Spot

Premium economy hits the perfect balance: comfort, practicality, and value. You’ll save a meaningful number of points while still enjoying a much better flight experience that lets you arrive rested, not wrecked.

If you’ve been sleeping on premium economy, now’s the time to give it a closer look. Use PointsYeah to find, compare, and track the best premium economy award flights worldwide. You might just find it’s the class you never knew you needed.

🔍 Start searching premium economy award flights now on PointsYeah.com