Editorial Disclosure: Opinions, reviews, analyses & recommendations are PointsYeah’s alone, and have not been reviewed, endorsed or approved by any of these entities. Some links on this website will earn an affiliate commission.

The Capital One Venture Rewards Credit Card is a lower version of The Capital One Venture X Rewards Credit Card and one of the most user-friendly travel credit cards on the market. It’s excellent if you’re new to the points and miles world.

But don’t misunderstand: It’s not some entry-level rewards card that you’ll graduate from when you become a travel rewards “expert.” I’ve had this card for many years — and I’ve got no intention to ever cancel it. That’s because it:

- Earns rewards at a high rate

- Makes redeeming your miles effectively foolproof (you’ll see why in a minute)

- Gives you access to helpful programs like Capital One Travel and Capital One Entertainment

You can earn one of the highest bonuses we’ve ever seen from the card: 75,000 bonus miles(redeemable through Capital One Travel) after spending $4,000 on purchases within the first three months from account opening.

Here’s a quick Capital One Venture Rewards Credit Card review. You’ll know if the card is right for you by the time you’re finished.

How do Capital One Venture rewards work?

How to earn Capital One miles

Again, the Capital One Venture Rewards Credit Card currently offers a welcome bonus of 75,000 miles (to be used through Capital One Travel) after you spend $4,000 on purchases within the first three months from account opening.

The card also earns:

- 5 miles per dollar on hotels, vacation rentals, and car rentals booked through Capital One Travel

- 2 miles per dollar on all other eligible purchases

When it comes to travel credit cards, this is as straightforward as it gets. A 2x base earning rate for your spending means you’re guaranteed to get a solid return on everything.

How to use Capital One miles

When redeeming miles for travel, you’ve got a couple options. Both are virtually effortless — especially if you’re a PointsYeah user:

- You can transfer your miles to airline and hotel partners.

- You can simply swipe your card to pay for a travel purchase (airfare, cruises, Uber, hotel stays, even many on-site hotel restaurants). You’ve then got 90 days to offset your eligible purchase with miles at a rate of 1 cent each.

- You can use miles to book flights, accommodation, or rental cars through Capital One Travel at a rate of 1 cent each.

Transferring miles to airlines and hotels is typically the way you’ll squeeze the most travel from your rewards. Here’s a look at all the loyalty programs that partner with Capital One (1:1 transfer ratio unless otherwise noted).

| Accor Live Limitless (2:1) | Emirates | Singapore Airlines |

| Aeromexico | Etihad | TAP Portugal |

| Air Canada Aeroplan | EVA Air (2:1.5) | Turkish Airlines |

| Avianca | Finnair | Virgin Red |

| British Airways | Flying Blue (Air France and KLM) | Wyndham Rewards |

| Cathay Pacific | JetBlue (5:3) | |

| Choice Privileges | Qantas |

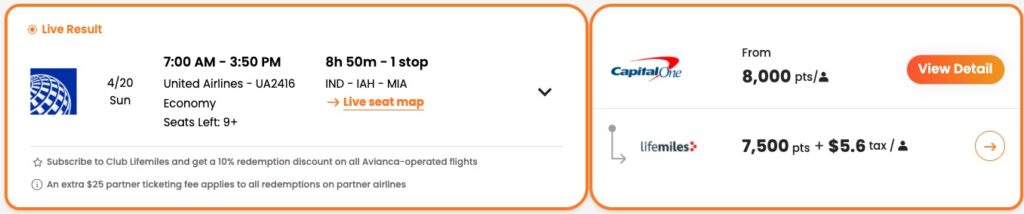

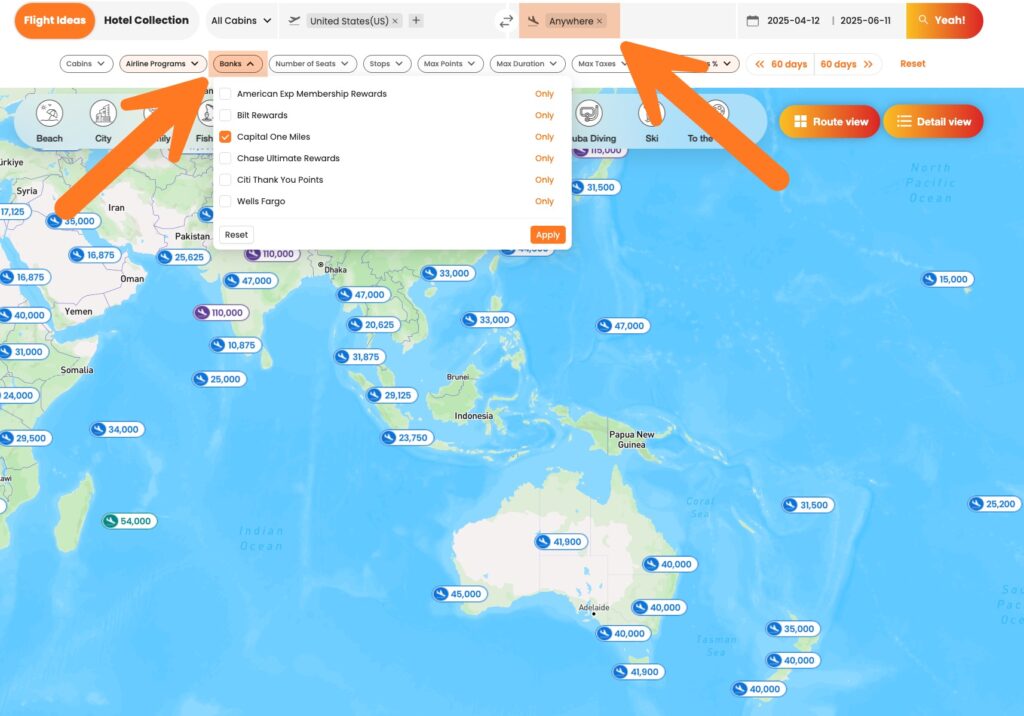

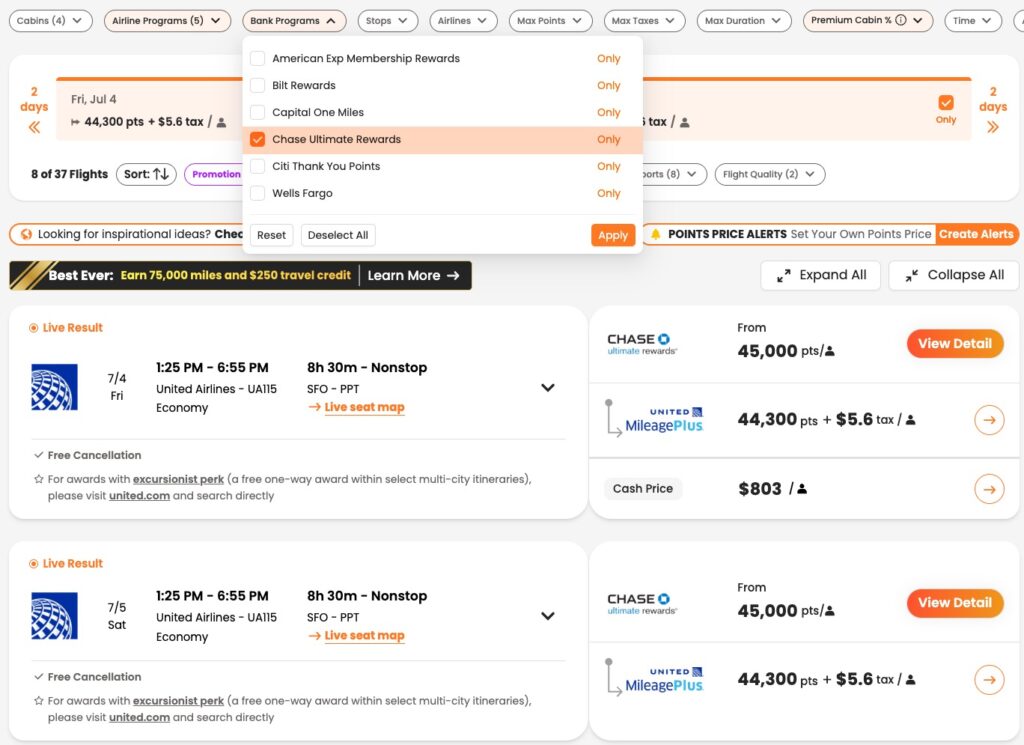

As you can see, Capital One has a great list of airline partners that can help you to get nearly anywhere on the planet. If you’re not sure how to use them, defer to the PointsYeah search engine.

PointsYeah lets you filter your award search by bank program. This makes it simple to quickly find flights and hotels you can book with Capital One miles.

PointsYeah helped me to find a United Airlines business class seat to Germany by transferring 70,000 Capital One miles to Avianca LifeMiles. That’s a steal for a Polaris seat!

Is the Capital One Venture worth a $95 annual fee?

The Capital One Venture charges a $95 fee upon account opening and after each cardmember anniversary. If you make good use of its perks, that price tag may easily be worth it.

In other words: If you’d pay $95 for the below card benefits, the Capital One Venture is a good deal.

Speed through airport security checkpoints

The Capital One Venture comes with up to $120 in credit to reimburse you for the application fee of either TSA PreCheck or Global Entry.

TSA PreCheck grants you the humanity of keeping your shoes, belt, and light jacket on when going through most domestic security checkpoints. You can also keep your laptop and TSA-approved toiletries in your bag (instead of pushing dozens of gray bins through the x-ray machine). You won’t even have to raise your arms in that invasive phone booth scanner thing — you’ll walk through a friendlier metal detector.

Global Entry lets you skip the immigration line when returning to the U.S. from another country. You can walk up to a self-serve kiosk, let it take a quick glance at your face, and head out the door. You’ll walk through a short checkpoint where an officer may ask you a question or two, but that’s it.

Global Entry comes with TSA PreCheck privileges — so it’s the better one to apply for.

Membership with both of these programs lasts for five years. And because the Capital One Venture’s $120 credit renews every four years, you’ll never have to pay out-of-pocket for these programs.

Access to Capital One Travel

Those with the Capital One Venture Rewards Credit Card can access Capital One’s online travel booking agency — Capital One Travel. This is one of the better online travel agencies because of perks like:

- Price drop protection. Get up to $50 in travel credits if your flight price decreases within 10 days of booking.

- Price freeze. Hold the current price of your itinerary for up to 14 days for a small fee.

- Cancel For Any Reason coverage. Change or cancel your travel details for any reason (even Basic Economy fares) and get up to 90% of your money back for a small fee.

You can also book hotels through the Capital One Lifestyle Collection, which gives you elite-like benefits (think room upgrades, late checkout, and a $50 experience credit) during your stay.

No foreign transaction fees

Several credit cards charge an arbitrary fee (often around 3%) when you buy something outside of the U.S. That makes any travel purchases, shopping, etc. during your international trip notably more expensive.

The Capital One Venture eats this fee, making it a good spending option for traveling overseas.

Reserve fancier rental cars for less

With a few clicks through your Capital One Venture online account, you can enroll in Hertz Five Star elite status. This status otherwise requires 10 rentals or $2,000 in Hertz spending. Benefits include 25% bonus points on paid rentals, upgrades when available, and more.

Decent travel insurance

The Capital One Venture Rewards Credit Card comes with travel insurance that, while not stellar (the Chase Sapphire Preferred’s travel insurance is considerably better), are sufficient for a mid-tier travel credit card. Coverage is automatic as long as you make your travel purchases with the card.

You’ll get:

- Rental car insurance. You are covered for theft or collision damage up to the actual cash value of most cars. Coverage is secondary when renting domestically, meaning the card will only reimburse what your personal insurance won’t cover. You’ll get primary coverage when renting outside the U.S.

- Lost luggage reimbursement. Capital One will give you up to $3,000 when the airline, cruise ship, etc. loses your luggage.

- Travel accident insurance. Get up to $250,000 in compensation against loss of life, limbs, sight, speech, or hearing when the common carrier (like an airline) is at fault.

The card’s also got helpful benefits like Roadside Dispatch (similar to AAA) and Travel and Emergency Assistance Services. These aren’t “insurance,” but they can work to get you out of a bind when you’re away from home.

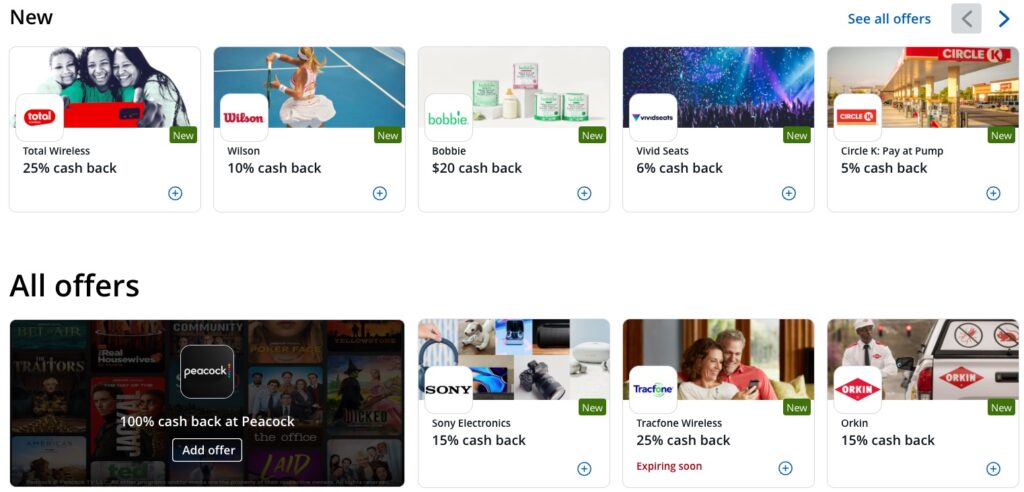

Book events and restaurants that others can’t

Capital One routinely gives its cardholders early and/or exclusive access to reserve popular events such as concert tickets, sports, culinary experiences, etc. Some restaurants even save tables for Capital One Venture cardholders in case they decide to book a last-minute reservation.

Is the Capital One Venture right for you?

If you’re still not sure whether to go for the Capital One Venture Rewards Credit Card, ask yourself the following questions.

Can you make $4,000 in purchases within the next three months? The card’s current bonus is really good. But to earn the 75,000 bonus miles, you’ll have to spend $4,000 on purchases within three months.

This bonus is incentive enough to at least kick the tires on the card for a year to see if it complements your travel style.

Do you hate mentally juggling bonus spending categories? The card’s got a flat return rate of 2 miles per dollar for most purchases — which is excellent. You don’t have to stress about when to use the card and when not to. It’s great for all purchases.

Is the Capital One Venture easy to get?

The Capital One Venture Rewards Credit Card isn’t hard to get. It comes with many of the same standards as other similar rewards credit cards — though Capital One enforces some unique rules of its own:

- Credit score. You should apply for this card if your credit score is 670 or above (considered “good” by FICO). If your credit score is lower, it may be tougher to get approved.

- 48-month rule. If you’ve received a Capital One Venture welcome bonus within the past 48 months, you won’t be eligible for another.

- 1/6 rule. Your results may vary with this one, but generally Capital One won’t approve you for more than one credit card application every six months.

So yeah, that’s the deal

For good reason, the Capital One Venture Rewards Credit Card is a super popular travel credit card. It’s got a huge welcome bonus — 75,000 bonus miles to use through Capital One Travel after meeting minimum spending requirements.

The card also has a high-octane earning rate that’ll help you to replenish your miles long after that bonus is spent.