I’ve been obsessed with miles and points for the past 25 years. At one point, I was an active member of more than 30 frequent flyer programs (now down to about 10) and even held top elite status in nine programs in a single year. Surprisingly, I was never a JetBlue member and had never even flown them.

When I first heard about JetBlue’s 25th Anniversary promotion(Earn 150,000 miles for 15 destinations, 350,000 for 20, and 25 years Mosaic Status for 25 with connecting airport counts), I didn’t plan to participate. Then I noticed something that changed everything: miles redemption tickets also counted toward the challenge.

Planning and Preparation

The goal of this trip was not to maximize earnings or redemptions, nor to hope that JetBlue Mosaic status might someday convert to United Silver if they ever merge within the next 25 years. It was simply to visit some fun places, earn guaranteed miles, and have a good time.

Here are five things I did during the planning and preparation:

1. Getting JetBlue co-branded cards ready

I grabbed the JetBlue Business Card with an 80,000-point bonus, enough to cover the second half of my trip. The bonus posts within 30 days after meeting the spending requirement and paying the annual fee, not based on the statement cycle.

Perks included:

- 10% miles back on redemptions

- Group A boarding

- Free checked bag

With those benefits, 5,000 anniversary miles, and an amazing airline (more on that later), I plan to keep the card long-term.

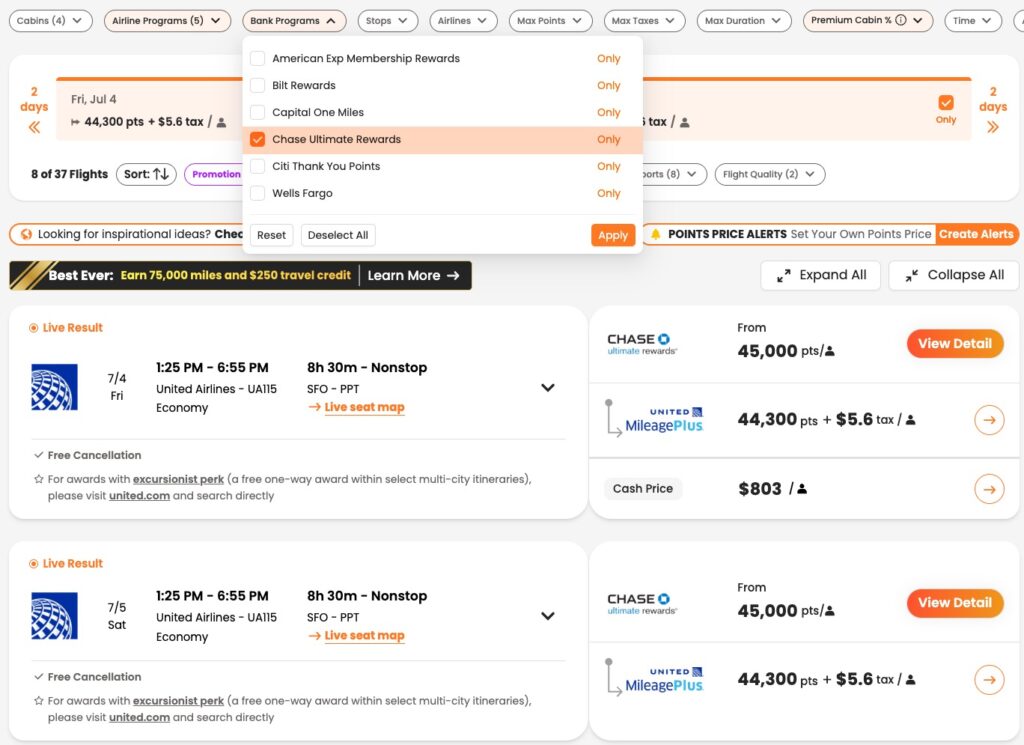

2. Get points ready from Chase

Only Chase and Citi offer 1:1 transfers to JetBlue, so I transferred 100K Chase points to start the trip.

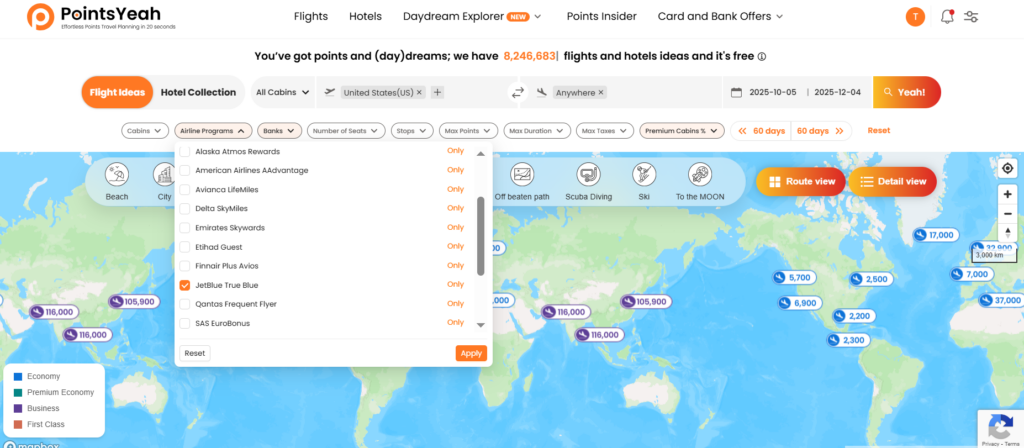

3. PointsYeah Daydream Explorer

JetBlue’s route map is not always up to date with seasonal flights, so using PointsYeah Daydream Explorer saved me a lot of guesswork on where they actually fly.

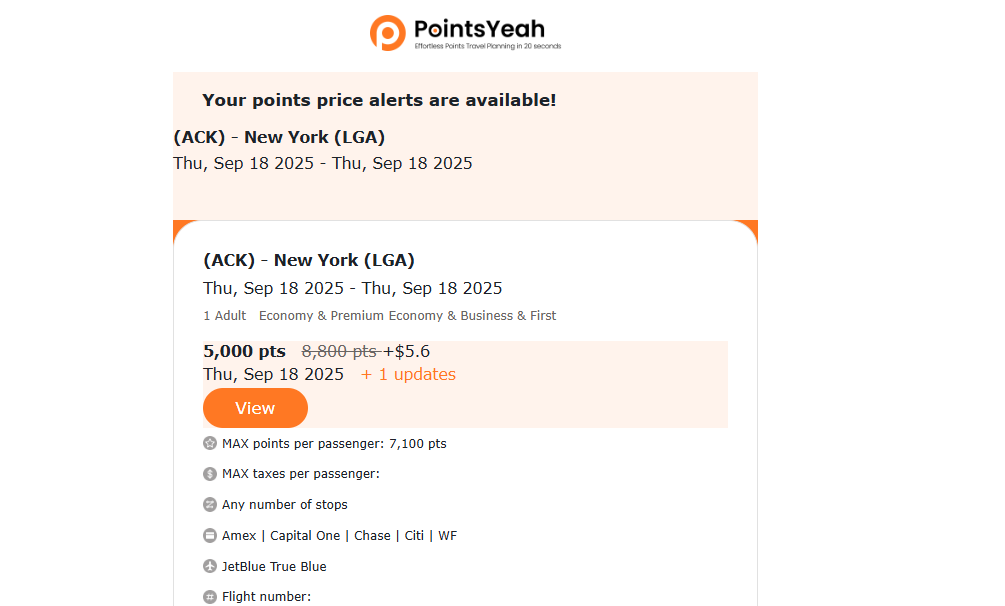

4. PointsYeah Points Price Alert

This is a great feature. Since JetBlue tickets can be canceled and rebooked for free, about half of my bookings ended up dropping in price later.

Many hotels were sold out during the trip. Without Hotel Alerts, I wouldn’t have known when rooms opened up again for redemption.

I matched my Platinum Pro status to Mosaic 2 for the run, but the co-branded card is enough for me. The perks are generous enough to make the flight comfortable.

Flights

Part I

I split the trip into three parts so I could rest in between and wait for both the credit card bonus and the first 15-destination bonus to kick in.

| DCA-BOS-PHL | 9800 |

| PHL-BOS-MVY | 9,600 |

| ACK-LGA | 4,900 |

| JFK-ROC | 5,700 |

| ROC-JFK-RDU | 7,100 |

| RDU-JFK-PWM | 0(Flight delayed, used AS miles for AA last minutes instead) |

| PWM-JFK-DCA | 10,100 |

| Total | 47,200 miles before 10% rebate |

| Total Airports | 8 |

I had never flown JetBlue before, so I didn’t know what to expect. After my Part I run, I have to say this is one of the best airlines I have ever flown

- Seat pitch is wider than most airlines, 32–34 inches in standard economy. I didn’t even need an Even More Space seat to feel comfortable.

- All seats have AC power, USB, and Type-C ports.

- Free high-speed Wi-Fi with one-click access. I even had a video call with my team without any issues.

- Four types of complimentary snacks.

I don’t usually get excited about airline cabins anymore, but JetBlue is an exception. Maybe it’s because the aircraft made it easy to work onboard and stay connected with my team, making weekday flights guilt-free. lol.

I’m really looking forward to Part II and Part III of the run.

Hotels

Philadelphia

Sonesta Select Philadelphia Airport

One-Bedroom Suite – 17,500 Points

Many Sonesta properties offer higher room categories at the same price. Sonesta and Bank of America have a co-branded credit card, though new applications are not being accepted right now.

Edgar Hotel Martha’s Vineyard, an Ascend Collection Hotel

1 King Bed – 45,000 Choice Points

It was peak October weekend, with most rooms on the island costing $400 or more per night. I’ve had the Choice co-branded card for years, but you can also transfer from Citi at a 1:2 ratio, which is great value.

Nantucket

Faraway Hotel Nantucket

Not many point options here, so I used Airbnb instead with a 25% gift card I bought at Lowe’s. I also earned some Delta miles by booking through Airbnb. You can earn Avios too, but I prefer programs with flexible cancellation. It was pouring rain when I visited, so I’ll probably go back another time.

Standard Room – Category 4 Certificate

This hotel moved to a higher category this year, but it’s still bookable with a Category 1–4 certificate, especially on weekends when rates are 18,000 points per night.

Hyatt Regency JFK Airport at Resorts World New York

Standard Room – 15,000 Points (upgraded to a suite)

This newly opened property is very close to JFK, but unfortunately, there’s no shuttle. It’s a great hotel, though I didn’t get to experience much of it since I arrived late and left early.

Two promotions triggered while staying there:

1. Casino: Earn 777 Hyatt points at casino hotels.

2. Hyatt Regency: Earn up to 20,000 Hyatt bonus points when booking through the app.

Standard Room – 9,500 Points. The hotel was sold out that night.

Rochester

Standard Room – 5,000 Points

The hotel was full, so I felt lucky to get a room. Haha! Part of the Hyatt Regency promotion and one of the few Category 1 Hyatts in the United States.

Hyatt House Raleigh Durham Airport

Studio King – 6,500 Points, upgraded to a 1-Bedroom Suite.

Portland, Camden, Acarida Maine

Camden Harbour Inn, an SLH Hotel

Junior Suite – 100,000 Hilton Points per night

This was the best hotel of the first leg of the trip, and I think it’s one of the best boutique hotels in the country. Complimentary breakfast included lobster benedict and mimosas.

(Please forgive my photography skill)

Deluxe Tent – 40,000 Hyatt Points, with 15% rebate promotion

It was cold at night, and honestly, I preferred my $50 per night luxury tent in Senegal better, you can even walk with Lion there lol

Standard Room – 20,000 Points

I still have some Best Western points and like them, but it would be better if they joined a transferable program someday.

Fun times on the road

I still had to work, so not much happened at PHL, ROC, or RDU, other than working from the hotels.

New York

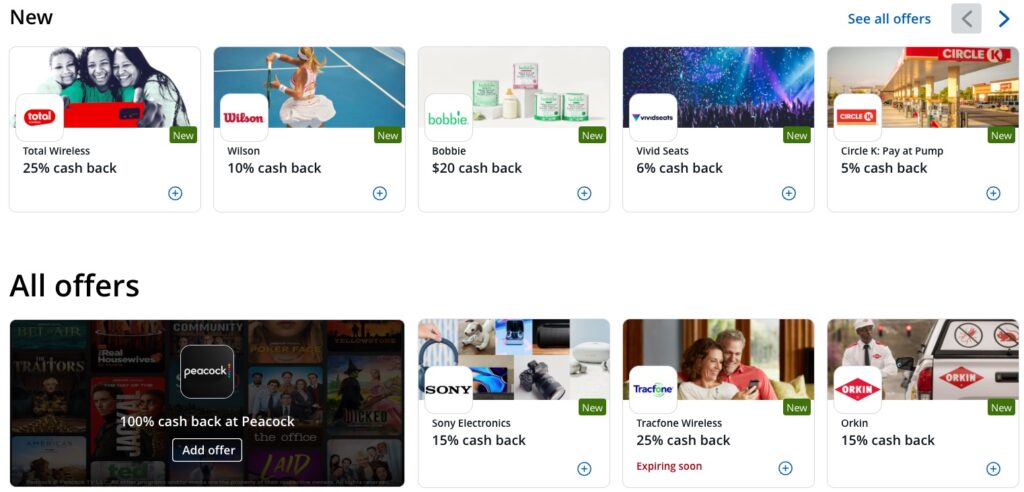

Still working, but with a twist. It was the weekend Amex refreshed it’s new benefits on personal Platinum cards, so I stayed busy visiting several Resy restaurants, Lululemon, and Saks.

It was also Dua Lipa’s New York tour! Thanks to TopCashback, StubHub, and my Chase Sapphire Reserve $150 StubHub credit, I got to see her concert for almost nothing

Maine

This was definitely my favorite stop, maybe because I’m a lobster guy. I went to Rockport Lobster several days in a row for fresh ones.

Stay tuned for Part II of my JetBlue 25th Anniversary Mileage Run, coming soon.