You know all the makings of a premium travel credit card: It’s made of shiny metal; it comes with fancy perks like airport lounge access; it offers hundreds of dollars in travel-related statement credits per year; it’s got an eye-watering annual fee.

The Capital One Venture X Rewards Credit Card fits the bill as an unquestionable premium travel rewards card — but with an annual fee that’s considerably lower than its competitors. In fact, because of its effortlessly valuable yearly benefits, the card’s fee is effectively zero.

Even better, the card earns super valuable (and super easy-to-use) rewards. This makes it a great option for anyone who travels even semi-regularly, whether you’re an award travel veteran or you’re just entering the world of miles and points.

How do Capital One miles work?

How to earn Capital One miles

The Capital One Venture X Rewards Credit Card comes with an intro offer of 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening.

The card also has a high earning rate for everyday purchases:

- 10 miles per dollar on hotels and rental cars booked through Capital One Travel

- 5 miles per dollar on airfare and vacation rentals booked through Capital One Travel

- 5 miles per dollar on Capital One Entertainment purchases

- 2 miles per dollar on all other eligible purchases

Up to 10X miles is beyond impressive. But the star of the show is its base 2X return rate. No matter how unusual your spending habits, you’re guaranteed to get a good return for your swipes.

When it comes to travel credit cards, this earning structure is as straightforward as it gets.

How to use Capital One miles

Capital One gives you a few basic ways to redeem your rewards. You can:

- Convert miles into airline miles or hotel points with Capital One travel partners, such as Avianca and JetBlue.

- “Erase” travel purchases you make with your card up to 90 days later at a rate of 1 cent each. You can redeem your miles for transactions like flights, hotels, public transit, even campgrounds.

We’re a bit biased (and correct) when we say that converting your miles into airline and hotel rewards is hands-down the best way to use your miles. It gives you the potential to book exponentially more travel than those other two options.

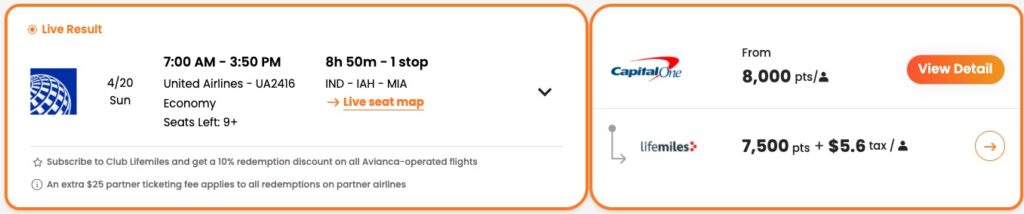

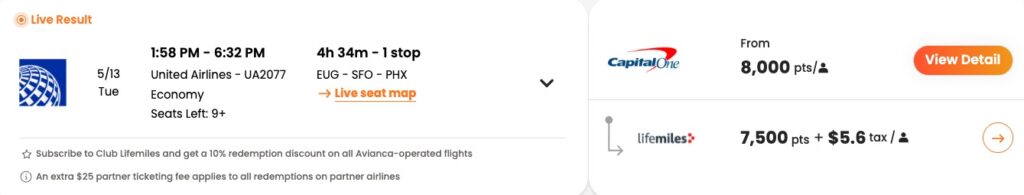

For example, if you were to purchase the below $161 United flight from Eugene (EUG) to Phoenix (PHX), you’d spend 16,100 Capital One miles to “erase” the transaction. But by transferring Capital One miles to Avianca, the flight would cost just 7,500 miles and $5.60 in fees.

Here’s a chart of the airline and hotel programs that partner with Capital One. All transfers are 1:1 unless otherwise specified.

| Accor Live Limitless (2:1) | Emirates | Singapore Airlines |

| Aeromexico | Etihad | TAP Portugal |

| Air Canada Aeroplan | EVA Air (2:1.5) | Turkish Airlines |

| Avianca | Finnair | Virgin Red |

| British Airways | Flying Blue (Air France and KLM) | Wyndham Rewards |

| Cathay Pacific | JetBlue (5:3) | |

| Choice Privileges | Qantas |

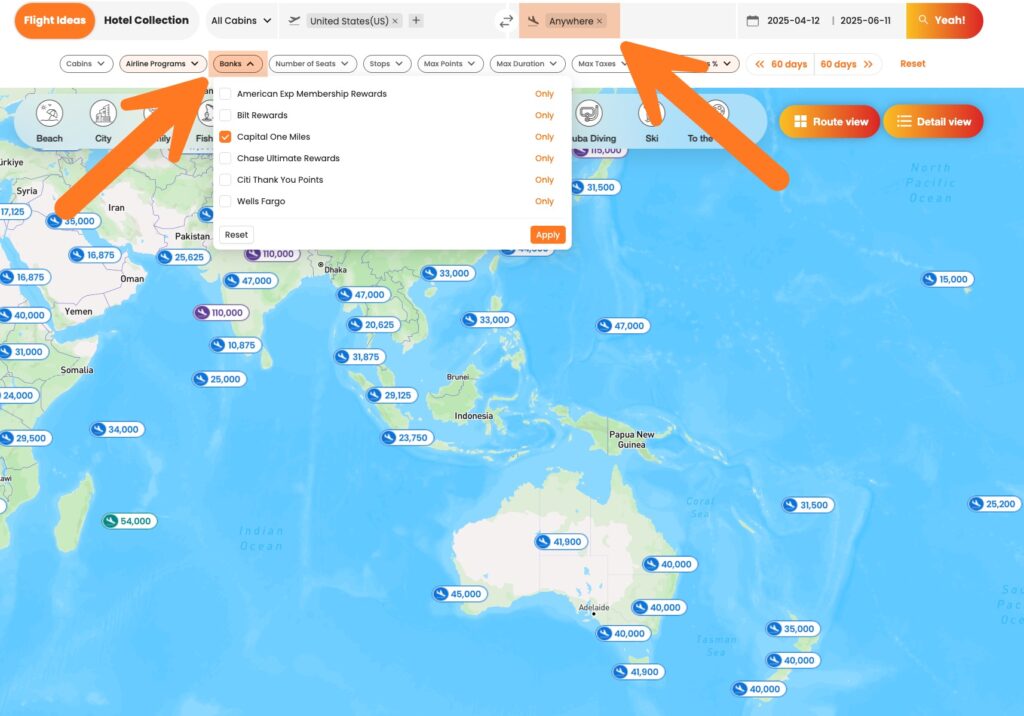

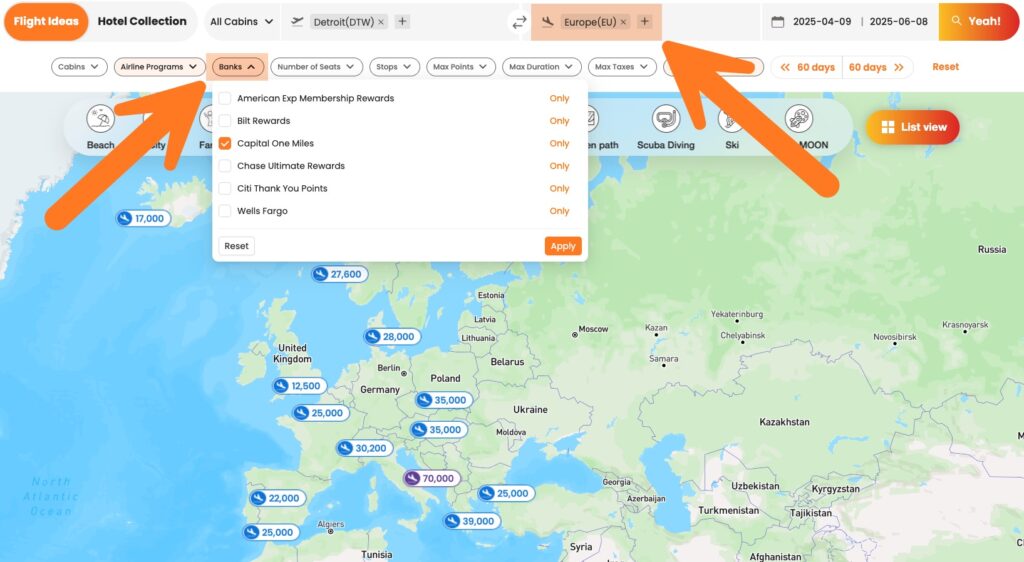

No matter where you want to go, a Capital One partner can get you there — and PointsYeah can help you to quickly find a suitable award seat. Enter your origin and destination into the PointsYeah search bar and filter results to only show Capital One partners. We’ll take care of the rest.

Or, if you aren’t exactly sure where you want to go, you can use the Daydream Explorer tool to enter countries or continents (or even all of Earth) as your destination and see what jumps out at you.

Is the Capital One Venture X worth a $395 annual fee?

The Capital One Venture X Rewards Credit Card charges a $395 membership fee — but again, travelers may consider this card to be no-annual-fee. If you travel even once per year, the card can pay for itself without breaking a sweat. Here’s why.

Yearly bonuses

The Capital One Venture X comes with two incredibly useful annual rewards that post to your account after each cardmember anniversary, which make your annual fee effectively to zero:

- Up to $300 in travel credit to be redeemed through Capital One Travel for flights, hotel stays, rental cars, etc. (you’ll also get this credit upon account opening)

- 10,000 bonus Capital One miles (beginning on your first account anniversary)

These perks alone can offset the $395 annual fee for even the intermittent traveler. The 10,000 bonus miles alone can be enough for a round-trip flight to lots of fun destinations (read our guide to where you can go with 5,000 miles or less).

Access to airport lounges

You’ve probably seen fancy airport lounges dotted throughout the concourse during your travels. But you may not know how easy they are to get into.

With the Capital One Venture X Rewards Credit Card, you can enter over 1,300 airport lounges around the world. Airport lounges often come with free food and alcohol, fast Wi-Fi, tons of electrical outlets, and sometimes even showers and children’s play areas.

The card confers access to Capital One Lounges, a collection of upscale lounges, as well as Capital One’s new restaurant-first concept — Capital One Landing. You’ll also get to use lounges within the ubiquitous Priority Pass lounge network. And you can bring two guests for free.

And get this: Even Venture X authorized users will get their own airport lounge access. You can add up to four authorized users for free.

Expedited airport security experience

Every four years, the Capital One Venture X Rewards Credit Card gives you up to $120 in credit to reimburse you for the application fee to “trusted traveler” programs TSA PreCheck and Global Entry.

TSA PreCheck costs $78 for a five-year membership. It gives you the ability to (practically) sprint through the domestic airport security checkpoints without having to remove your shoes or belt — or even take your laptop out of your bag. Plus, you’ll go through an exclusive security lane that processes much faster.

Global Entry costs $120 for a five-year membership. It helps you to skip the immigration line when entering the U.S. from overseas. Instead of getting grilled by an immigration officer, just find a dedicated kiosk and it’ll quickly confirm your identity. Global Entry also comes with TSA PreCheck privileges.

Excellent travel insurance

The Capital One Venture X Rewards Credit Card is an all-time great when it comes to protecting your travel purchases. Its insurance will automatically activate when you pay for your travel with the card.

Here’s what you’ll get:

- Primary rental car insurance. When renting a car, the card covers up to $75,000 against theft or damage. You don’t even have to tell your personal insurance provider about the accident — so your premiums won’t be affected at all.

- Trip delay reimbursement. When your trip is delayed by at least six hours or requires an overnight stay, you’ll get up to $500 per ticket toward “reasonable” expenses. This can include a hotel room, meals at a restaurant, a phone charger, and more.

- Trip cancellation and interruption insurance. Whether you’ve got to cut your trip short or cancel it before it begins, you can be reimbursed up to $2,000 per person for nonrefundable prepaid travel. Eligible reasons include injury or death of an immediate family member or if the carrier on which you’re traveling goes bankrupt.

- Lost luggage reimbursement. Get up to $3,000 when the common carrier (airline, cruise ship, ferry, bus, etc.) loses your luggage.

- Travel accident insurance. You’ll receive up to $1 million in coverage against accidental loss of life, limbs, sight, speech, or hearing if the tragedy is the common carrier’s fault.

Trust me, these perks are better than what the vast majority of travel credit cards offer. If you travel regularly, you’ll get good use from these (but fingers crossed that you miraculously never need to use them!).

Cell phone protection

When you pay your monthly cell phone bill with the Capital One Venture X Rewards Credit Card, your phone is covered for up to $800 against damage or theft(max two claims and $1,600 in coverage per 12-month period).

Top-tier Hertz elite status

Hertz’s highest level of status is called President’s Circle — and it’s complimentary with the Capital One Venture X (though you’ve got to enroll your card). Without the card, you’d have to either complete 15 rentals or spend $3,000 with Hertz in a calendar year.

President’s Circle comes with perks like:

- 50% bonus points on paid rentals

- Guaranteed upgrades

- A dedicated customer service line

Get special access to restaurants and events

Capital One caters heavily to dining and entertainment. It partners with some restaurants to help you land a reservation even when the joint is fully booked. Its Capital One Dining platform also hosts special experiences like cooking classes with prominent chefs.

And through Capital One Entertainment, you can book super popular music and sporting events and experiences through presale opportunities — so you can be one of the first to buy.

Is the Capital One Venture X right for you?

A $395 annual fee isn’t exactly a pittance. To decide if the Capital One Venture X Rewards Credit Card is worth the price point, ask yourself these simple questions.

Do you fly a couple times each year? With its myriad air travel-related protections and its airport lounge access, the Capital One Venture X is especially valuable for flyers. You’re neglecting a lot of value if you don’t find yourself in an airport at least once or twice per year.

Do you book travel through online travel agencies? When you book airfare, hotel stays, or rental cars, do you use a website like Expedia or Priceline? If so, you’ll make good use of the card’s up to $300 in annual travel credit — since it can only be redeemed through Capital One Travel. Plus, the Capital One Venture X Rewards Credit Card earns tons of bonus miles when you pay for travel through this platform.

Do you like road-tripping? The Capital One Venture X Rewards Credit Card is one of the best credit cards to use for renting a car thanks to its top-notch travel insurance and its 10X return rate for car rentals through Capital One Travel. It even offers the highest level of Hertz elite status (though you typically won’t get rental car elite status perks when booking via Capital One Travel — you’ll have to book directly with Hertz).

Is the Capital One Venture X easy to get?

Again, the Capital One Venture X Rewards Credit Card is a premium travel credit card. But it’s not notoriously hard to get. Here are some guidelines to follow:

- Maintain a good credit score. We recommend that you not apply for this card unless your credit score is at least 720. While there may be anecdotal evidence of folks being approved with a lower score, a 720+ score gives you the best chance.

- 48-month rule. If you’ve earned the welcome bonus on a Capital One Venture X within the past 48 months, you won’t be eligible to earn it again.

- 1/6 rule. Capital One usually won’t approve you for more than one credit card application within a six-month period.

So yeah, that’s the deal

The Capital One Venture X Rewards Credit Card is a premium credit card with a more accessible annual fee. And because the fee can so easily be offset with perks like airport lounge access, $300 in annual travel credit, and 10,000 yearly bonus miles, the Capital One Venture X Rewards Credit Card is an easy win for just about every traveler.