The Platinum Hotel Credit Just Got Easier to Use

If you hold the either American Express® Platinum Card, you already know it’s packed with travel perks. One of the best and most overlooked is the $600 Hotel Credit, split into two $300 statement credits each year. It applies to prepaid stays booked through Fine Hotels + Resorts® (FHR) or The Hotel Collection via Amex Travel.

It’s a great perk in theory, but in practice,finding the right hotels that fit your budget, destination, and travel style can be time-consuming, especially when most searches show ultra-luxury properties far above your $300 credit.

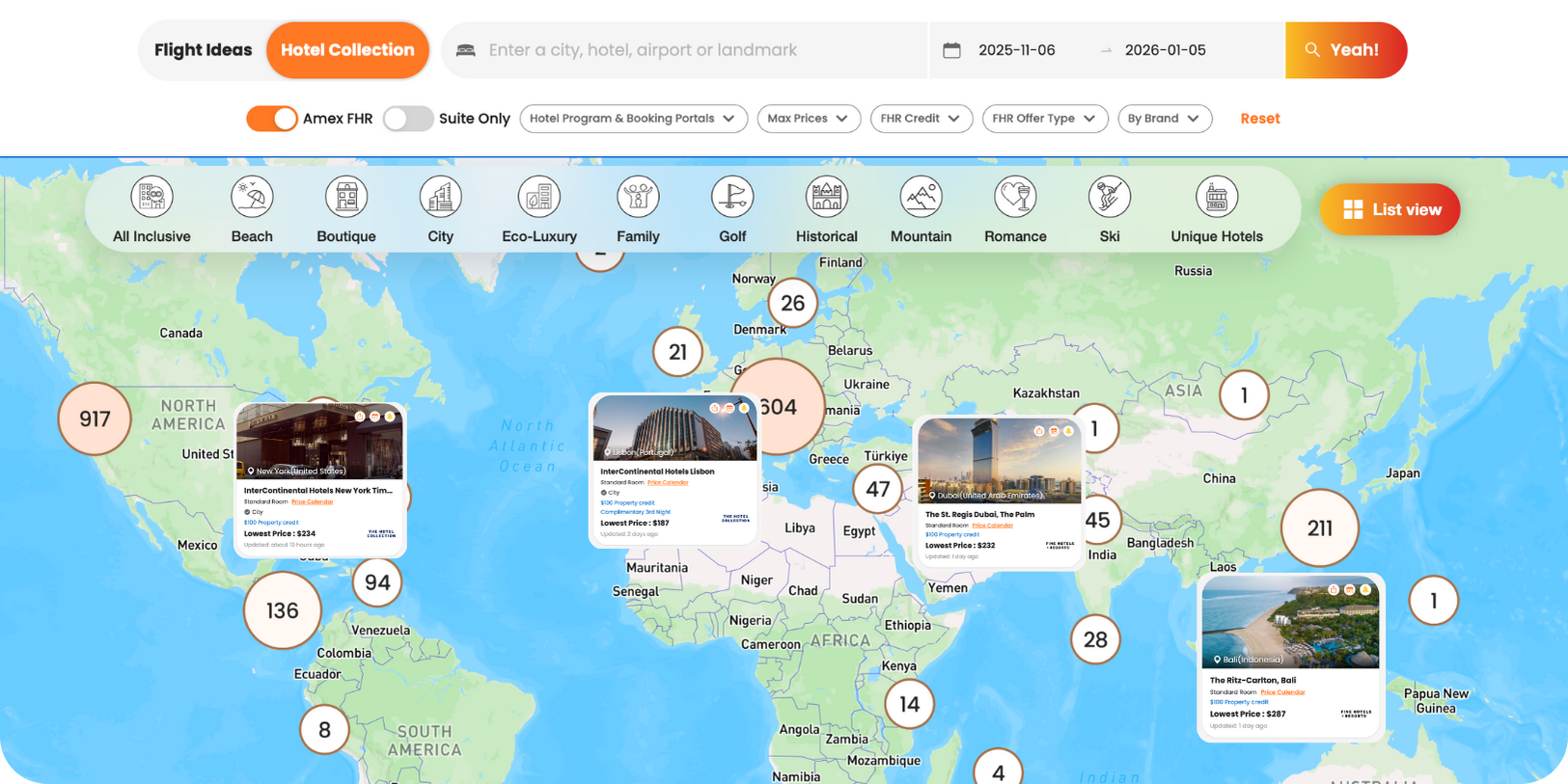

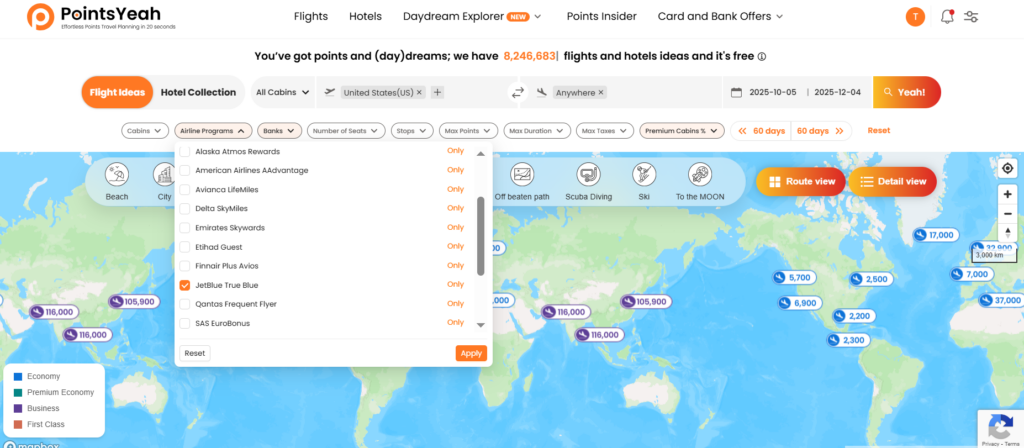

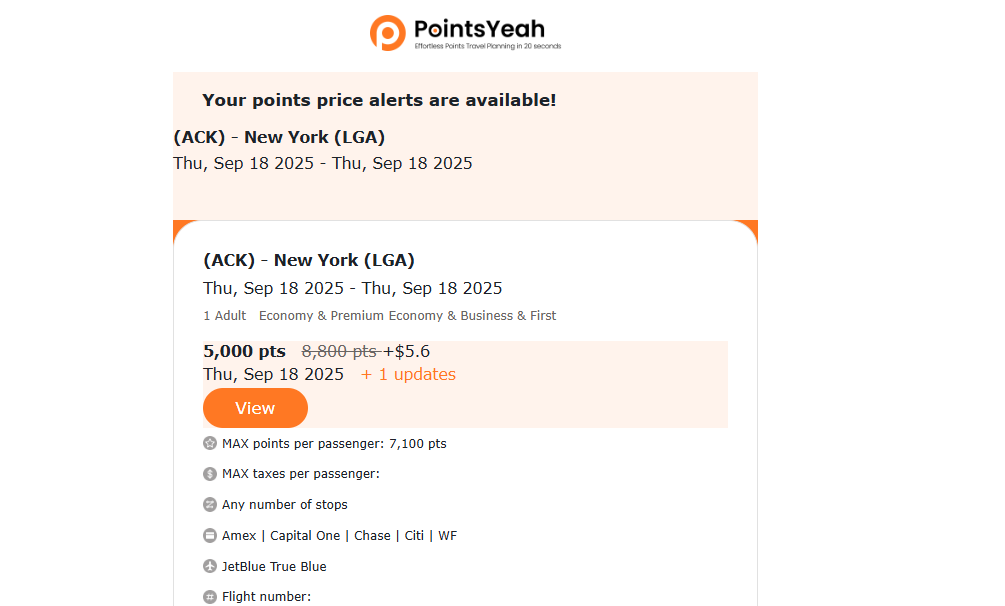

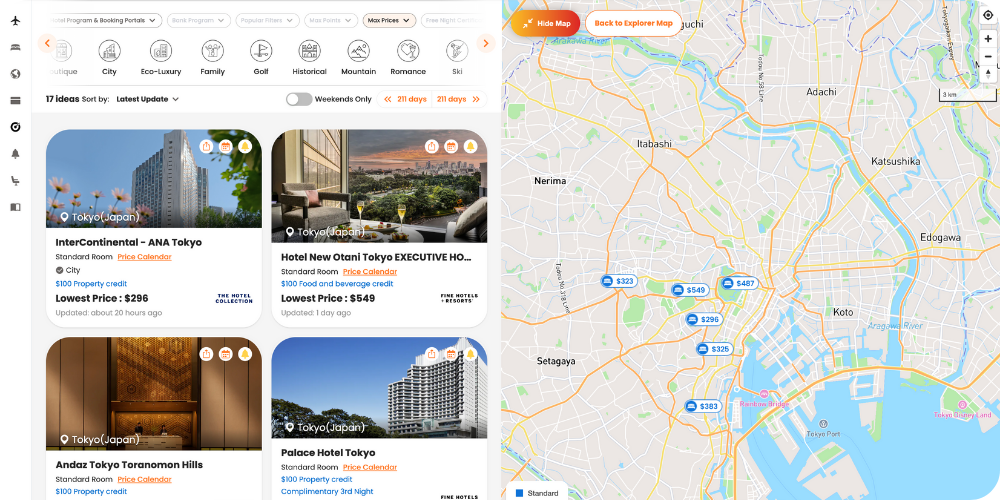

That’s why we built the PointsYeah FHR Filter. It’s a new way to explore the entire Amex FHR network, now searchable, filterable, and viewable in both map and list formats. Whether you’re trying to find a one-night stay fully covered by your credit or a luxury resort that’s worth a little extra, the FHR Filter makes it easy to plan smarter.

🔍 Explore FHR Hotels on PointsYeah →

What Are Fine Hotels + Resorts® and The Hotel Collection?

Fine Hotels + Resorts® (FHR) and The Hotel Collection (THC) are Amex’s two premium hotel programs for Platinum and Centurion Card Members. Together, they include more than 2,000 top-tier properties worldwide that provide exclusive perks automatically applied when you book prepaid stays through Amex Travel.

Every FHR booking includes:

- Daily breakfast for two

- Guaranteed 4pm late checkout

- Noon check-in when available

- Room upgrades upon arrival (when available)

- A $100 property experience credit, typically for dining or spa services

- Earn hotel points and elite credit

The Hotel Collection bookings include:

- Up to a $100 property credit per stay (varies by hotel)

- Room upgrades upon arrival when available

- A minimum two-night stay requirement

For many travelers, these perks can easily add $200–$400 of value to a single night, but only if you can find the right property to use them at. That’s where PointsYeah’s FHR Filter comes in. It gives you visibility across the full network, making it easy to see where your credit stretches the farthest.

Why PointsYeah Built the FHR Filter?

We created the FHR Filter because the Platinum Card’s best perks were often going unused. Travelers told us the same things over and over:

“I never know which hotels qualify.”

“I can’t tell which FHR stays are under $300.”

“I just want to use my credit without overspending.”

The FHR Filter solves all of that. It is a free tool that lets you see the entire FHR ecosystem at once, not just in a list buried inside Amex Travel. You can now explore globally, compare prices, and find hotels that align with your credit and comfort zone.

It’s for every kind of traveler:

- Weekend explorers who want one-night getaways covered entirely by the $300 credit.

- Luxury seekers looking for aspirational stays worth a modest top-up.

- Frequent flyers who want to plan multi-city trips around their credits.

Before, planning around your hotel credit required patience. Now it’s simply a filter away.

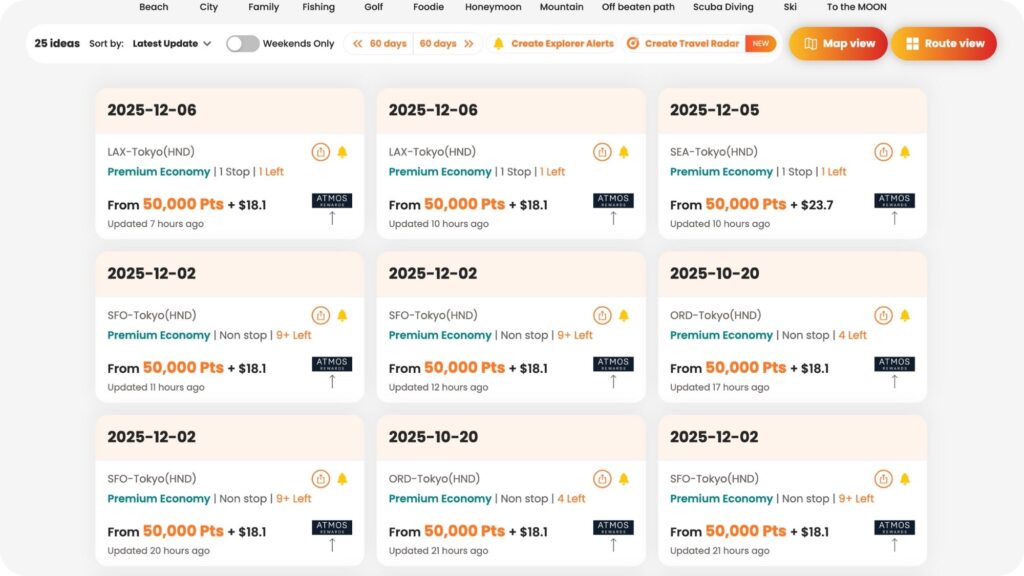

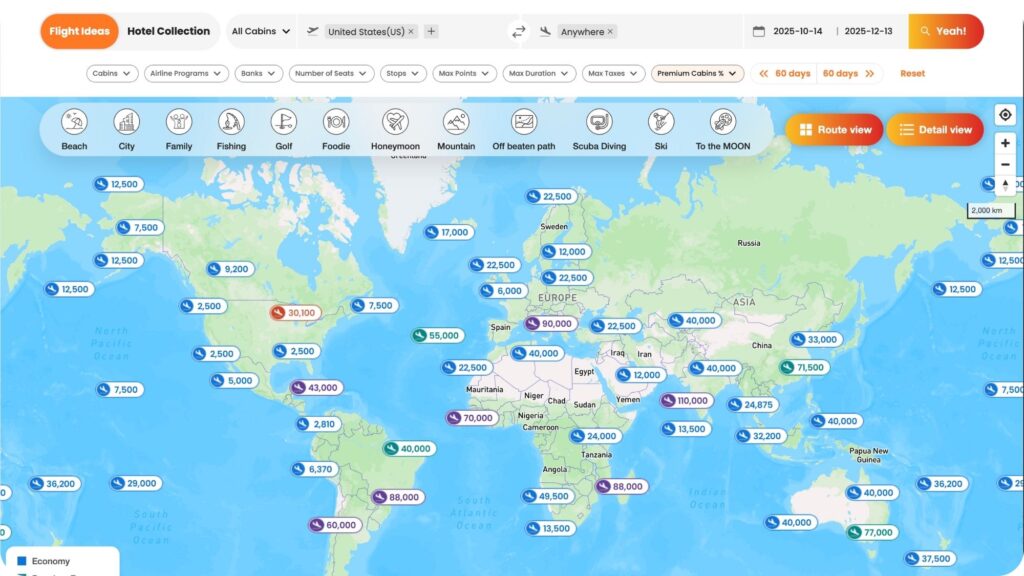

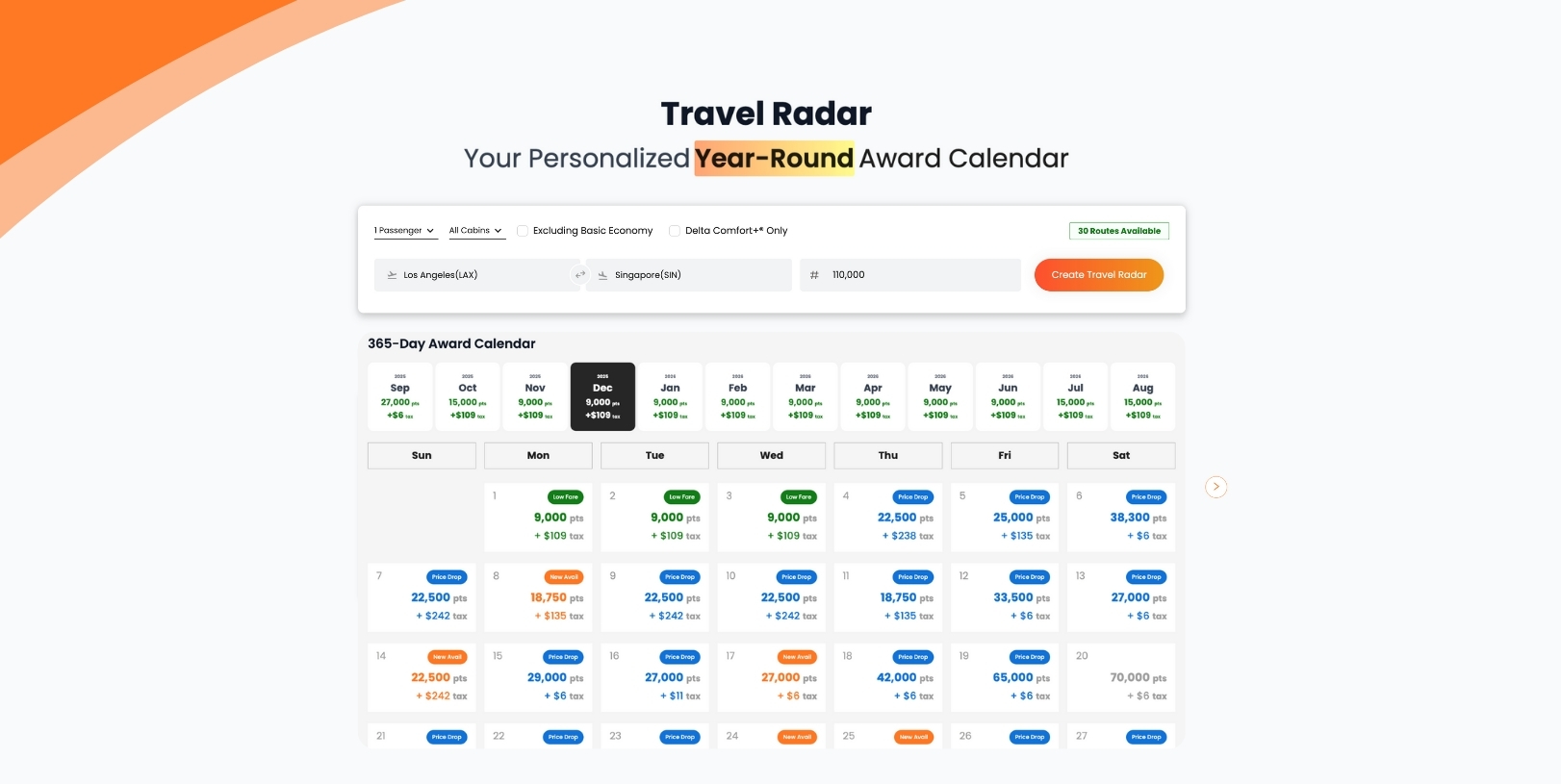

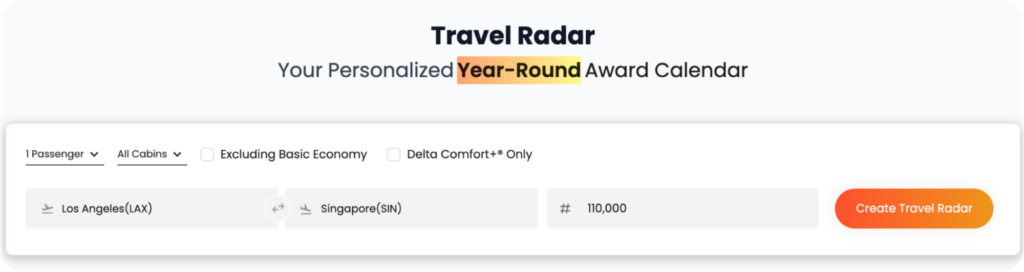

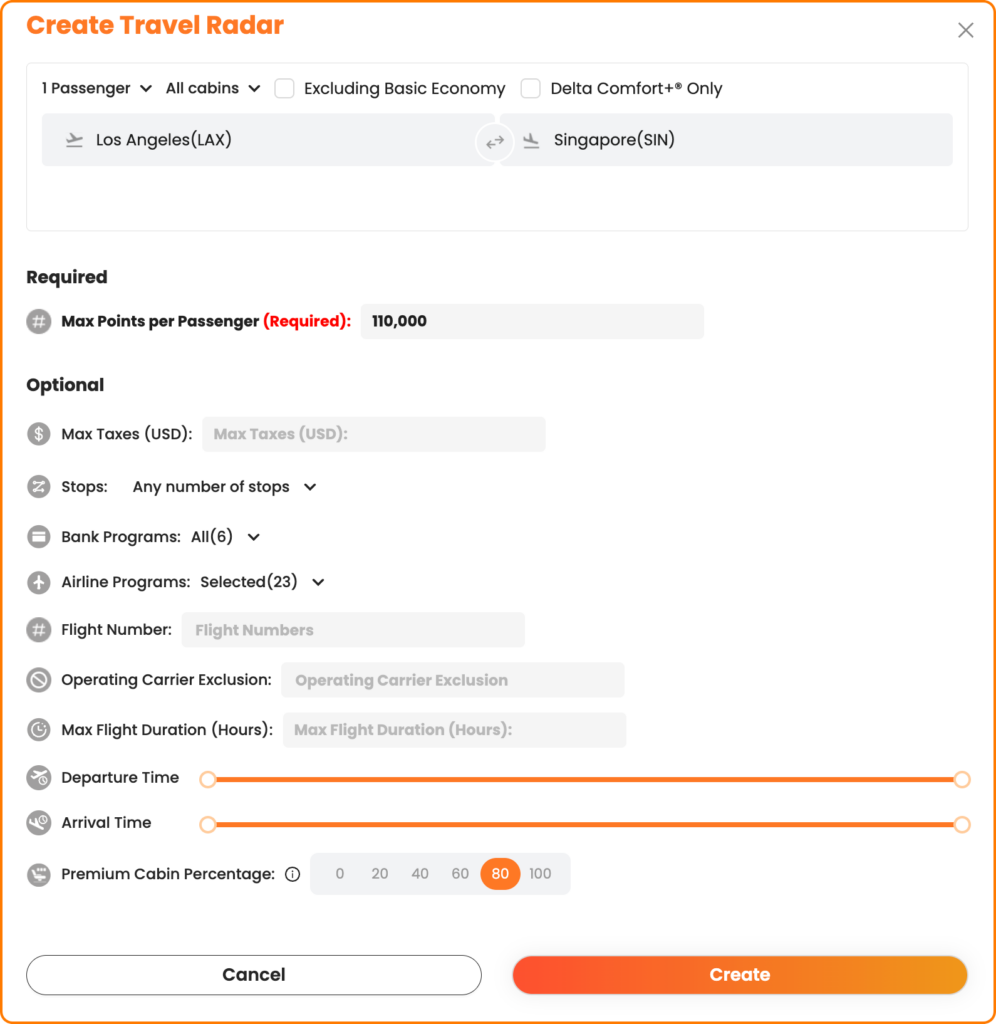

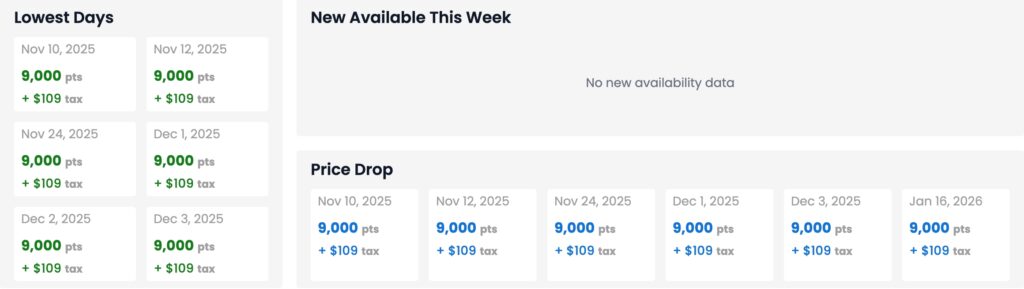

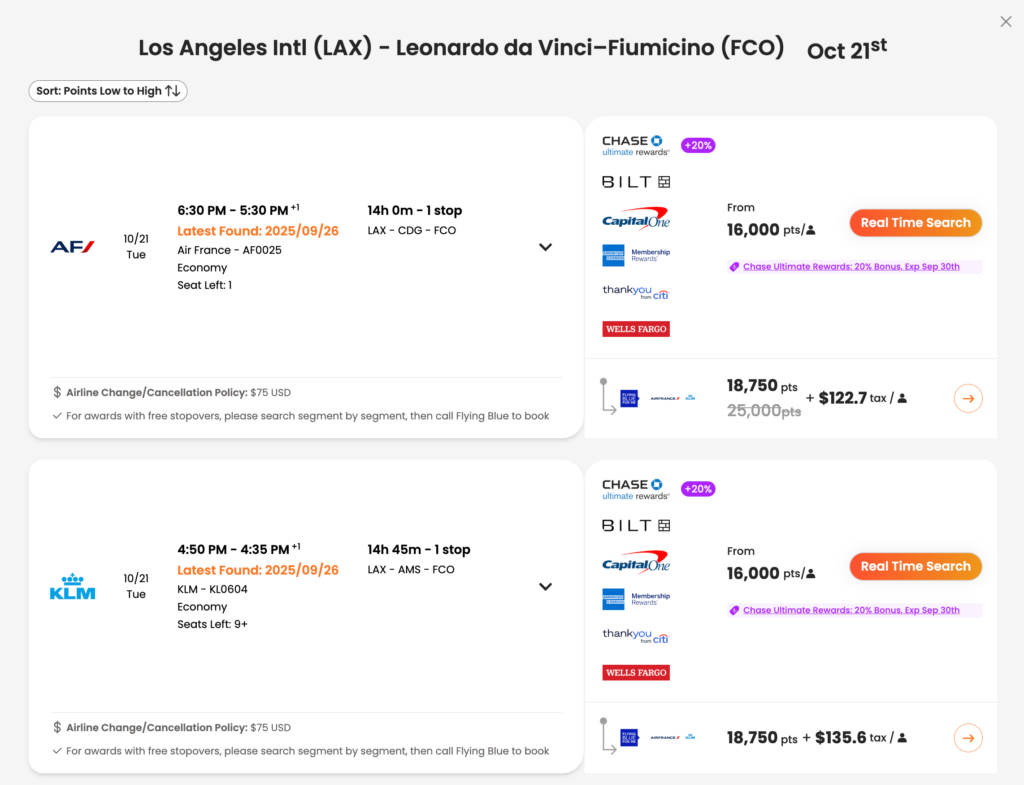

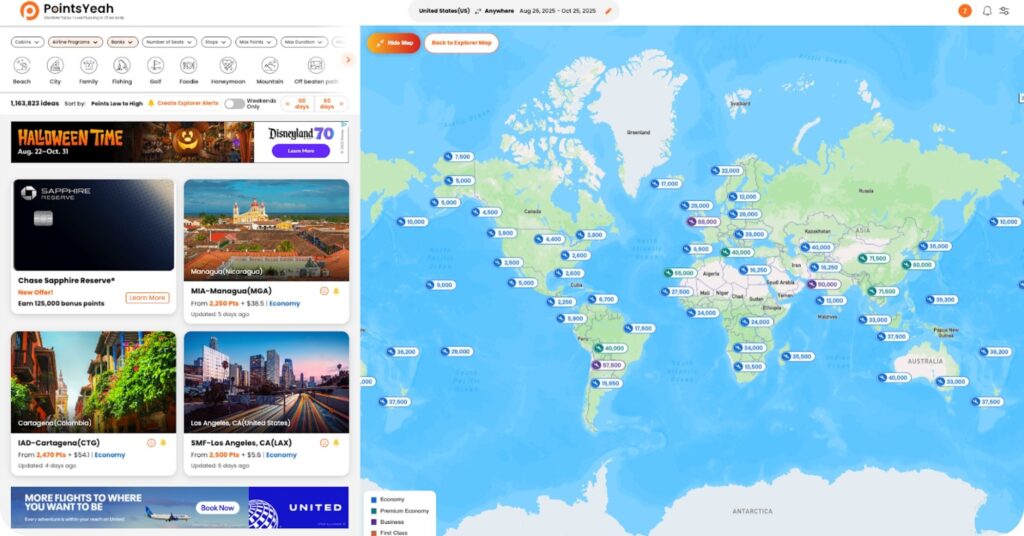

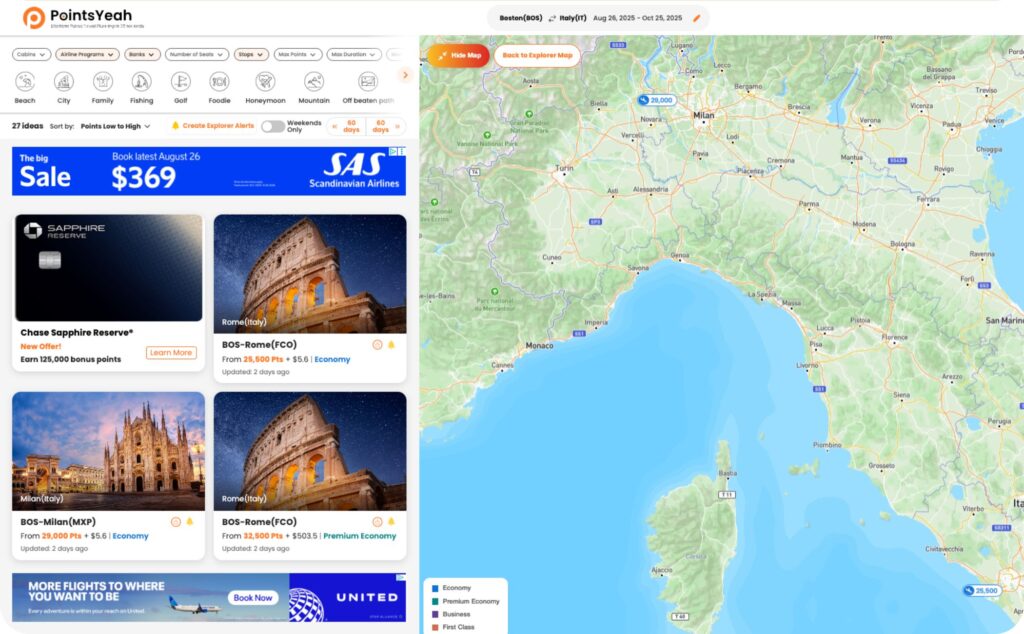

How the PointsYeah FHR Filter Works

Using the FHR Filter is simple but powerful. Here’s how it works:

- Search any destination in the PointsYeah Hotel Collection.

- Turn on the “Fine Hotels + Resorts®” filter.

- Instantly see verified Fine Hotels + Resorts® and The Hotel Collection properties across that city or region.

- Choose your view:

- Map View: Browse visually to see where hotels are located and explore surrounding attractions.

- List View: Quickly compare prices, amenities, and brand details.

- Refine your results by adjusting dates, price range, or destination preferences.

- Use live pricing to find stays that make the most sense for your $300 semiannual credit.

What makes this different is flexibility. You are no longer limited to a static portal. You can visualize, compare, and plan your trip all in one seamless interface.

✨ Try the FHR Filter Now →

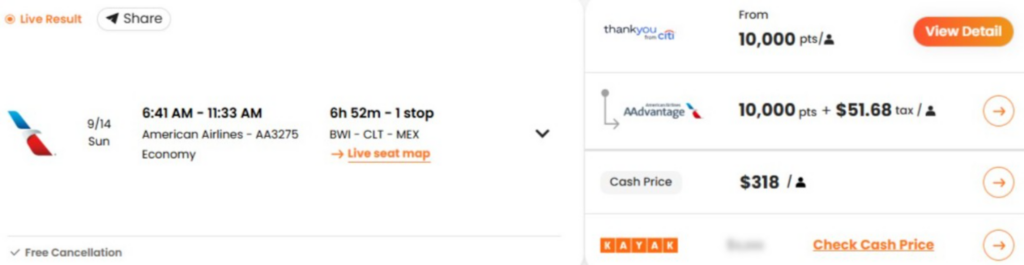

Finding Stays That Fit Your Credit and Your Budget

Luxury doesn’t have to mean overspending. For many Platinum Card Members, the ideal stay is one that fits within the $300 semiannual hotel credit or just slightly above it, whether you’re booking through Fine Hotels + Resorts® or The Hotel Collection.

Here’s how travelers are using it:

- Fully covered stays: Filter for FHR properties under $300 per night. These are perfect for single-night getaways fully paid by your credit.

- Sweet spot stays: Look in the $350–$450 range. Paying a small amount out of pocket can unlock much higher-end hotels.

- Luxury upgrades: Combine both $300 credits for an extended stay or premium destination without blowing your budget.

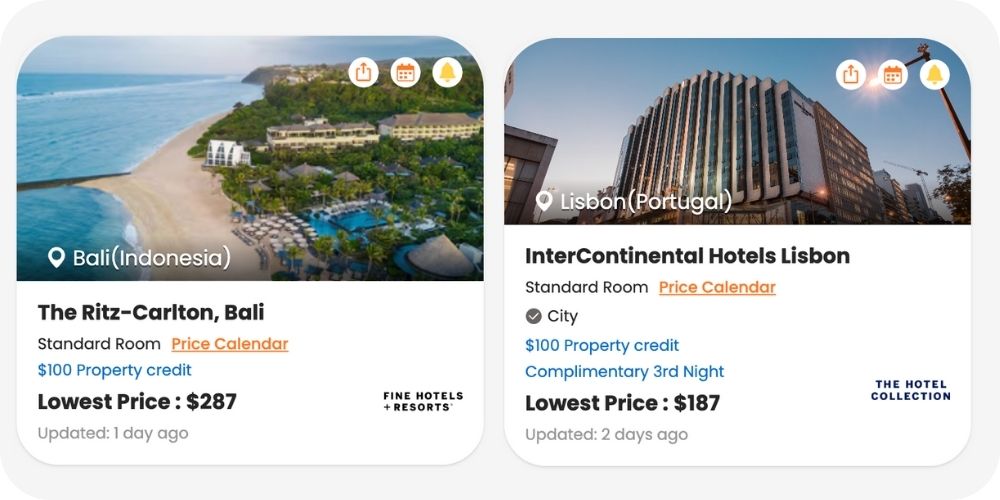

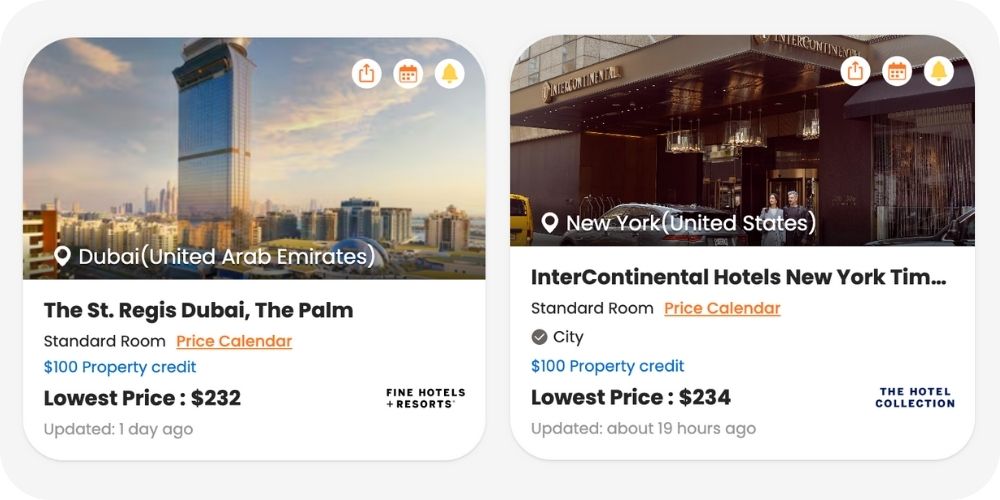

To put it in perspective, here are a few examples of high-value FHR stays often found near or below the $300 mark:

- The Ritz-Carlton, Bali – from $290/night

- InterContinental Lisbon – from $190/night

- The St. Regis Dubai, The Palm – from $232/night

- InterContinental New York Times Square – from $234/night

Each property still includes the signature FHR perks such as breakfast, upgrades, and late checkout. Even a one-night stay feels like a complete getaway.

The best part is that you don’t need to guess. The filter helps you spot these hidden gems instantly, saving time while helping you get more from your Platinum benefits.

Why This Feature Matters for Platinum Card Members

Before this, using the FHR benefit felt complicated, not because the program lacked value but because it lacked accessibility. The Amex Travel interface wasn’t designed for discovery. It worked if you already knew where you wanted to go, but not if you were trying to decide how to use your credit wisely.

The PointsYeah FHR Filter changes that completely. It gives you the freedom to explore, experiment, and plan without committing to a booking. You can see the full picture first, then decide how to use your credit.

Here’s why it matters:

- Transparency: You can see what’s available, what it costs, and how far your credit goes.

- Flexibility: Map or list view means you can browse in whatever way feels most natural.

- Efficiency: Save hours of searching by focusing only on eligible hotels.

- Inspiration: Discover destinations and FHR stays you may have never considered.

This feature isn’t about promoting luxury. It’s about making it practical and usable for everyone who holds a Platinum Card.

Explore the FHR Filter on PointsYeah →

Final Thoughts

The $600 Hotel Credit from the Amex Platinum Card is one of the most generous travel benefits available, but only if you actually use it.

With PointsYeah’s FHR Filter, that becomes effortless. You can find properties that fit your plans and budget, visualize your options on a map, and make smart choices about where to redeem your credits.

It’s not just a new search filter. It’s the missing link between knowing your benefits and actually using them.

Whether you are planning a one-night getaway, a spontaneous weekend trip, or a bucket-list vacation, the FHR Filter helps you see what’s possible, instantly.

Start Searching Fine Hotels + Resorts® on PointsYeah →

Frequently Asked Questions

What is the Fine Hotels + Resorts® program from Amex?

Fine Hotels + Resorts® (FHR) is Amex’s luxury hotel network for Platinum and Centurion Card Members. It includes premium properties worldwide that offer benefits like daily breakfast, late checkout, room upgrades, and on-property credits when booked through Amex Travel.

How can I find Fine Hotels + Resorts® properties online?

You can explore all Fine Hotels + Resorts® properties using PointsYeah’s FHR Filter. It allows you to view verified FHR hotels in both map and list view, compare prices, and plan how to use your Platinum Card credits.

Can I use PointsYeah to see which hotels fit my Amex Platinum credit?

Yes. The FHR Filter shows real pricing for each property, so you can easily find hotels that fit within your $300 semiannual credit or your total $600 annual limit.

What’s the best way to use the Amex Platinum hotel credit?

Use your Platinum Card’s $600 hotel credit strategically by finding FHR stays under $300 per night. Many travelers use PointsYeah to find one-night getaways fully covered by the credit or short luxury stays that cost only a little more.

Can I find Fine Hotels + Resorts® stays under $300 per night?

Yes. Many FHR properties around the world are available for under $300 per night. The PointsYeah FHR Filter makes it easy to find and compare these options instantly.

Do I need to log in or link my Amex account to use PointsYeah?

No. Anyone can browse FHR properties on PointsYeah. Platinum and Centurion Card Members simply need to book through Amex Travel to receive the benefits and statement credits.

Are the Fine Hotels + Resorts® listings on PointsYeah updated regularly?

Yes. FHR properties are verified and refreshed often to ensure the listings and pricing reflect the latest availability.

Does the PointsYeah filter include The Hotel Collection too?

Yes. The filter includes both Fine Hotels + Resorts® and The Hotel Collection properties. You can view them together in map or list view when you toggle on the “FHR” filter.

Can I book Fine Hotels + Resorts® stays directly through PointsYeah?

No. PointsYeah helps you research and compare properties quickly. You’ll still book through Amex Travel to receive the official Platinum benefits and credits.