American Express is a PointsYeah.com Advertiser

So you’re a business owner searching for the perfect travel rewards card? If you’re looking for the cream of the crop, the The Business Platinum Card® from American Express is the creamiest.

The card is stuffed with benefits which can easily be worth well over $1,500 in value each year. And its current welcome bonus is one of the highest we’ve ever seen.

Here’s everything you need to know about the Amex Business Platinum Card — and a quick look at how powerful its rewards can be.

How do American Express Membership Rewards points work?

How to earn American Express Membership Rewards points

The Amex Business Platinum Card offers a strong bonus offer, 200,000 American Express Membership Rewards® points after spending $20,000 on purchases within the first three months from account opening.

You’ll also earn points for your everyday spending at the following rates:

- 5 points per dollar on flights and prepaid hotels booked on AmexTravel.com

- 2 points per dollar on purchases at U.S. construction material & hardware suppliers, electronic goods retailers, software & cloud system providers, and shipping providers

- 2 points per dollar on each eligible purchase of $5,000 or more, up to $2 million per year (only the highest bonus applies if multiple would qualify)

- 1 point per dollar on all other eligible purchases

How to use American Express Membership Rewards points

There are plenty of fun ways to use Amex Membership Rewards points when you’ve got the Amex Business Platinum Card — but the best options involve travel. For example, you can redeem your points for:

- Airfare through Amex Travel at a rate of 1 cent each. And when booking business- or first-class seats, you’ll get a 35% rebate on your points (a feature exclusive to the Amex Business Platinum) — effectively making your points worth ~1.5 cents each

- Hotel stays through Amex Travel at a rate between 0.7 and 1 cent each

But to unlock the most potential from your Amex points, convert them to into airline miles and hotel points.

It’s possible to get exponentially more value from your points by transferring to the below travel partners (transfers are 1:1 unless otherwise specified).

| Aer Lingus | Choice Hotels | Iberia |

| Aeromexico (1:1.6) | Delta | JetBlue (5:4) |

| Air Canada | Emirates | Marriott Bonvoy |

| ANA | Etihad | Qantas |

| Avianca | Flying Blue (Air France and KLM) | Qatar Airways |

| British Airways | Hawaiian Airlines | Singapore Airlines |

| Cathay Pacific | Hilton Honors (1:2) | Virgin Atlantic |

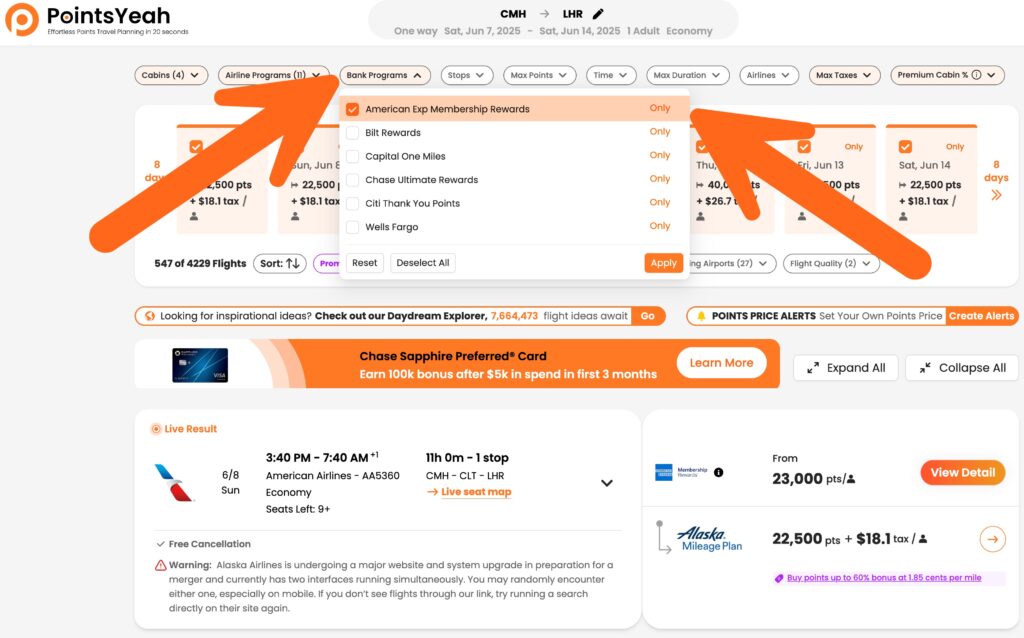

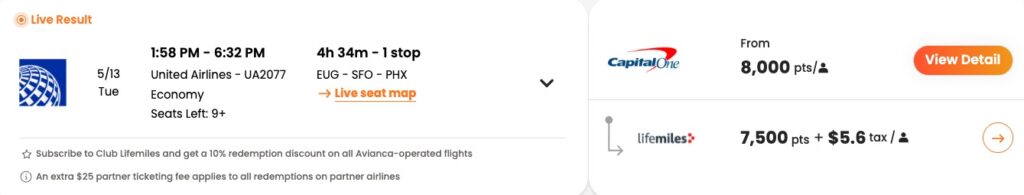

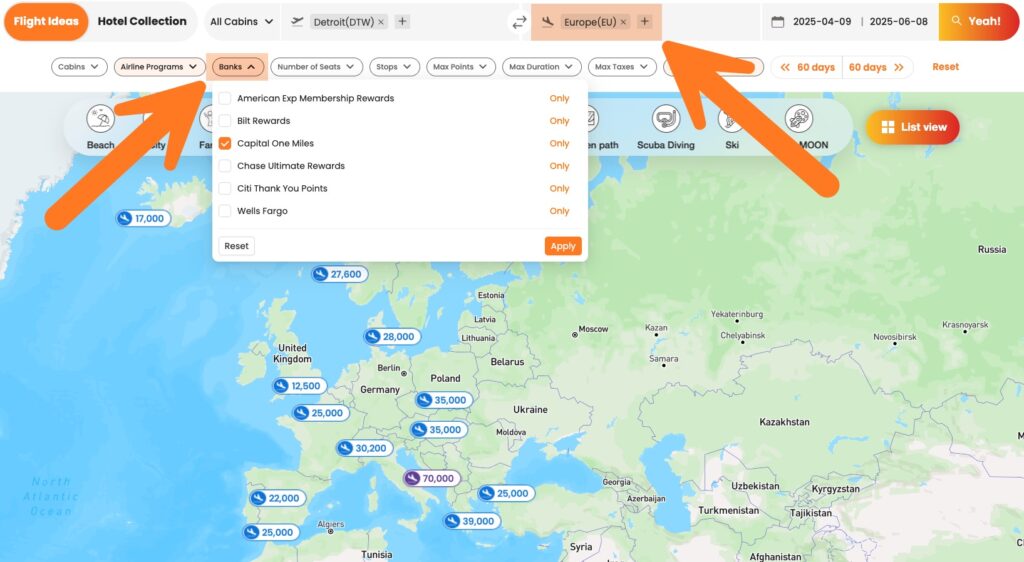

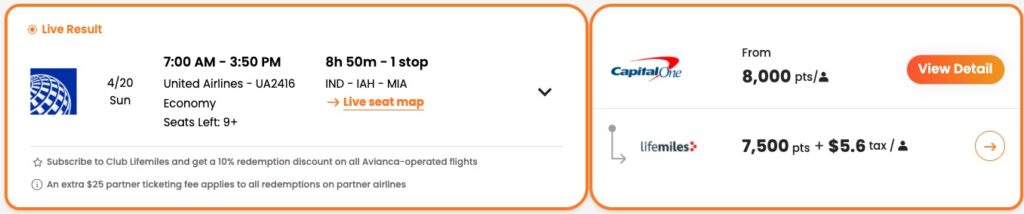

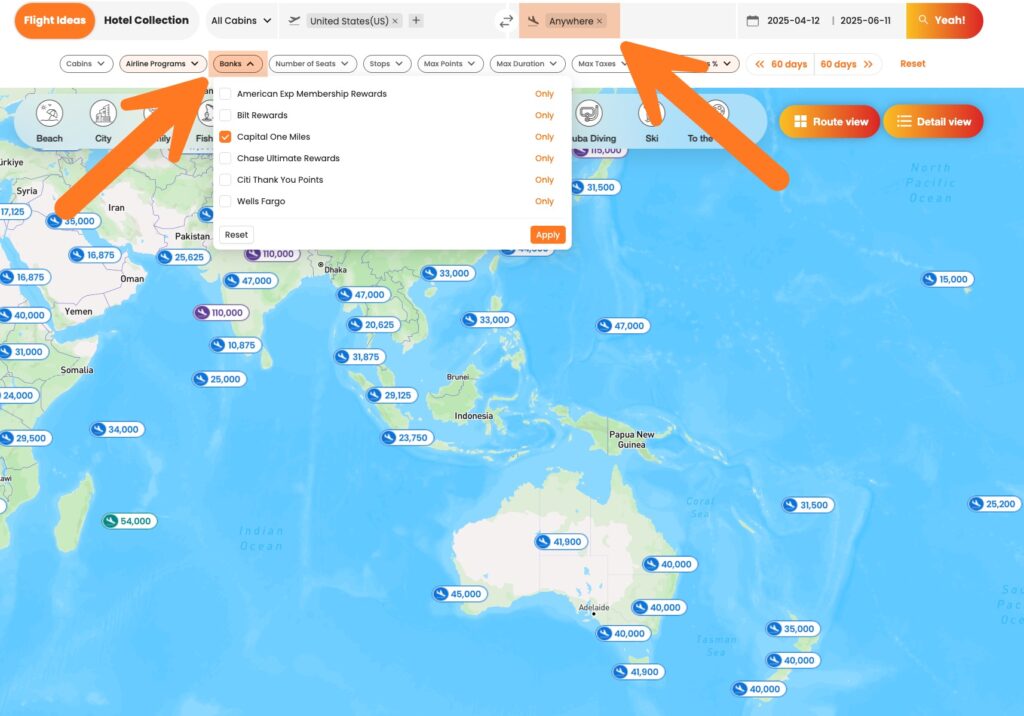

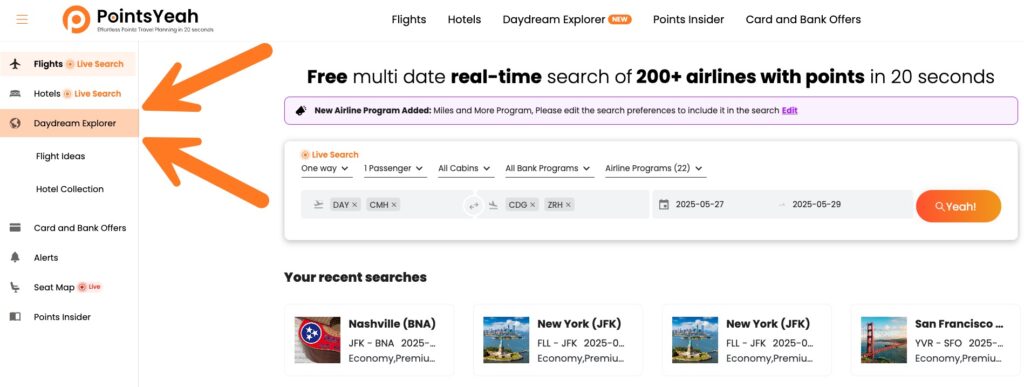

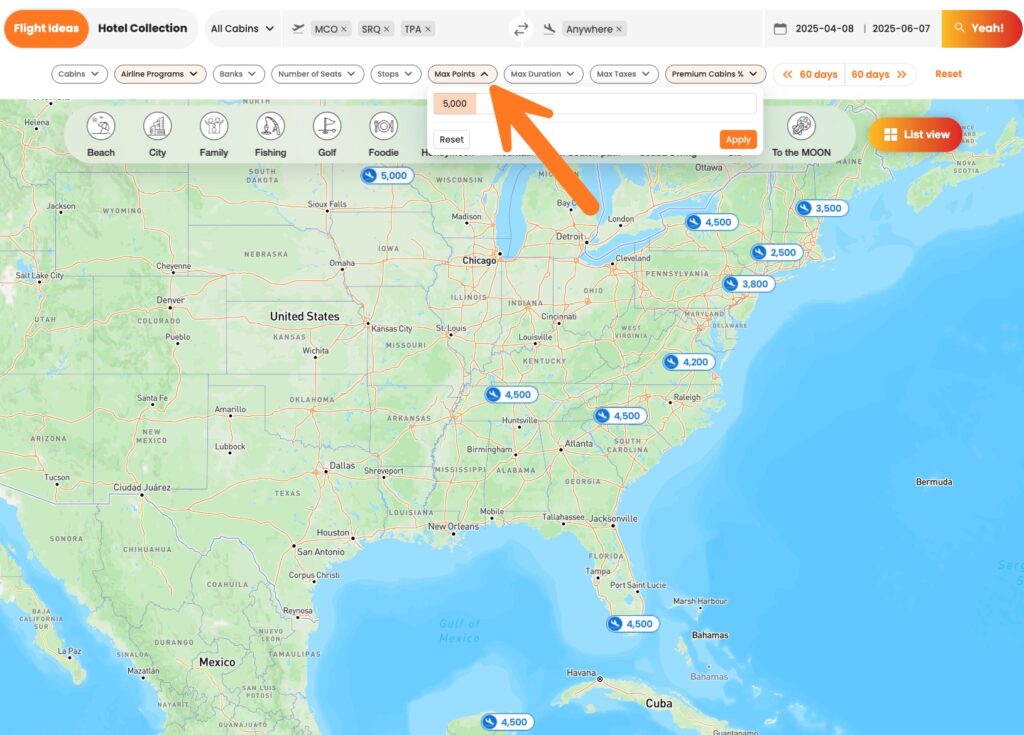

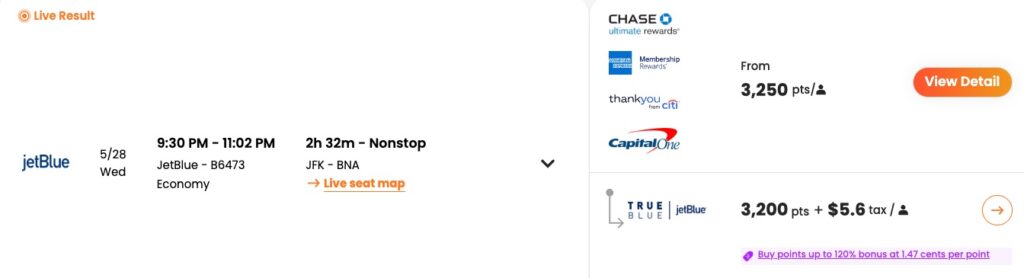

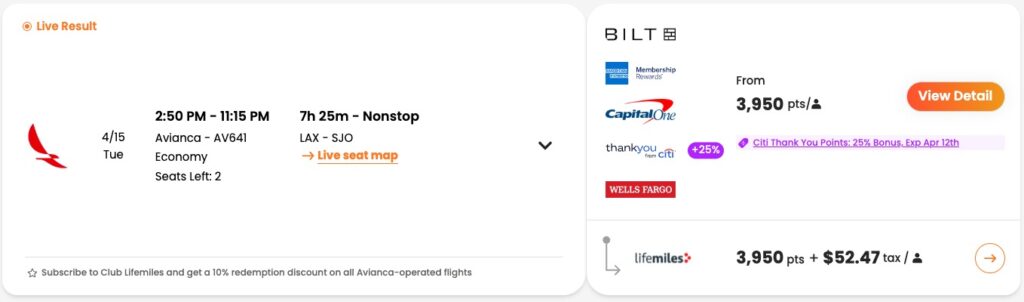

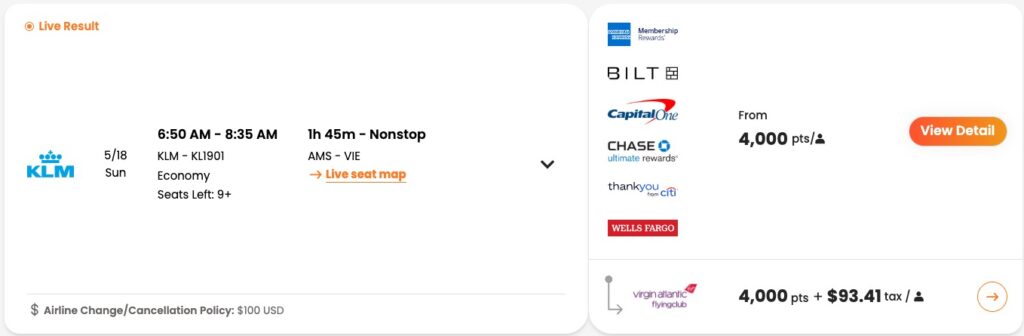

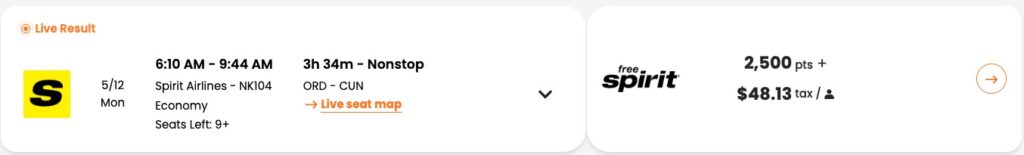

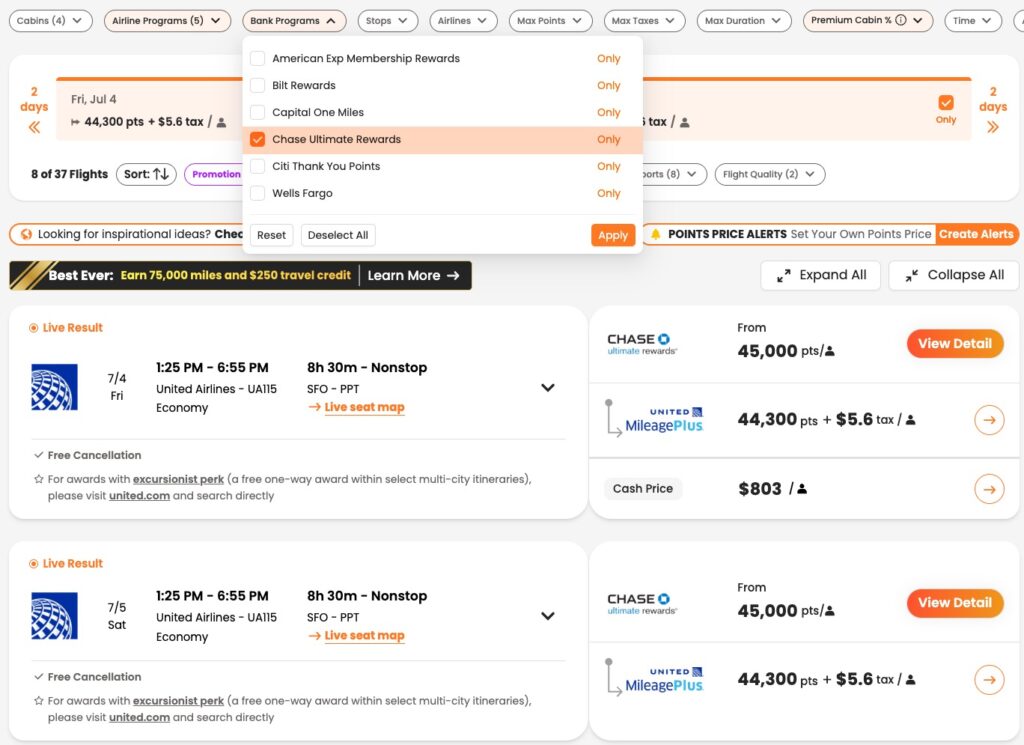

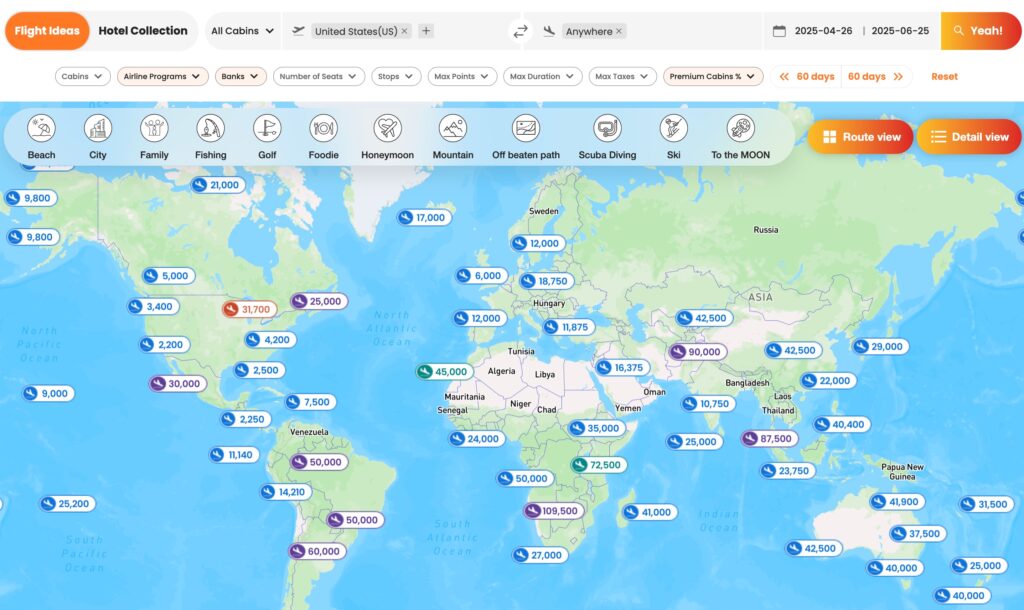

You can use PointsYeah to find flights between your home airport (or anywhere else) to all over the world with Amex points. Just filter your search to display only flights that can be booked with Amex Membership Rewards.

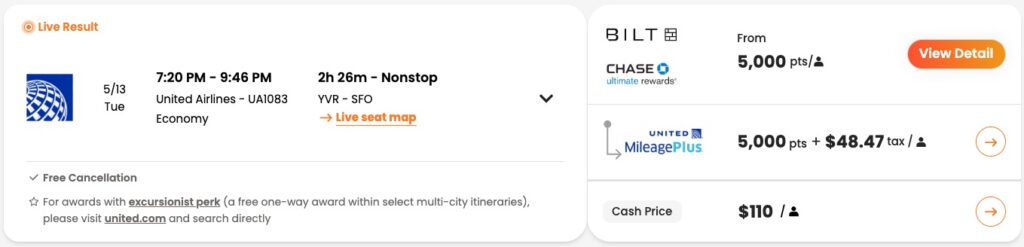

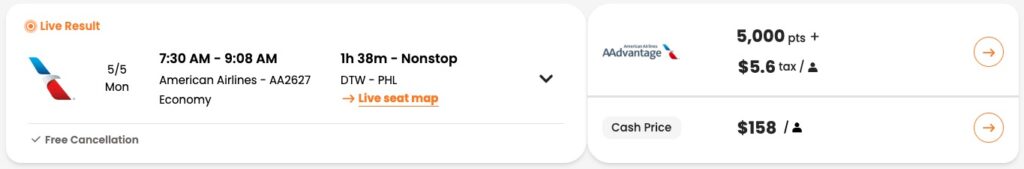

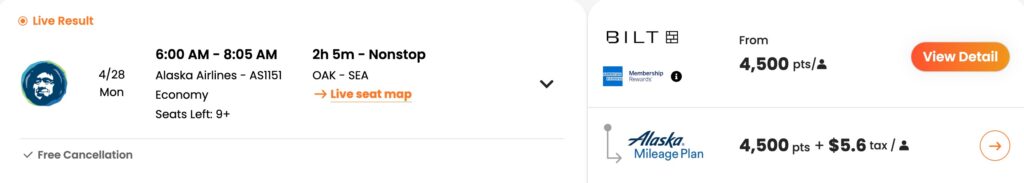

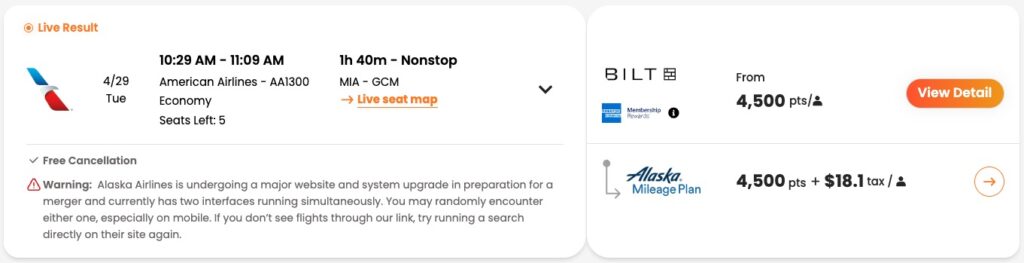

With this card’s 200,000-point bonus, there’s virtually nowhere you can’t go. Here’s a quick snapshot of award prices for flights you can book from the U.S. with Amex points.

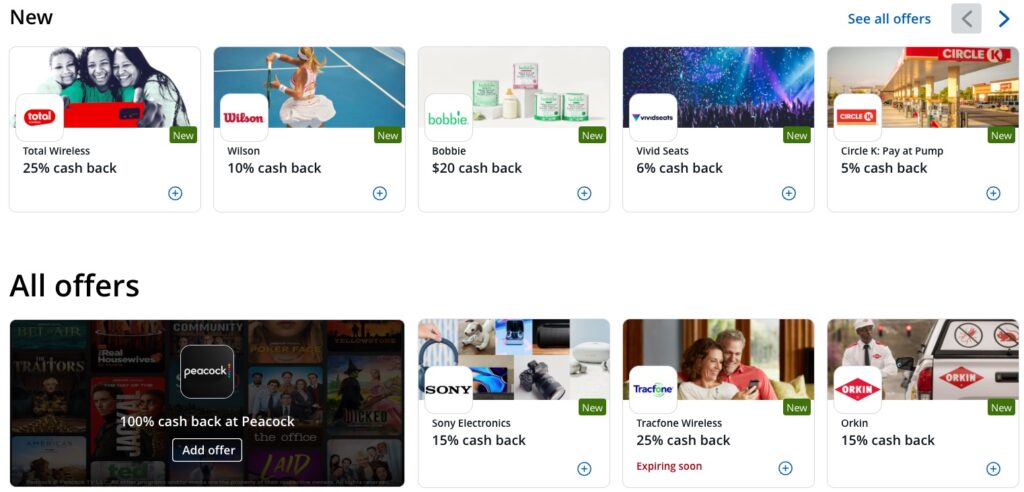

You can even use the PointsYeah Hotels tool to find and book fancy hotels with your rewards. When I first opened the Amex Business Platinum Card, I transferred part of its bonus to Hilton for a stay at the Waldorf Astoria Maldives — a resort where villas routinely cost over $2,000 per night!

Is the Amex Business Platinum Card worth a $895 annual fee?

The Amex Business Platinum Card’s $895 annual fee (rates and fees) isn’t the easiest to shrug off. But here’s the thing: Annual fees aren’t as scary as they sound.

As long as you can organically squeeze more value from a credit card’s benefits than you spend on the annual fee, it’s a great deal! Examine the Amex Business Platinum Card’s benefits and then do some simple math.

Statement credits galore

The Amex Business Platinum Card offers over $1,000 in annual statement credits alone. If you can use even a fraction of them, the card could be a fair deal.

First are the travel-focused credits, such as:

- Up to $600 in annual credits on prepaid Fine Hotels + Resorts or The Hotel Collection bookings through Amex Travel. You get up to $300 twice per year. The Hotel Collection requires a minimum two-night stay.

- Up to $200 in annual Hilton For Business credits. Eligible purchases made directly with Hilton properties qualify.

- Up to $200 in annual airline fee credits. Choose a participating airline and use this to offset charges like checked bags, pet fees, seat upgrades, and more.

- Up to $209 CLEAR Plus credit per year. CLEAR helps you speed through select airport security checkpoints.

Terms apply.

Then there’s the business-focused credits:

- Up to $120 in annual wireless credits. Get up to $10 per month for wireless telephone service purchases made directly with a U.S. provider.

- Up to $360 in annual Indeed credits. Receive up to $90 back per quarter for Indeed expenses.

- Dell Technologies credits. Enroll to get up to $150 in statement credits on U.S. purchases directly with Dell each year, plus an additional $1,000 statement credit after you spend $5,000 or more on that same card per calendar year.

- Adobe credit. Enroll to get a $250 statement credit after you spend $600 or more on U.S. purchases directly with Adobe per calendar year.

Enrollment required for some benefits.

Perks to enhance your travel experience

- Up to $120 in TSA PreCheck/ Global Entry credit. These “trusted traveler” programs get you through airport security in a hurry. You get to keep your shoes and belt on (instead of throwing them in a grungy gray bin) — and you can even keep your laptop and TSA-approved toiletries in your bag. Global Entry also expedites your entry back into the U.S. when returning from abroad.

- Airport lounge access. No travel card on the market gives you access to more airport lounges than the Amex Business Platinum Card — Over 1,550 airport lounges across 140 countries worldwide. You can visit super fancy Amex Centurion Lounges, Delta Sky Clubs (eligible same-day Delta ticket required), Plaza Premium lounges, Priority Pass lounges*, and more. Airport lounges are a travel game-changer.

- Access to American Express Fine Hotels & Resorts. You can book over 2,600 top-tier luxury hotels through an exclusive platform to get special benefits like free breakfast for two, room upgrades when available, late checkout, and a property credit (typically worth $100+).

- Hotel elite status. You’ll get complimentary Gold elite status with both Marriott and Hilton. This comes with perks like bonus rewards on paid stays, welcome amenities, free upgrades when available, and more.*

- Rental car elite status. Receive Hertz President’s Circle status, National Executive status, and Avis Preferred Plus status.* These come with perks like free upgrades, bonus points on paid reservations, etc.

* Enrollment required for some benefits.

High-quality insurance

The Amex Business Platinum Card delivers some of the best travel insurance around. As long as you pay with your card, you’ll be covered. Here are some highlights:

- Trip delay insurance. When your flight is delayed by at least six hours (or requires an overnight stay), Amex will give you up to $500 for “reasonable expenses” — meals, a night at a hotel, that type of stuff.

- Trip cancellation/interruption insurance. When you book round-trip travel with your card, you’ll get up to $10,000 in coverage per trip (max $20,000 per 12-month period) to reimburse you for prepaid nonrefundable travel that causes you to cancel or shorten your trip for a covered reason.

- Rental car insurance. The Amex Business Platinum Card only confers secondary rental car insurance (meaning it’ll cover you for whatever your personal insurance doesn’t). HOWEVER, you can opt into Amex’s Premium Car Rental Protection for a small fee per rental. This gives you primary insurance and more comprehensive coverage than virtually any other card on the market.

- Cell phone protection. Get up to $800 in cell phone insurance (max two claims per 12-month period) against damage or theft. You’ll just have to pay a $50 deductible. This protection is automatic as long as you pay your monthly phone bill with the Amex Business Platinum Card.

Is the Amex Business Platinum Card right for you?

The Amex Business Platinum Card isn’t for everyone. Even if the card’s benefits easily justify its price point, it’s not exactly painless to pony up the $895 annual fee (rates and fees). Ask yourself these questions to decide if the card is a fit for you.

Can you spend $20,000 within the next three months? To earn the card’s enormous 200,000-point bonus, you’ll have to make $20,000 in purchases within three months. If you can meet that by making purchases you’d normally make (don’t go into debt just to earn points!), the bonus alone is worth trying the card out for a year to see if it complements your business and personal goals.

Are you a big spender? If your business makes a lot of large transactions, the Amex Business Platinum Card is one of the best cards for you. That’s because it’s a No Preset Spending Limit (NPSL) card, meaning you don’t have a firm credit limit. Instead, Amex will learn your spending habits and give you more purchase power when you need it.

Plus, the card earns 2 points per dollar for transactions of $5,000 or more (again, capped at $2 million in spending per year).

Do you fly at least a few times each year? Some of the card’s best benefits are related to air travel. From up to $200 in airline incidental credits to fantastic airport lounge access to trip delay insurance , flyers specifically will squeeze the most value from the Amex Business Platinum Card.

Can you organically use a few of the card’s business-centric cards?

Does the nature of your business take advantage of the card’s many hundreds of dollars worth of annual business credits? If you spend money on services from Indeed or Adobe anyway, the Amex Business Platinum Card is almost certainly a good deal for you.

Is the Amex Business Platinum Card easy to get?

The Amex Business Platinum Card isn’t “hard to get.” If you’ve got a credit score above 700 — and you own a business — you shouldn’t have a difficult time opening this card. Just a couple notes:

- If you’ve earn the welcome bonus for the Amex Business Platinum Card before, you aren’t eligible to earn it again. Amex abides by a once-in-a-lifetime rule when it comes to card bonuses.

- You must own a business. Whether it’s a multi-million dollar enterprise or you simply drive for Uber or run an Etsy shop, you must have a for-profit venture to open the Amex Business Platinum Card.

And here’s another fantastic thing about American Express: If you already have an Amex card, American Express can often let you know if you’ll be approved for a card before you formally submit your application. No crossing your fingers after you hit the “Apply Now” button.

So yeah, that’s the deal

The Amex Business Platinum Card currently offers 200,000 points after meeting minimum spending requirements.