We get it, you love to travel. And if you’re here, you probably book with points and miles like a pro. You might even have a credit card that technically includes travel insurance.

So why bother reading this?

Because this one is different. It’s not just fine print on a credit card. It’s the kind of protection that actually works, and pays out fast, even on award travel. From miles redeposit fees to stolen gear, this is the kind of travel insurance you’ll wish you had, until you do.

And yes, we know that from experience.

The Flight That Turned Around, and the Claim That Didn’t

In 2022, Troy, our co-founder, was flying from Istanbul to Belgrade. A points master, travel pro, and co-founder of PointsYeah, he was halfway through the flight when the plane turned around due to weather.

Troy didn’t wait. He booked a hotel inside the terminal, paid for dinner, and went to sleep, while everyone else waited in line for airline accommodations.

A few days later, he filed a claim through Allianz. He was reimbursed without drama. No phone calls. No delays. No stress.

That moment changed how he thought about travel insurance. It wasn’t about the money. It was about keeping control of the trip when everything else fell apart.

Stolen Laptops. A Missing Wallet. Covered.

And that wasn’t the only time Allianz stepped up.

In Cancun, one laptop and an iPad were stolen from Troy’s hotel room. In Madrid, his wallet (yes, the one with 20+ cards) was snatched while he was out exploring.

Both times, he filed a claim online, uploaded the documents, and was reimbursed in less than a week.

Not every plan includes baggage loss or theft coverage, but many do. You can review the details before you buy, and if it’s not the right fit, cancel within 15 days for a full refund.

Plan changed, charged miles redeposit fee?

We all know by now that U.S. airline programs no longer charge a redeposit fee to cancel mileage bookings. However, most non-U.S. programs still do. The Annual Executive Plan will reimburse up to $500 for these fees

The Kind of Coverage That Matters

Travel insurance from Allianz is built around real-life problems, the ones travelers actually face. Depending on your plan, benefits may include:

- Miles redemption redeposit fee

- Trip cancellation

- Trip interruption

- Emergency medical and dental

- Emergency transportation

- Baggage loss, damage, or delay

- Travel delay reimbursement

- 24-hour assistance line

- Concierge support

You’ll see all of these listed in your policy documents, along with covered reasons, exclusions, and limits. The point is, this isn’t fluff. It’s designed for the kind of travel we actually do.

How It Works

Travel insurance is designed to protect you from the unexpected so you can focus on the part that matters, actually enjoying your trip.

Getting started with Allianz is simple. You don’t need to sort through dozens of policies or decode complicated language. Just follow the basics:

- Enter your trip details Include your travel dates destination

- Explore plan options Allianz will show you coverage options tailored to your trip.

- Choose the plan that fits Select the coverage that works for your travel style, budget, and needs.

That’s it. No guesswork. No long forms. Just straightforward protection that travels with you.

Get started now and see your options in seconds.

The Claims Process That Doesn’t Make You Want to Scream

Allianz rebuilt their entire claims system based on customer feedback. It’s now one of the most intuitive in the industry.

- You’ll get a short walkthrough when you start your claim

- A clean dashboard shows exactly where your claim stands

- You’ll get a personal document checklist

- You can file and track everything from the Allyz app

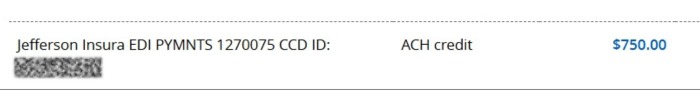

You can also choose how you want to be paid. Direct deposit and debit disbursement are the fastest, often arriving within a few business days.

If you’re already traveling and something goes sideways, the 24-hour assistance hotline is your lifeline. From lost passports to medical emergencies, the support team is ready when you need them.

Not Sure Yet? You’ve Got Flexibility

Still not sure? Allianz offers a 15-day free look period (or longer, depending on your state). That means you can buy now, review later, and cancel with a full refund, as long as your trip hasn’t started and you haven’t filed a claim.

You don’t have to commit blindly. You can see exactly what’s included and make sure the plan fits your needs.

In other words, you can plan responsibly without overthinking it.

When One Thing Goes Wrong, You’ll Be Glad You Did

We spend hours building perfect trips. We choose routes with better aircraft, hotels with better lounges, transfer partners with better value. But even the most optimized itinerary can fall apart with one delayed flight, one missed connection, one stolen bag.

That’s why travel insurance isn’t just backup. It’s part of the strategy.

It protects your time. It protects your momentum. And it makes recovery feel manageable instead of overwhelming.

Because when things go right, you’ll never think about your policy. But when something goes wrong, you’ll feel like it saved your entire trip.

Get a personalized quote and make sure your next adventure has the backup it deserves.

Leave a Reply