The Capital One Venture X Business Card was forged from stainless steel exclusively for business owners with a passion for travel. It’s a premium card that comes with hundreds in annual travel credits, bonus miles after each account anniversary, airport lounge access, and much more.

The card offers up to 400,000 bonus miles after completing spending requirements. You’ll earn:

• 200,000 bonus miles after spending $30,000 in the first 3 months

• An additional 200,000 miles after reaching $150,000 total spend in the first 6 months

How do Capital One miles work?

How to earn Capital One miles

The Capital One Venture X Business currently comes with a tiered welcome offer of up to 400,000 bonus miles. That’s a high minimum spending threshold (though businesses with considerable expenses may not bat an eye at that figure).

The Capital One Venture X Business also has a great return for purchases:

- 10 miles per dollar on hotels and rental cars booked through Capital One Travel

- 5 miles per dollar on airfare and vacation rentals booked through Capital One Travel

- 5 miles per dollar on Capital One Entertainment purchases

- 2 miles per dollar on all other eligible purchases.

How to use Capital One miles

Capital One gives you a few simple ways to redeem your rewards. You can:

- Convert miles into airline miles or hotel points with Capital One travel partners, such as Avianca and JetBlue.

- Offset travel purchases you make with your card up to 90 days later at a rate of 1 cent per mile. You can redeem your rewards for transactions like flights, hotels, rental cars, ferries, timeshares, and more.

You’ll almost always get the most travel from your miles by converting them into airline miles and hotel points.

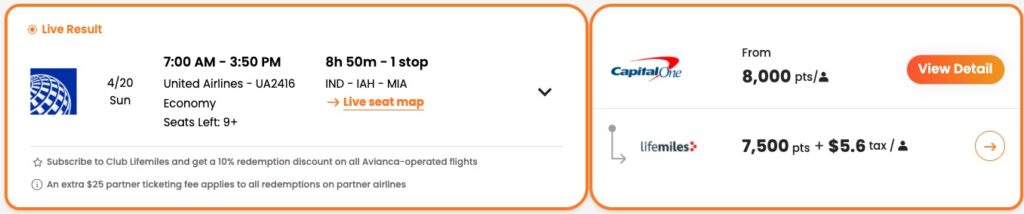

For example, if you were to purchase the below $366 United flight from Indianapolis (IND) to Miami (MIA), you’d spend 36,600 Capital One miles to offset the transaction. But by transferring Capital One miles to Avianca, the flight would cost just 7,500 miles and $5.60 in fees.

Here’s a look at the airline and hotel programs that partner with Capital One. All transfers are 1:1 unless otherwise specified.

| Accor Live Limitless (2:1) | Emirates | Singapore Airlines |

| Aeromexico | Etihad | TAP Portugal |

| Air Canada Aeroplan | EVA Air (2:1.5) | Turkish Airlines |

| Avianca | Finnair | Virgin Red |

| British Airways | Flying Blue (Air France and KLM) | Wyndham Rewards |

| Cathay Pacific | JetBlue (5:3) | |

| Choice Privileges | Qantas |

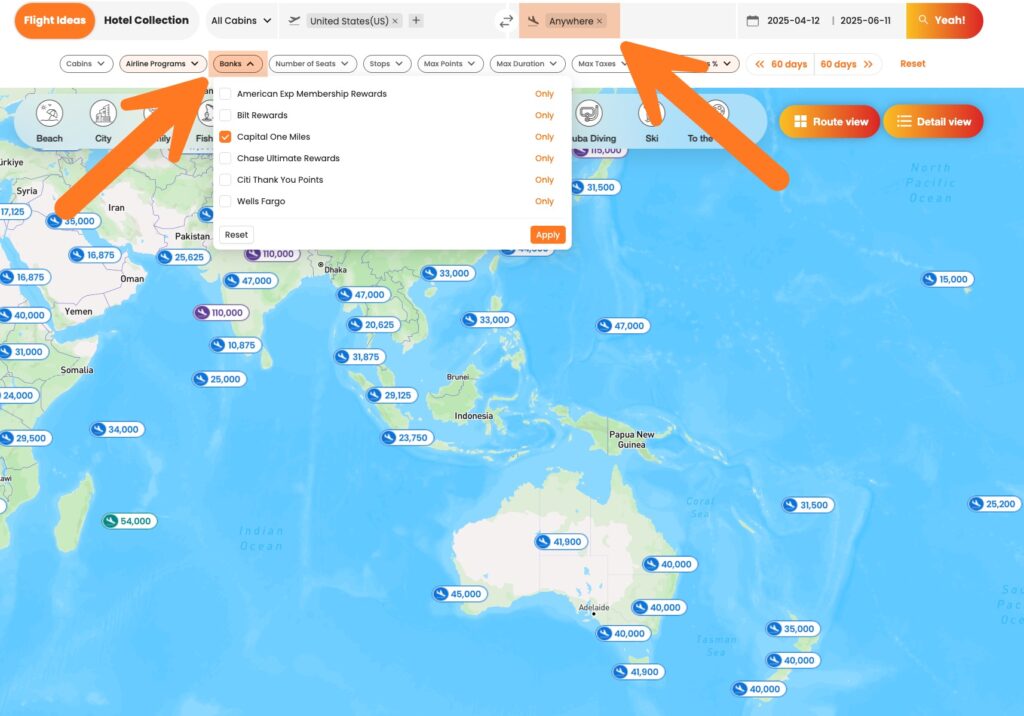

No matter where you want to visit, a Capital One partner can get you there. And PointsYeah makes finding the perfect award seat super easy. Enter your origin and destination into the PointsYeah search bar and filter results by Capital One partners. We’ll show you all your options in seconds.

If you’re feeling adventurous, try our Daydream Explorer tool to explore entire countries or continents at a time. You can even search all of Earth at once by typing “anywhere” as your origin and/or destination.

Is the Capital One Venture X Business worth a $395 annual fee?

The Capital One Venture X Business charges a $395 annual fee. But with one ounce of effort, you’ll be able to recoup that fee. We consider this card to be effectively a no annual fee card thanks to the following benefits.

Yearly bonuses

Here’s the key to squeezing more value from the Venture X Business than you’re investing in its annual fee. You’ll get two annual rewards that post to your account after each anniversary year:

- Up to $300 in travel credit to be redeemed through Capital One Travel for flights, hotel stays, rental cars, etc. (you receive this credit upon account opening, as well)

- 10,000 bonus Capital One miles (beginning on your first account anniversary)

Remember, the 10,000 bonus miles are worth a minimum of $100 in travel. Between the annual travel credit and the bonus miles, Capital One is basically giving you $400 in free travel each year.

But transferring your miles to travel partners can make the deal even better. Check out our guide to where you can go with 5,000 miles or less for some inspiration.

Access to airport lounges

While walking through the terminal, have you ever noticed the sliding glass doors that business travelers are always ducking into? You don’t have to be a big shot to get in. You just need a card like the Capital One Venture X Business.

It gives you access to more than 1,300 airport lounges around the world. Airport lounges often come with free food and alcohol, fast Wi-Fi, conference rooms, lots of electrical outlets, and sometimes even showers and day beds.

You can visit Capital One Lounges, a collection of upscale lounges, as well as Capital One’s new restaurant-first concept, Capital One Landing. You can also use Priority Pass lounges — which are just about everywhere. And you can bring two guests for free.

More freedom to charge big expenses

The Capital One Venture X Business is a NPSL (No Preset Spending Limit) card. This means you don’t have a firm credit line. Instead, the card learns your spending habits and gives you extra leeway if you’re in the habit of making large purchases.

If the nature of your business demands that you charge tens of thousands of dollars at a time, you’re likely better off with a NPSL card than a standard credit card. Just note that you must pay your debt in full each month — the card doesn’t allow you to carry a balance month-to-month.

Expedited airport security experience

Every four years, the Capital One Venture gives you up to $120 in credit to reimburse you for the application fee to “trusted traveler” programs TSA PreCheck and Global Entry.

TSA PreCheck costs $78 for a five-year membership. It gives you the ability to (practically) sprint through the domestic airport security checkpoints without having to remove your shoes or belt — or even take your laptop out of your bag. Plus, you’ll go through an exclusive security lane that processes much faster.

Global Entry costs $120 for a five-year membership. It helps you to skip the immigration line when entering the U.S. from overseas. Instead of getting grilled by an immigration officer, just find a dedicated kiosk and it’ll quickly confirm your identity. Global Entry also comes with TSA PreCheck privileges.

Get special access to restaurants and events

Capital One caters heavily to dining and entertainment. It partners with some restaurants to help you land a reservation even when the joint is fully booked. Its Capital One Dining platform also hosts special experiences like cooking classes with prominent chefs.

And through Capital One Entertainment, you can book super popular music and sporting events and experiences through presale opportunities — so you can be one of the first to buy.

Is the Capital One Venture X Business right for you?

The Capital One Venture X Business is a uniquely capable business card that can serve just about any entrepreneur. But it’s especially great for business owners that answer “yes” to the following questions.

Is your business spending unconventional? If your business expenses don’t fall into a typical bonus category (think office supplies, shipping, online advertising, gas, etc.), this 2X everywhere card is a stellar option to funnel all your purchases through.

Does your business have lots of expenses? If you need a sizable credit line to make big business purchases, the Capital One Venture X Business is one of your best options since it has no preset spending limit.

Do you have travel aspirations? This card is meant for travelers. if you don’t travel for pleasure or business, a cash back credit card may better serve your goals.

Is the Capital One Venture X Business easy to get?

Again, the Capital One Venture X Business is a premium travel card. But it’s not notoriously hard to get. Here are some guidelines to follow:

- You must own a business. This card is exclusively for business owners compared to the Capital One Venture X built for all travelers.

- You have a good credit score. As a premium card, lower credit scores might not get accepted.

- Abide by the 1/6 rule. Capital One usually won’t approve you for more than one credit card application within a six-month period.

So yeah, that’s the deal

Though the Capital One Venture X Business is a premium business card, its $395 annual fee is notably lower than its high-end competitors. You can very easily negate that fee thanks to its anniversary bonuses such as a $300 travel credit and 10,000 bonus miles.

Leave a Reply