It’s made of heavy metal and it’s gold-colored. It must be good, right?

The American Express® Business Gold Card is one of the best rewards cards for small businesses. It offers hundreds of dollars in statement credits each year; its return rate for common purchases is confusingly high; it’s got a substantial six-figure welcome bonus after meeting minimum spending requirements.

Let’s examine the Amex Business Gold Card to help you decide if it’s a good pickup for your situation.

How do American Express Membership Rewards points work?

How to earn American Express Membership Rewards points

The Amex Business Gold Card comes with 100,000 American Express Membership Rewards® points after spending $15,000 on purchases within the first three months from account opening.

That’s a big deal. Amex points are some of the most valuable travel rewards in existence. With 100,000 points, you can book a bucket list trip to just about anywhere for pennies on the dollar.

The card is also great at earning points on everyday business expenses. Most impressive is its 4 points per dollar on the top two eligible bonus categories in which you spend the most each billing cycle (for up to $150,000 in combined purchases each calendar year, then 1x). Eligible categories include:

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- Purchases at U.S. media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software/cloud system providers

This is an above-average return to say the least. You’ll also earn:

- 3 points per dollar on flights and prepaid hotels booked through AmexTravel.com

- 1 point per dollar for all other eligible purchases

How to use American Express Membership Rewards points

Amex Membership Rewards points are a potent and easy-to-use tool in your travel utility belt. Here are some popular ways to use them:

- Transfer them to airline and hotel loyalty programs partnered with American Express (typically the best way to stretch your points the furthest).

- Book airfare through Amex Travel at a rate of 1 cent each.

- Book hotel stays through Amex Travel at a rate between 0.7 and 1 cent each.

- Redeem for cash back at a rate of 0.6 cents each

As award travel enthusiasts, we always suggest that you transfer your points Amex travel partners. You can convert your Amex points into points and miles with the below programs (transfers are 1:1 unless otherwise specified).

| Aer Lingus | Choice Hotels | Iberia |

| Aeromexico (1:1.6) | Delta | JetBlue (5:4) |

| Air Canada | Emirates | Marriott Bonvoy |

| ANA | Etihad | Qantas |

| Avianca | Flying Blue (Air France and KLM) | Qatar Airways |

| British Airways | Hawaiian Airlines | Singapore Airlines |

| Cathay Pacific | Hilton Honors (1:2) | Virgin Atlantic |

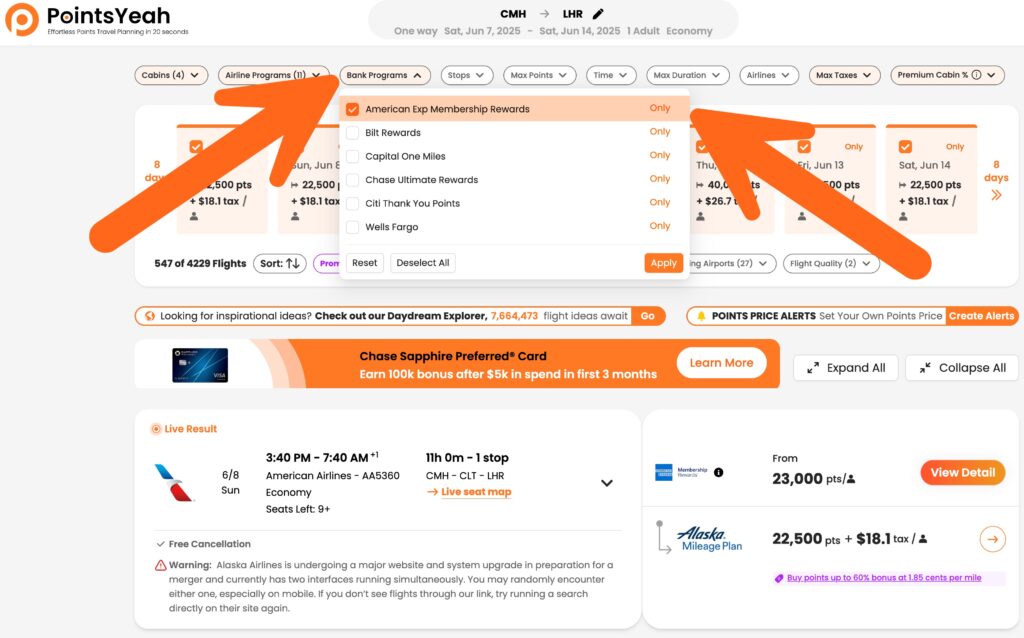

PointsYeah will help you to quickly find reasonably priced flights FROM anywhere TO anywhere (try out our Daydream Explorer — it’s totally free).

You can even filter your results to exclusively show seats that you can book with American Express Membership Rewards.

With this card’s 100,000-point bonus, there’s virtually nowhere you can’t go. In fact, you can even go many places in a fancy lie-flat seat.

For example, I was able to book a business class flight on American Airlines between Charlotte (CLT) and Paris (CDG) for just 55,000 Amex points and $19 in fees by transferring points to Hawaiian Airlines* (and onto Alaska Airlines). *Transfer ends 6/30/2025

Is the Amex Business Gold Card worth a $375 annual fee?

The Amex Business Gold Card charges a $375 annual fee (rates and fees). But don’t let that scare you off. It’s astonishingly easy to recoup your money from its valuable perks.

If the below features are worth $375 or more to you, the card is an easy win.

Annual statement credits

The Amex Business Gold Card has a few easy-to-use statement credits that can save you hundreds each year:

- Up to $240 in annual “Flexible Business Credit.” You’ll receive up to $20 in monthly statement credits toward eligible U.S. purchases made with FedEx, Grubhub, and office supply stores.*

- Up to $155 in annual Walmart+ Credit. When you pay for a monthly Walmart+ subscription with your Amex Business Gold, you’ll get up to $12.95 (plus taxes) in credits each month to offset the cost (excludes Walmart’s “Plus Ups” subscription). Walmart+ comes with perks like exclusive discounts, free delivery from the store, and Paramount+.*

- Amex Offers. Within your American Express online account are digital coupons that you can manually add to your card. These can save you money on purchases you already planned to make. American Express drops new offers all the time, so it’s worth checking back often.*

*Enrollment required for some benefits

Travel benefits

The Amex Business Gold Card isn’t overtly a travel card (though it earns American Express Membership Rewards points, which are most powerful when redeemed for travel). Still, the card has a couple noteworthy travel perks:

- The Hotel Collection. American Express handpicks more than 1,000 upscale hotels that, when booked through Amex Travel, come with elite status-esque benefits like room upgrades (when available) and a $100 property credit per stay. You must book at least two consecutive nights to qualify for these perks.

- Travel insurance benefits. When you pay for your travel with the Amex Business Gold Card, you’ll get trip delay insurance, rental car insurance, baggage insurance, and more.

0% intro APR offer

The card offers 0% intro APR on purchases for the first six months from account opening, then 18.49% – 27.49% variable (see rates). Handy for those who foresee some business expenses that’ll need floated for a few months.

Is the Amex Business Gold Card right for you?

The Amex Business Gold Card is easily worth its annual fee for many — but not all. If you answer yes to even one of the below questions, chances are it’s a good deal for your lifestyle.

Can you spend $15,000 within the next three months? To earn the card’s enormous 100,000-point bonus, you’ll have to spend $15,000 on purchases within the first three months from account opening. If you can achieve that with purchases you’d normally make, the bonus alone is motivation enough to give the card a test run. If you decide after a year that it’s not worth paying the annual fee, you can cancel or downgrade it in 12 months.

Do you spend a lot in the card’s 4x categories?

Earning 4 points per dollar is a nearly unprecedented return. If your business spends just a couple thousand bucks per month in categories like U.S. restaurants and U.S. gas stations, you could earn around 100,000 bonus points each year.

Will the card’s statement credits actually save you money?

The card’s up to $20 in monthly credit toward merchants like Grubhub and FedEx can be as good as cash to those who already make those types of purchases. Same goes for the monthly Walmart+ credits. If you already subscribe to Walmart+, it’s an effortless money saver.

Is the Amex Business Gold Card easy to get?

The Amex Business Gold is reasonably easy to get as long as your credit score is good (preferably 700+) and you’re a business owner.

If you’ve already got an American Express card, Amex will likely let you see if you’re approved for the card before you formally apply. That way you won’t incur a hard credit inquiry for nothing.

So yeah, that’s the deal

The Amex Business Gold Card currently comes with 100,000 bonus points after meeting minimum spending requirements. In the rewards credit card world, this bonus is far above average.

If you’re a business owner (whether you operate a coffee shop or you’re simply an Instacart delivery driver), the Amex Business Gold Card could be a fantastic addition to your wallet. It earns points quickly, and its ongoing benefits can save business owners serious money.

For rates and fees of the American Express® Business Gold Card, click here.

Leave a Reply